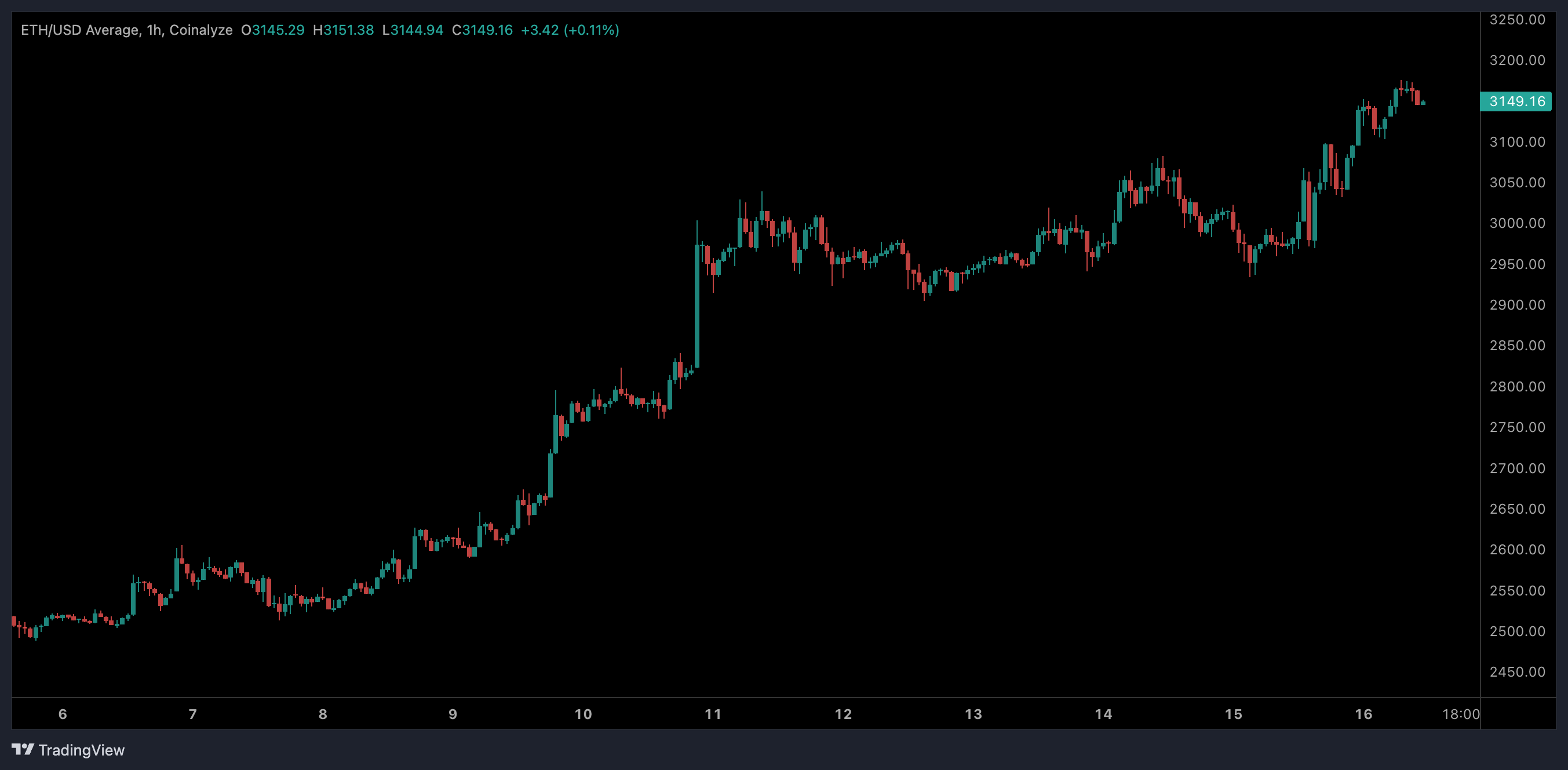

Ethereum price has surged past $3,149, gaining 6.2% in the last 24 hours, as fresh signals confirm the start of the altcoin season. Bitcoin dominance is slipping, ETH/BTC is breaking out, and institutional inflows into Ethereum are accelerating, painting a bullish picture for the coming weeks.

Altcoin Season Bell Rings as Bitcoin Dominance Falls

Several traders are calling it loud and clear that the altseason is back. CryptoGoos shared a breakout chart of ETH/BTC, showing it clearing a major resistance zone. Bitcoin dominance is going down, which usually means more money is moving into altcoins like Ethereum.

When the ETH/BTC ratio increases, it indicates that Ethereum is outperforming Bitcoin. This is an important sign for a broader rally in altcoins.

Recent tweets from multiple analysts on X suggest that it may be time for an “altseason,” indicating a shift in momentum from Bitcoin to riskier assets in the cryptocurrency market.

READ MORE: XRP Price Forecast: Can Ripple Hit $50 as Expert Predicts?

This shift is also backed by new investment, as Ethereum’s open interest increased by 9.32% in just 24 hours, now exceeding $21.4 billion on major derivatives exchanges such as Binance, Bybit, and Huobi.

Institutional Accumulation Increases

While retail traders ride the altseason hype, institutions are quietly stacking ETH. Peter Thiel’s Founders Fund acquired a 9.1% stake in BitMine Immersion, which holds a 163,142 ETH treasury, signaling confidence in ETH’s long-term value.

Additionally, SharpLink Gaming allocated $156 million to Ethereum purchases, becoming the largest corporate holder of ETH with 285,894 ETH.

Another notable data point is that ETH ETFs have seen inflows jump to $12.9B AUM, up 14.5% in just a week, reflecting growing interest from traditional investors.

Ethereum Price Technicals Point to a Major Breakout

On the charts, ETH is approaching a critical breakout zone. Ash Crypto noted that ETH is only 9.73% away from breaking out of a massive 4-year accumulation triangle. If it clears this level, technical analysts expect an explosive rally.

The Ethereum price has surged almost 20% in the last 24 hours, and has jumped over 7% jump in just two days, currently trading at $3,149. As the bullish momentum intensifies, digital silver is expected to reach $3,500 by the end of this month.

If the current trend continues, some experts think the price of Ethereum could hit $4,000 by the third quarter. Right now, it has strong support around $3,000 to $3,050. The next levels to watch for resistance are $3,200 to $3,250, followed by $3,500. If altcoin season takes off, ETH could climb even higher, reaching $4,200 to $4,500 before the cycle peak.

Failing to hold above $3,000, however, could see a quick dip back to $2,850, though current momentum suggests that’s less likely.

READ MORE: Pump Fun Token Spikes 14% After Post-ICO Hype: Can $PUMP Reclaim $0.01?