The Ethereum price skyrocketed this week, reaching its highest level since February as the crypto market continued its comeback. ETH crossed the important resistance level at $3,000, meaning that it has jumped by over 115% from its lowest point this year.

Ethereum Price Technical Analysis

The daily chart shows that the ETH price bottomed at $1,388 in April and then staged a strong rally. After months of consolidation, the coin surged this week amid the crypto market bull run.

The token moved above the key resistance level at $2,875, the highest point in May. Moving above that level was important as it invalidated the forming double-top pattern, a popular risky sign.

The Ethereum price has also formed a golden cross pattern, as the 50-day and 200-day Exponential Moving Averages (EMAs) crossed each other. This cross is one of the most common bullish chart patterns in technical analysis.

Ethereum also moved above the forming bullish flag pattern and the 50% Fibonacci Retracement level. Also, the Relative Strength Index (RSI) and the MACD have all pointed upwards.

Therefore, the most likely scenario is where the ETH price drops briefly and retests the support at $2,875. Such a move is known as a break-and-retest pattern and is one of the most popular continuation signs.

That retest will then trigger a continuation, which could lead to further upside, potentially reaching the psychological point at $4,000.

READ MORE: Solana Price Analysis as the Staking SOL ETF Assets Surges

ETH ETF Inflows Cross Key Level

The Ethereum price surged due to the broader crypto market rally and increased demand, particularly from Wall Street investors. Data shows that spot Ethereum ETF inflows crossed the important $5 billion milestone for the first time ever.

This happened as these inflows jumped for ten consecutive weeks, the longest streak ever. The momentum is also accelerating as the funds added $1 billion this week, up from last week’s $219 million.

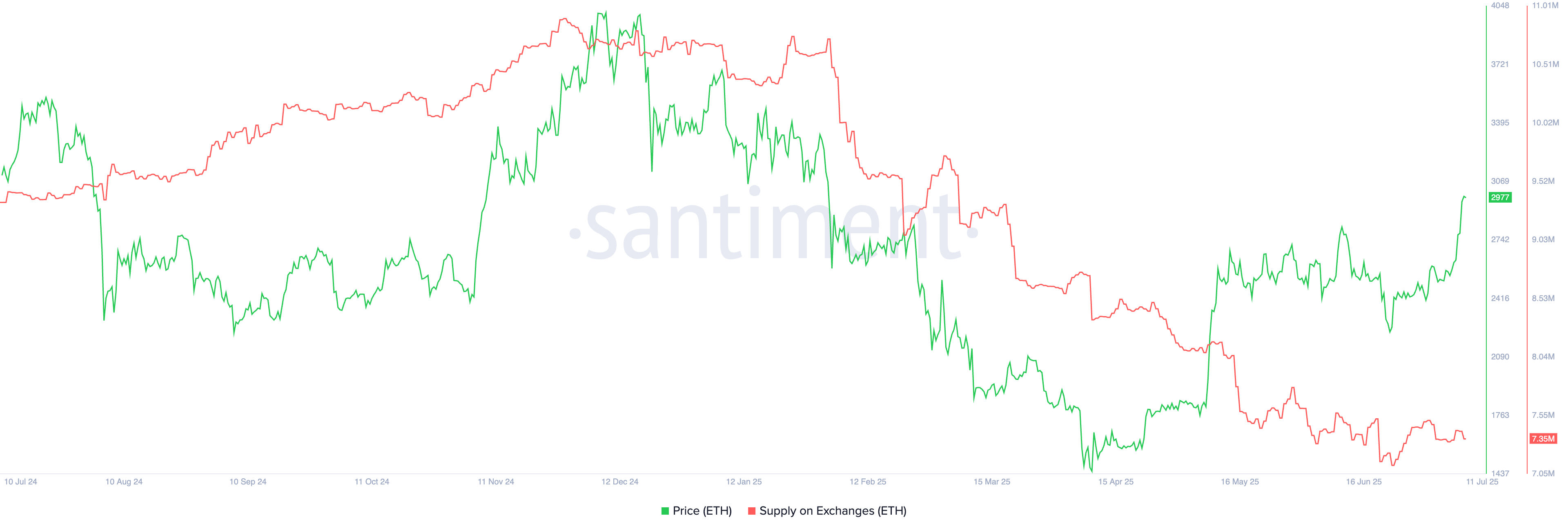

This surging demand occurred at a time when Ethereum supply on exchanges continued to fall. It has dropped to 7.35 million, down from the year-to-date high of 10.75 million, a sign that investors are not selling.

ETH supply on exchanges | Source: Santiment

Ethereum price also surged because of the ongoing Bitcoin breakout. BTC made a slow breakout above $110,000 and then quickly soared closer to $120,000. Bitcoin gains lead to more upside among other altcoins as investors embrace the fear of missing out (FOMO).

Ethereum also had encouraging ecosystem data, with the total value locked (TVL) in its DeFi ecosystem soaring to over $156 billion. Its stablecoin supply soared to a record high of $128 billion.

READ MORE: XRP Price Prediction: Targets $6.2 as Ripple Tailwinds Rise