Dogecoin (DOGE) is facing a tug-of-war between macro uncertainty and technical resistance after slipping 2% over the past 24 hours. Now trading around $0.224, the meme coin is flashing mixed signals as bulls attempt to defend key support levels while short-term indicators hint at a possible rebound.

Fed Caution, Liquidations Weigh on DOGE

DOGE’s recent price weakness comes against a backdrop of market-wide caution. With traders bracing for the July 30–31 Federal Reserve meeting, the broader crypto market has entered a risk-off mode.

Although most expect interest rates to remain unchanged, uncertainty around the Fed’s forward guidance has triggered deleveraging in high-beta altcoins like Dogecoin.

Trading volume for DOGE dropped to $2.03B, down over 24% in 24 hours, as profit-taking and failed breakout attempts near $0.25 forced a pullback. According to data, more than $13.5 million in long positions were liquidated near the $0.225 mark, amplifying the downward pressure.

READ MORE: ZBCN Price Analysis: Here’s Why the Zebec Network Crypto is Going Up

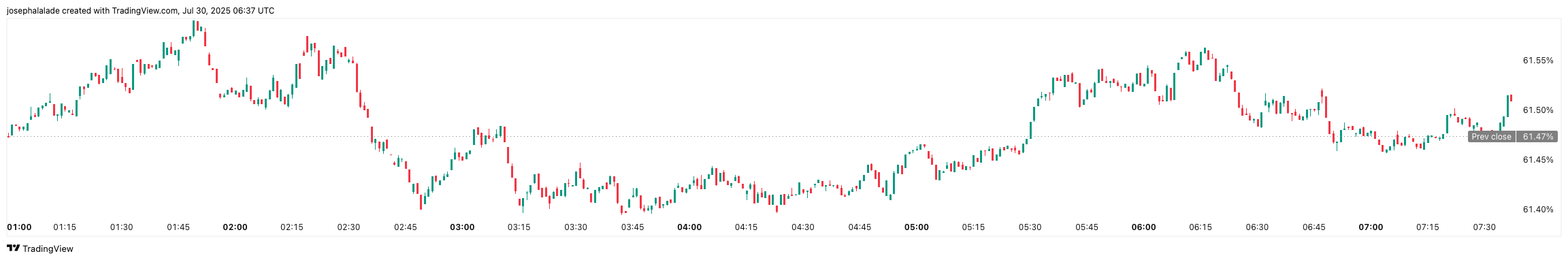

DOGE’s price action remains tightly correlated with Bitcoin, and with BTC dominance hovering near 61.47%, meme coins have struggled to find momentum independently.

Yet, not all signals are bearish. On July 29, crypto analyst Ali noted a TD Sequential buy signal flashing on the 4-hour chart, suggesting a potential short-term reversal could be forming if price action confirms.

Neutral Bias with Rebound Potential

Technically, the Dogecoin price is in a fragile but potentially opportunistic zone. TradingView’s summary for DOGE/USDT leans neutral on both the 1-day oscillators and overall trend. The MACD and Momentum indicators remain in the red, while RSI (14) sits at 52.6, neither overbought nor oversold.

However, moving averages tell a slightly different story: 9 out of 15 tracked MAs are still flashing buy, with DOGE trading above its 50-day and 100-day simple moving averages. The next resistance sits at $0.235, followed by $0.25, where the last rally was rejected. Support is pegged around $0.221 and $0.215, according to pivot and fib levels.

Zooming out, GalaxyBTC tweeted that Dogecoin remains firmly in its “accumulation phase” on the monthly RSI chart, highlighting past cycle patterns where a long sideways grind eventually preceded explosive upside. While not a timing tool, it suggests the longer-term macro setup may be constructive.

Dogecoin Price Forecast: Breakout Requires Volume, or $0.21 May Be Retested

The short-term outlook for DOGE depends on whether buyers can push the price back above the $0.23–$0.235 range. If it breaks above $0.25, there could be a rally towards $0.28. However, this requires more support from the overall market and better economic conditions.

On the other hand, if the DOGE price fails to hold the support at $0.221–$0.215, it might drop to $0.20, especially if Bitcoin struggles after the FOMC announcement.

For long-term holders, some are taking a more optimistic view. Analyst Javon Marks points to historical fractals and previous bull market behavior, projecting that DOGE price could gain over 226% from current levels to retest its all-time high of $0.739. A more aggressive forecast suggests 830% upside, potentially reaching $2.11 in future cycles.

But for now, all eyes remain on short-term volume and whether the buy signal from the 4-hour chart materializes into a genuine reversal.

READ MORE: TRON Price Prediction: Will TRX Hit a New High Soon?