The XRP price rally gained momentum this week and surged to a record high as the US House of Representatives voted for the GENIUS Act, along with a surge in demand. Ripple crossed the previous year-to-date high of $3.40 and hit an all-time high of $3.46. Let’s explore why it has soared and the next key target.

How the GENIUS Act Benefits XRP Price

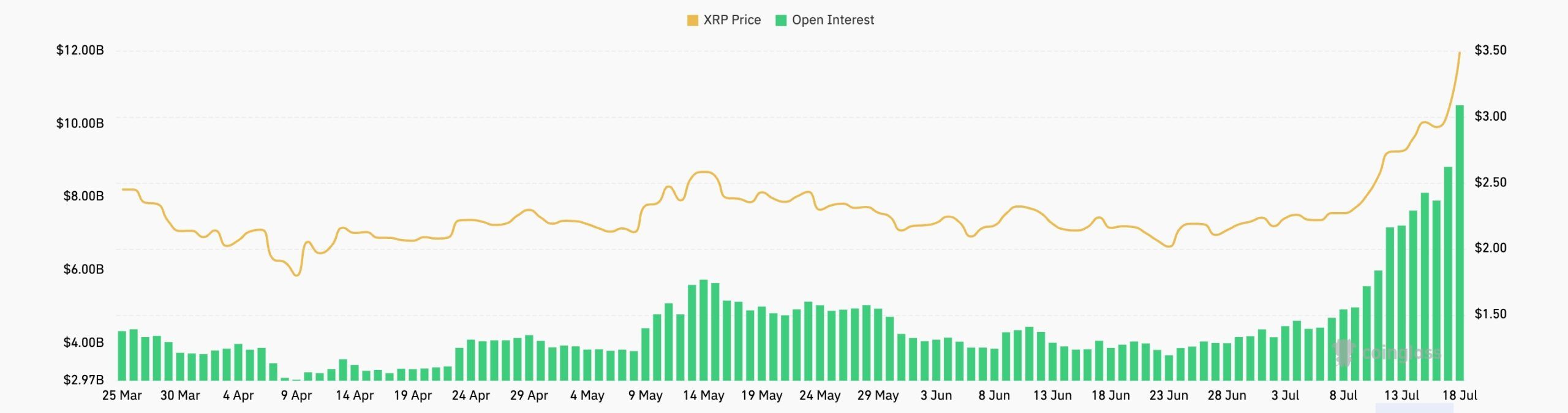

The XRP price surged in a high-volume environment after the GENIUS passed in the House. Its 24-hour volume jumped by over 100% and reached a high of $17.45 billion, and its futures open interest moved to a record level of over $10.45 billion.

The GENIUS Act will benefit the XRP token because of its role in the stablecoin industry, where Ripple is emerging as a big player. CMC data shows that the Ripple USD (RLUSD) stablecoin has grown from zero in December last year into a $550 million asset.

READ MORE: Dogecoin Price Prediction: DOGE is a Coiled Spring Ready to Pounce

There is a chance that stablecoins like RLUSD, PYUSD, and USDC will gain more assets in the coming months if Tether fails to comply with the act. That’s because it mandates that fiat currencies and short-term US government bonds should back all US dollar stablecoins.

USDT, the largest stablecoin in the industry, is backed by these assets and other volatile products, such as gold and Bitcoin. As such, USDT assets on US exchanges will likely be transitioned to other compliant stablecoins, such as RLUSD and USDC.

XRP price has also jumped because of the rising assets in the Teucrium 2x Long Daily XRP ETF (XXRP). Data shows that the fund’s assets have ballooned to over $327 million in the last three months.

This makes it one of the best-performing ETFs this year. Its growth is a sign that there is adequate appetite for standard XRP ETFs as the odds of approval jump to over 85%.

XRP Price Technical Analysis

The daily chart shows that the XRP price broke out, as we had predicted here and here. It moved above the upper side of the triangle and the year-to-date high of $3.4.

Most importantly, the token surged above the upper side of the bullish pennant pattern, which had a depth of about 86%. Therefore, measuring the same distance from its breakout point of $2.3 brings the target price to $4.26. A move above that level will point to more gains to $5.

The bullish XRP price forecast is being supported by the Average Directional Index (ADX), which has jumped to 40. Similarly, top oscillators, such as the Relative Strength Index (RSI) and the MACD, have all pointed upward.

To be clear: the surge to $5 will not be linear, and the token may retreat several times before getting to that target.

READ MORE: Pi Coin Price Value Can Surge if These 4 Catalysts Play Out