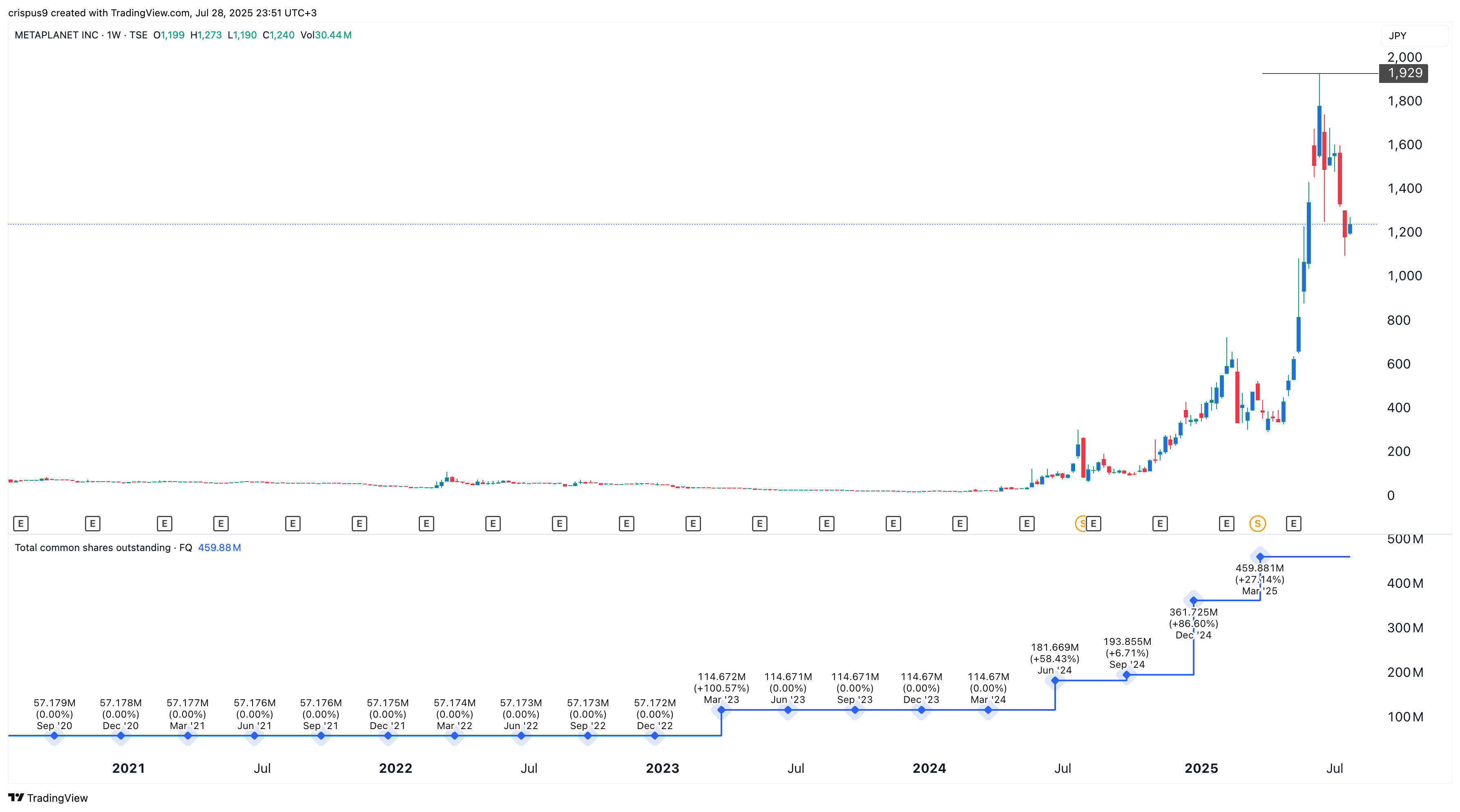

Metaplanet stock price has crashed into a deep bear market in Japan, crashing from a high of ¥1,930 in June to the current ¥1,240. It has plunged by 35% from the highest point this year, even as the Bitcoin price loiters near its all-time high. So, will the Metaplanet share price recover?

Why Metaplanet Stock Price Has Crashed

There are three main reasons why the Metaplanet stock has plunged even as it continued to accumulate Bitcoin.

Indeed, the company continued to accumulate BTC last week, acquiring 780 coins, and bringing its holdings to 17,132. Its Bitcoin holdings are now worth $2.01 billion, which is significantly lower than the company’s market cap of $6 billion.

As BanklessTimes previously reported, one of the primary reasons why the Metaplanet share price has tumbled is that it is overvalued compared to other Bitcoin treasury companies. In this regard, it has a net asset value (NAV) multiple of 2.77, which is much higher than that of other companies, such as Marathon Holdings and Semler Scientific.

Second, the Metaplanet share price crashed due to ongoing dilution, as its common outstanding shares have increased to over 459 million, up from 57 million in 2022. This means that investors have suffered a 87% dilution.

Third, the stock has plunged because of the ongoing performance of the Strategy share price. Like Metaplanet, MSTR stock has deviated from the ongoing Bitcoin price. Therefore, there are jitters among investors that the Bitcoin treasury business was losing appeal.

Will the Metaplanet Share Price Recover?

The future performance of the Metaplanet stock will depend on how Bitcoin trades over time. Bitcoin is likely to rebound in the coming days or weeks, as we previously predicted.

For one, Bitcoin has formed the highly common bullish pennant pattern, which comprises a vertical line and a symmetrical triangle. This pattern is one of the most common continuation patterns in technical analysis.

Furthermore, Bitcoin remains well-positioned with strong fundamentals. Its supply on exchanges has continued falling and is now at its lowest level in years. At the same time, demand continues rising, with the cumulative spot ETF inflows jumping to over $58 billion.

Companies such as Trump Media, Volcon, and Blockchain Group have continued to buy Bitcoin over the past few months. Marathon Holdings, the biggest miner, is also raising funds to add more coins to its balance sheet.

Therefore, the ongoing Bitcoin dynamics mean that the price will rebound over time. Remember, BTC has been in a prolonged bull run in the past 16 years, soaring from near zero to around $118,000 today.

Analysts anticipate that the Bitcoin price will continue to soar in the coming years, with BlackRock targeting $700,000. Assuming that BTC reaches this target, it means that Metaplanet’s holdings will be worth over $11 billion, much higher than the current $2 billion.

Therefore, there is a likelihood that the Metaplanet stock price will recover over time.