The crypto market crash continued on Friday, with Bitcoin plunging to $113,000 and the market capitalization of all coins falling to $3.69 trillion, down from $4 trillion two weeks ago.

Most altcoins crashed today, August 1, with many of them entering a technical bear market after falling by over 20% from their highest level this year. Hyperliquid (HYPE), Jupiter (JUP), Raydium (RAY), and SPX6900 (SPX) were among the top laggards. Total liquidations jumped by 270% to $908 million.

Crypto Crash Happened After Tariffs and Weak Jobs Data

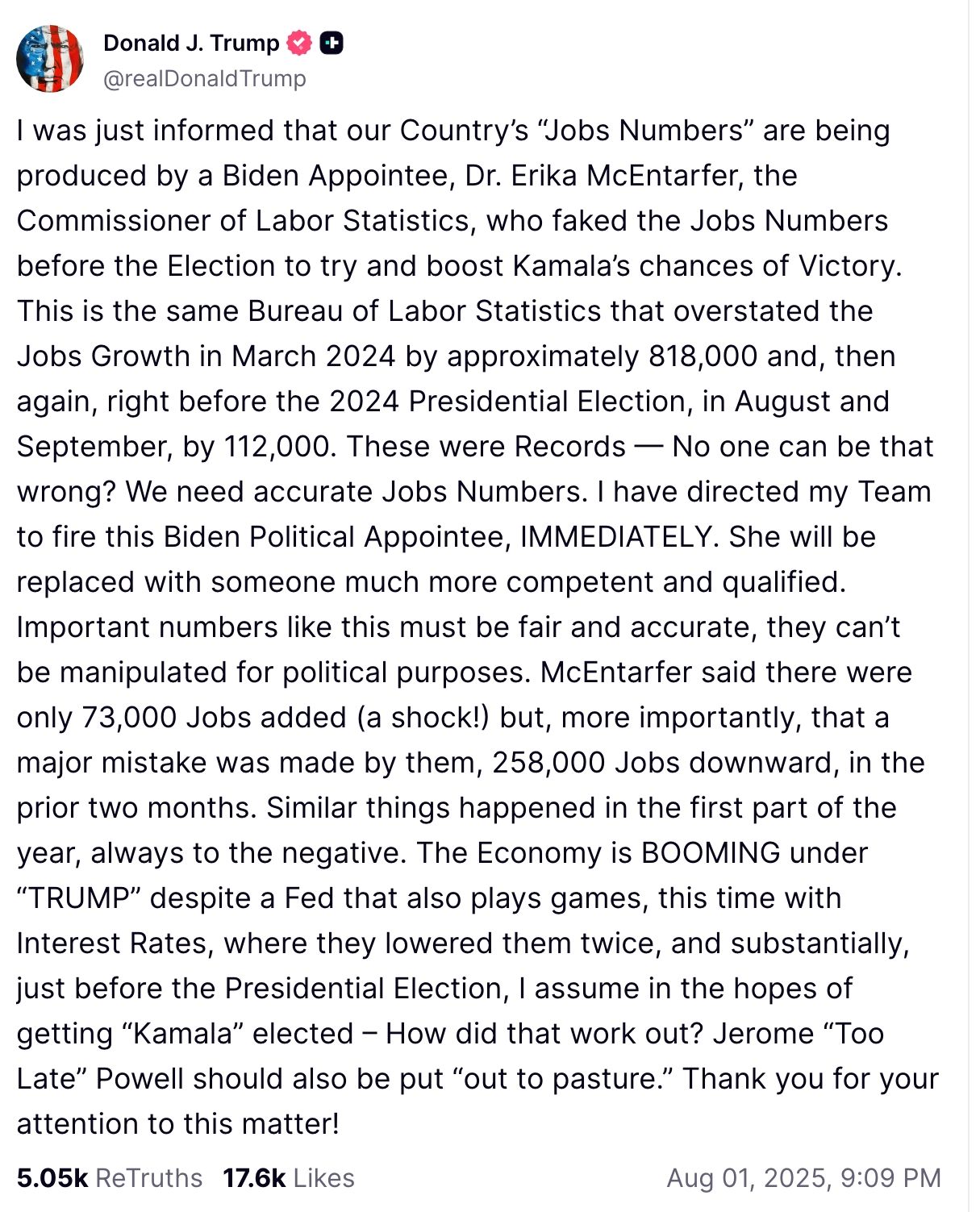

The main reasons for the crypto crash were the introduction of Donald Trump’s tariffs on many countries and the publication of a weak nonfarm payrolls (NFP) report by the Bureau of Labor Statistics (BLS).

These events also explain why the stock market plunged, with the Dow Jones and Nasdaq 100 falling by 542 and 450 points, respectively.

Trump implemented sweeping tariffs against some key trading partners like Switzerland, India, and South Africa. Even for the countries with which he reached agreements, Trump left tariffs of at least 15%.

The impact of these tariffs is starting to show, with inflation ticking up and the labor market worsening. A report by the Bureau of Labor Statistics (BLS) showed that the economy created 73,000 jobs in August as the unemployment rate rose to 4.2%.

The bureau also downgraded the previously released jobs numbers, a sign that the labor market is deteriorating. As a result, Trump threatened to fire the head of the bureau and replace her with someone “more competent and qualified”, raising concerns about the accuracy of future reports.

On the positive side, the stock and crypto markets always rebound from these knee-jerk reactions. For example, they both crashed after he unveiled his retaliatory tariffs in April and then surged by double digits a few months later.

The other positive is that the weak job numbers mean that the Fed may decide to cut interest rates by 0.25% in its September meeting. Stocks and crypto tend to perform well in periods of low interest rates.

READ MORE: Here’s Why the Sei Price Has Moved Into a Bear Market

Crypto Market Crashed Amid Profit Taking

The other main reason for the crypto crash is that investors are simply taking profits after the surge in the first half of the month. At the time, Bitcoin surged to $123,200, a big jump from the April low of $74,500. Ethereum jumped to nearly $4,000 from $1,350.

It is common for a soaring asset to retreat as investors take profits. In technical analysis, this performance is known as mean reversion. It is a process where an asset drops back to its historical average after a significant deviation.

Bitcoin has always pulled back after hitting an all-time high. For example, as the chart above shows, it surged to a record high of $112,200 in May and then pulled back to $98,190 in June before rebounding.

The current crash could be part of the formation of a bullish flag pattern, which often leads to a strong rebound. Therefore, there is a chance that the Bitcoin price will rebound this month, leading to more upside among altcoins.

READ MORE: JASMY Price Prediction as Whale Accumulation Jumps 188% in July