Litecoin price has risen sharply, increasing over 8.4% in the last 24 hours to about $119. This surge is driven by growing interest from institutions, positive technical signals, and rising hopes for a potential Litecoin ETF.

Currently ranked as the 19th largest cryptocurrency, Litecoin holds a market cap of $9.06 billion, according to CoinMarketCap. Daily trading volume has also spiked, nearing the $1 billion mark, a 23.9% increase in just one day.

With positive technical chart signals, on-chain metrics, and expert analysis, many believe Litecoin could still have more room to run, as long as buyers keep pushing.

Institutional Adoption and ETF Optimism Bolster LTC Sentiment

Much of Litecoin’s recent price strength is tied to growing institutional adoption. In mid-July 2025, Nasdaq-listed MEI Pharma made a $100M commitment to a Litecoin treasury strategy, the first time a U.S. public company has formally adopted LTC as a primary reserve asset.

This follows earlier accumulation by Luxxfolio Holdings, which holds over 20,000 LTC.

On August 4, Luxxfolio tweeted, “Did we just bolt ourselves to a rocket ship with Litecoin in our reserve? Because it’s starting to feel like liftoff,” hinting at confidence in LTC’s upside potential.

This wave of corporate interest has sparked comparisons to MicroStrategy’s early Bitcoin treasury moves, which proved a catalyst for BTC’s exponential rise.

READ MORE: Pi Crypto Price Analysis: Can Pi Network Surge to $100?

In parallel, Bloomberg analysts have recently assigned a 95% approval probability for upcoming Litecoin ETFs, citing its classification as a commodity by the CFTC and the precedent set by Bitcoin spot ETFs.

Litecoin Price Could Surge 192% if Bullish Setup Confirms

Technical indicators show that Litecoin is flashing a strong breakout setup. Analyst Javon Marks projects a bullish target of $354.36, a potential 192% gain from current levels.

According to his chart analysis, LTC has recently broken a key downward trendline, indicating it is ready for a rally that may last several months. It has already increased by over 50% in recent weeks.

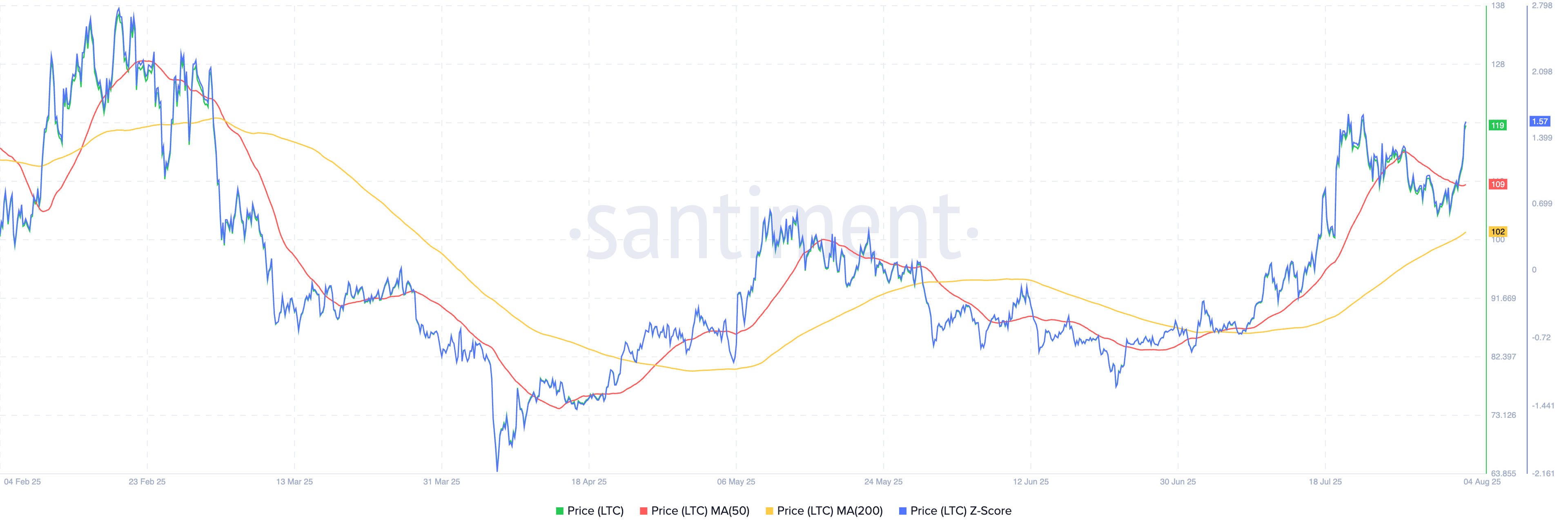

Data from Santiment supports this, showing a positive trend where the 50-day moving average has crossed above the 200-day moving average. The latest MA(50) is $109 while LTC trades at $119, well above both the 50- and 200-day averages, revealing trend strength.

Multiple other analysts confirm bullish technical setups, as some highlight a symmetrical triangle consolidation on LTC’s 2-day chart, with the Ichimoku Cloud offering reliable support.

A clean break above triangle resistance (around $120–125 range) would likely confirm a complete trend reversal and invite more momentum buyers.

In the short term, traders are eyeing the $122–$125 zone as immediate resistance. A decisive break above that would open up a path to $135, then $150, the latter being a psychological level and previous local top.

Mid-term, the $354.36 target from Javon Marks would require both sustained institutional interest and broader crypto market tailwinds. However, the 37.37% monthly gain and 84.65% 1-year return give bulls reason to remain optimistic.

READ MORE: Trending Pepe Crypto Rival Priced at $0.001 Could Hit $2 by November