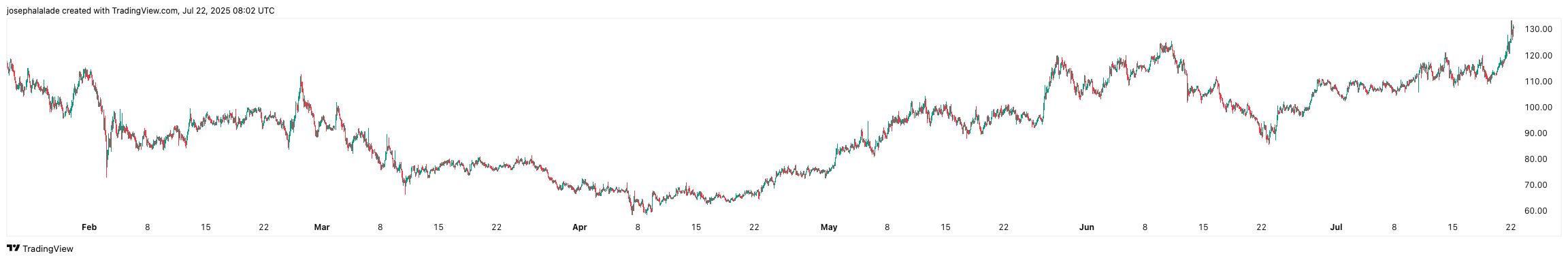

Quant (QNT) has surpassed the key $124 resistance, gaining over 8% in 24 hours to trade between $128 and $133. Trading volume also surged 179% to $62.4 million, indicating fresh interest from traders and investors.

This bullish move completes a cup-and-handle breakout, a pattern often linked to bigger rallies. If the Quant token holds above $124, analysts see a possible run toward $245, nearly doubling its value in the coming weeks.

Why This Breakout Matters

For more than 6 months, QNT has been stuck under this level. Breaking and closing above $124 turns this old resistance into new support, which could mark the beginning of a much larger bullish trend.

Technical indicators are backing the move. Most daily moving averages and oscillators indicate a strong buy signal, while the RSI is at 72–83, suggesting intense bullish pressure despite being close to overbought territory.

Furthermore, QNT is also gaining momentum from enterprise-focused narratives. The Fusion testnet, expected to launch late July 2025, will enable cross-chain transfers between private and public blockchains.

The Devnet is already live and accessible to invited users, with implementation contracts deployed across Ethereum Sepolia, Polygon Amoy, and Avalanche Fuji, according to a recent LinkedIn post by Quant (QNT).

READ MORE: Ethereum Price Prediction: Why ETH May Crash to $3k This Week

Quant’s Overledger technology also aligns with ISO 20022, a standard that major financial networks, such as Fedwire, are adopting. With more global financial institutions already shifting towards ISO-compliant tokens, Quant is well-positioned to benefit from this shift.

Whale accumulation remains high, with over 50% of the supply held by large holders, and only 1.64 million QNT available on exchanges, thereby reducing sell pressure.

Quant (QNT) Price Prediction – Key Levels to Watch

QNT has recently completed a strong cup-and-handle breakout, a pattern that often precedes significant price increases.

In the short term, QNT may test $124 as a support level before continuing its upward trend. However, if buyers maintain control in the medium term, the next targets are $150 and eventually $200–$245, representing a nearly 100% upside from the breakout zone, as noted by CRYPTOMOJO on X.

This is particularly likely to happen if the Fusion testnet launch drives institutional adoption as expected.

However, failure to hold $124 could see the price pull back toward $110–$115 in the near term, especially if the general altcoin market also loses momentum.

READ MORE: Dogecoin (DOGE) Jumps 12% After $11.3M Whale Buy, Eyes $0.30 Breakout