Solana (SOL) has dropped over 7% in the last 24 hours, sliding from $173 to $160.97 as bearish momentum took hold following a confluence of macro, technical, and regulatory headwinds.

The steep correction, marking roughly a 22% pullback from Solana’s July peak, has caught traders off guard despite a booming futures market on the CME.

July’s surge in institutional interest, including $8.1B in CME trading volume and a tripling in open interest to over $400M, painted a bullish macro narrative.

But under the surface, sentiment has turned risk-off, especially after the SEC’s “Project Crypto” announcement triggered renewed regulatory uncertainty across the altcoin space.

Regulatory News Trigger Panic Selloff

Solana’s recent dip wasn’t entirely technical. The U.S. Securities and Exchange Commission (SEC) unveiled “Project Crypto” on August 1, a policy initiative aiming to strengthen oversight on decentralized networks and staking-based protocols.

While the long-term goal is market clarity, traders reacted swiftly with risk aversion. SOL fell from $169.34 to $166.13 within hours, as volume surged 52.5% to $7.96B, according to CoinMarketCap.

Similarly, as BanklessTimes recently reported, the crypto market plummeted following tariffs and weak jobs data, with Bitcoin at $113,000 and total market cap dropping to $3.69T. Altcoins took the brunt of the fear-driven selloff.

Bitcoin dominance climbed to 61.14%, reflecting capital rotation away from high-volatility tokens. Meanwhile, the Altcoin Season Index plunged 14% this week, suggesting institutional players are leaning back toward safer bets.

Key Levels Breached, Bearish Signals Confirmed

The Solana price structure has shifted decisively bearish. The 50% Fibonacci retracement level from the June 22 low to the July 22 high sits at $164, precisely where SOL bounced before losing ground again.

As pointed out by crypto commentator MartypParty, this zone was a textbook level for a pullback, and once broken, opened the door to deeper downside targets.

Recent data shows that several important support levels have failed. The first level was $168.27, which is the 78.6% Fibonacci retracement from the July increase. The second level is $170.62, which was the 30-day simple moving average but has now turned into resistance. The third level, $163.87, was a minor support that was broken during intraday trading.

Bollinger Bands on the daily chart also suggest widening volatility, with SOL tagging the lower band near $156. MACD histogram has flipped negative (-2.1), and RSI sits at 48.4, indicating more room for sellers before oversold levels kick in.

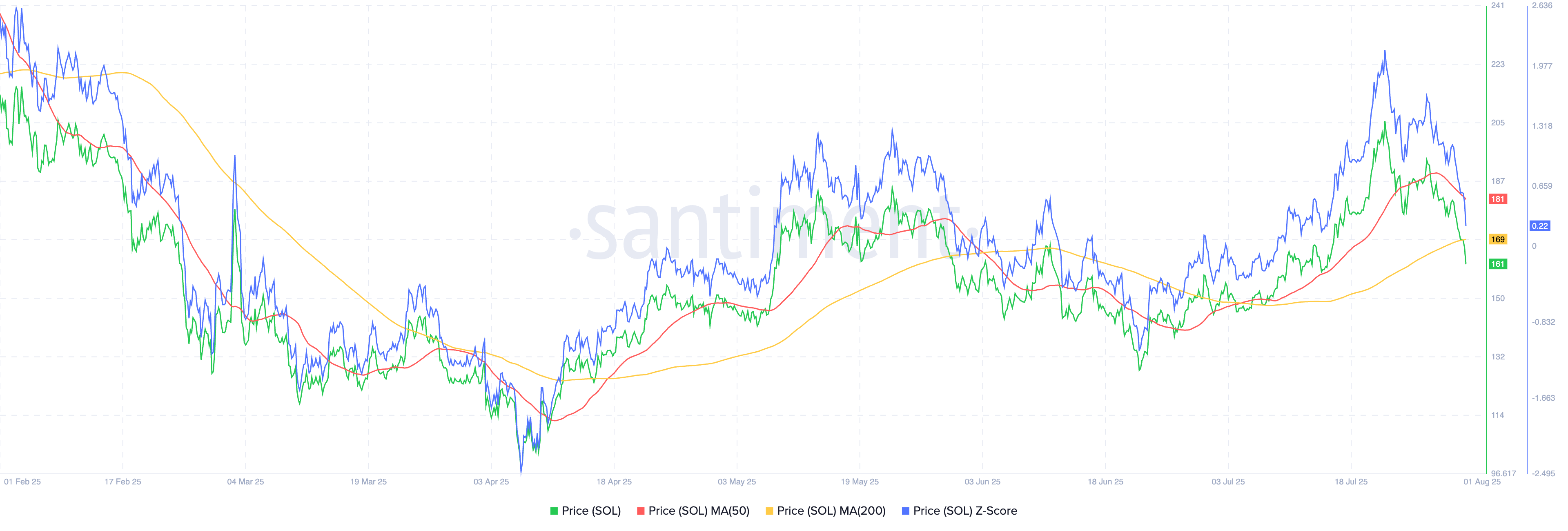

On Santiment, SOL’s price broke below both the 50-day and 200-day moving averages, with Z-Score metrics turning negative, another red flag for momentum traders.

Solana Price Outlook: $150–$140 Liquidity Zone in Focus

Trader @Degen_Hardy pointed out that over $100B in liquidations are sitting below the current price zone, with the $140–$150 region offering the next potential bounce. That zone aligns with the lower Fibonacci confluence and the psychological range observed in late June.

If $150 breaks decisively, the next support for the coin lies around $128.49, which coincides with pre-July breakout levels.

However, bullish traders aren’t entirely out of options. A reclaim of $170 could invalidate the breakdown and revive bullish interest, especially if the broader market stabilizes. But without that, SOL remains vulnerable to further downside.

READ MORE: Here’s Why the Crypto Bull Run is On Despite Altcoins Going Down