The Metaplanet stock price has plummeted this week, even as the Bitcoin price hovered near its all-time high. It has plunged to a low of ¥1,100, its lowest point since June 2nd, and 42% below its all-time high. This article examines the reasons behind the stock’s plummet.

Why the Metaplanet Stock Price Has Plummeted

Metaplanet has become one of the best-known Japanese companies in the past few years. At its peak in June, the stock was up by almost 560% from its lowest point in January.

While the Metaplanet share price has plunged by over 42%, it remains about 9,228% above its lowest level in 2024. This surge has brought its market capitalization to over $5 billion.

In theory, the Metaplanet stock price should be performing well this month, as Bitcoin has reached a record high. That’s because the company has continued to accumulate Bitcoin in the past few months. It acquired 797 coins in the week to July 14, bringing its total holdings to 16,352. Its total holdings are now worth over $1.96 billion.

READ MORE: Top 3 Reasons Why the Pepe Coin Price is About to Go Parabolic

There are two potential reasons why the Metaplanet share price has plunged this month. First, the crash is largely due to profit-taking among investors after the price surged by triple digits. It is common for a stock that has gone parabolic to pull back as traders take profits.

Second, the decline is attributed to its valuation. The company holds 16,352 coins worth over $1.96 billion, compared to its market capitalization of $5 billion. This gives it a NAV multiple of 2.7, which is higher than that of other companies.

For example, Strategy has a NAV multiple of 1.645, while MARA Holdings has a multiple of 1.168. Other companies, such as Riot Platforms, CleanSpark, and Semler Scientific, have a much lower multiple.

Metaplanet Share Price Analysis

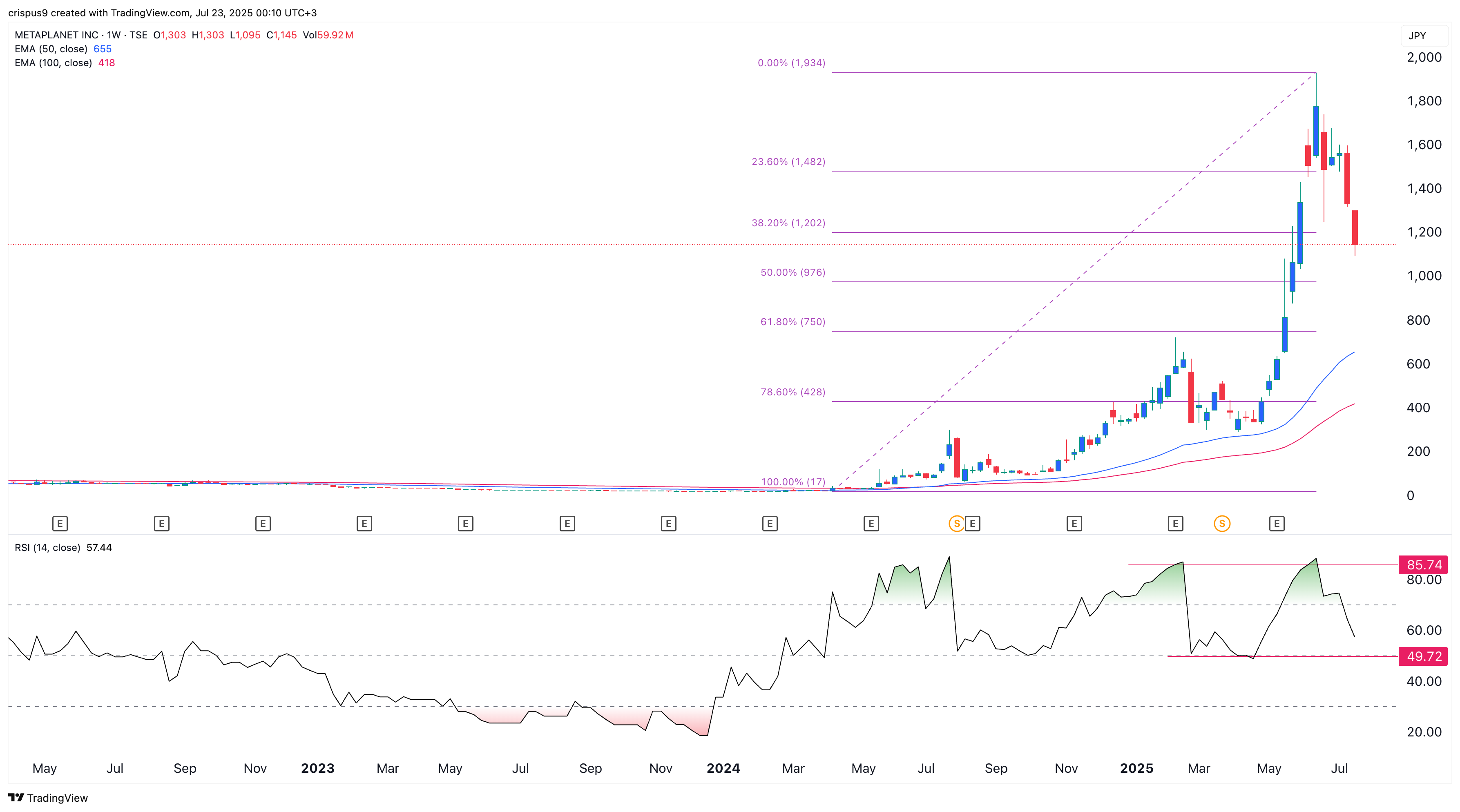

Metaplanet stock chart | Source: TradingView

The weekly chart shows that the Metaplanet stock price has crashed in the past few days. It dropped from a high of ¥1,934 in June to a low of ¥1,145, its lowest point since June 2.

Metaplanet has moved below the 38.2% Fibonacci Retracement level at ¥1,200. At the same time, the Relative Strength Index (RSI) has moved from the extreme overbought level of 85.7, where it formed a double-top pattern. It is now nearing the neckline at 49.

Therefore, the Metaplanet stock price will likely continue falling as sellers target the 50% retracement point at ¥976. A drop to that level will be confirmed if it moves below the psychological point at ¥1,000.

READ MORE: Polkadot Price Prediction: Here’s Why DOT Crypto is About to Rally