SYRUP price crashed into a bear market, falling by over 37% from its highest point this year to the current $0.4245. Maple Finance still remains about 365% above the lowest point this year, making it one of the best-performing altcoins.

Maple Finance Network is Growing

Third-party data shows that the Maple Finance total value locked (TVL) jumped to nearly $2 billion, up from $296 million on January 1 of this year.

More data shows that the assets under management (AUM) jumped to over $2.87 billion. The management hopes that the AUM will jump to over $4 billion by year’s end, which is a possibility.

Its outstanding loans jumped to $1.15 billion, making it one of the fastest players in the crypto industry.

Total loan originations jumped to over $8.6 billion, while the total interest paid to limited partners spiked to over $85.1 million. As a result, the monthly protocol revenue rose to a record high of $1.3 million, up from the $1.29 million it made in June.

Maple Finance’s revenue stood at just $270,000 in July last year and the $410,000 it made in January this year.

More data shows that the demand for the SYRUP token has soared in the past few months. For example, the amount of staked SYRUP jumped to 403 million, a significant figure as it has a circulating supply of 1.19 billion coins.

READ MORE: HBAR Price Tanks After Bearish Signal—Will Hedera Rebound?

SYRUP Price Technical Analysis

Maple Finance token chart | Source: TradingView

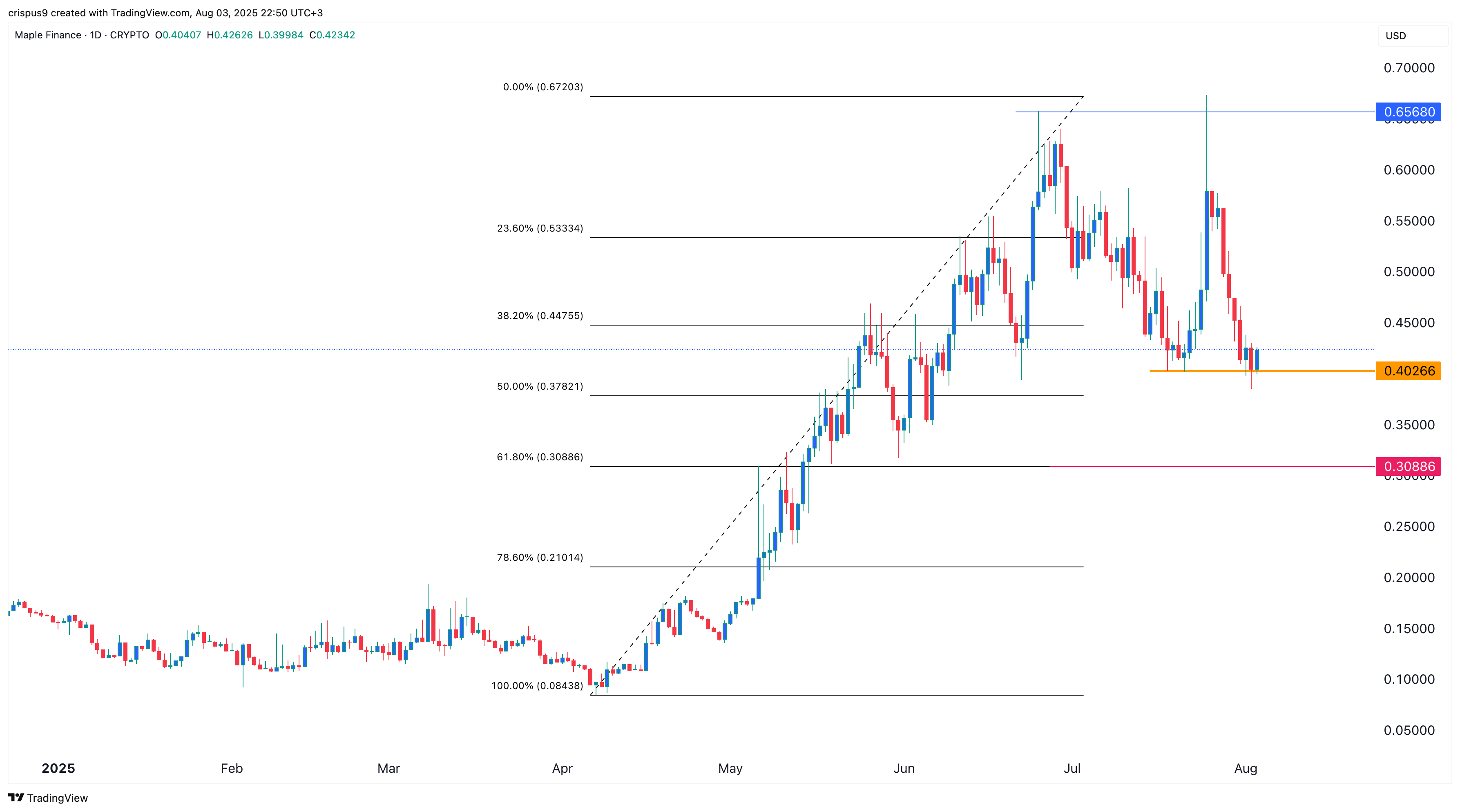

The daily chart shows that the Maple Finance price has crashed in the past few months. It plunged from a high of $0.6720 on July 25 to the current $0.4250, up slightly from a low of $0.3850.

On the positive side, the token has formed a double-bottom pattern at $0.4026, with its neckline at $0.6720.

Therefore, the token will likely bounce back in the coming days as bulls target the 23.6% Fibonacci Retracement point at $0.5335, up by about 26% above the current level.

On the other hand, a drop below this month’s low of $0.3850 will invalidate the bullish forecast. Doing that will validate the double-top pattern at $0.6568 and point to more downside, potentially to the 61.8% Fibonacci Retracement point at $0.3088, down by about 27% below the current level.

READ MORE: Cardano Price Plunges Ahead of Rare Evo as New $0.001 Token Surges