Cronos price formed a God candle, soaring by over 22% and reaching its highest level since June 11. It retested the crucial resistance level at $0.10, bringing its market capitalization to over $3.1 billion.

Why Cronos price surged

Cronos token soared after it was included in an upcoming ETF filing by Trump Media & Technology, the parent company of Truth Social.

The blue-chip ETF will have 85% of its assets allocated to Bitcoin and Ethereum, with the remaining assets comprising tokens such as Cronos and Solana.

Therefore, the CRO price jumped because the fund, if approved, will need to buy substantial CRO tokens over time.

CRO’s inclusion in the fund is likely because of the business relationship between Crypto.com and Trump Media. Cronos, formerly known as Crypto.com Coin, is part of Crypto.com’s business.

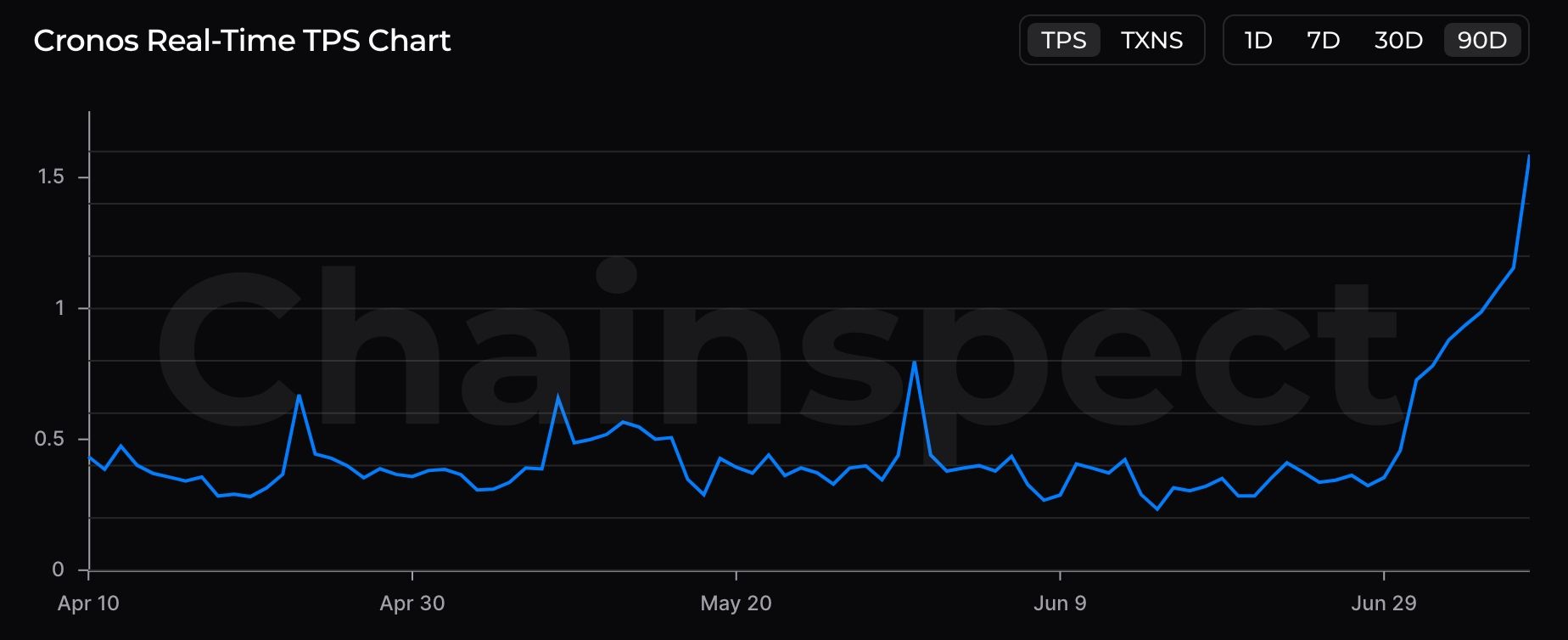

The CRO price also jumped after the recent network upgrade, which made it one of the top ten fastest blockchain networks in the cryptocurrency industry. The upgrade brought its block time from 5.6 seconds to 0.5 seconds. As shown below, the real-time TPS metric has surged recently.

READ MORE: Pepe Coin Price at Crossroads: Will This Meme Coin Rise or Crash?

The developers hope that this upgrade will bring more creators to the network. Data shows that Cronos network has 123 DeFi applications worth over $592 million, with the bridged TVL jumping to $341 million. The stablecoin market cap jumped to $157 million.

The other potential catalyst for the Cronos price is that the SEC may ultimately approve a spot CRO ETF later this year. Canary Capital and 21Shares have all filed for this ETF, and there are signs that they will be approved.

CRO Price Technical Analysis Points to a Crash

The daily chart shows that the Cronos price was in a deep slumber a few days ago, and then it formed a God candle after the blue-chip ETF news. It jumped and retested the lower side of the rising wedge pattern shown in purple.

This performance means that it has formed a break-and-retest pattern, a popular continuation sign.

Therefore, the most likely scenario is that the token will resume its downward trend in the next few days as momentum fades. If this happens, the token will retreat and return to the previous range around the support levels at $ 0.80. More downside will be confirmed if it drops below $0.0774.

READ MORE: XLM Price Prediction: Here’s Why Stellar Token Could Surge Soon