Jupiter Exchange’s much-anticipated Jupiter Lend went live in private beta on August 6, but rather than sparking a rally, the Jupiter token, JUP, is down over 4% in the last 24 hours, continuing a broader downward trend that’s seen the token shed over 14% in the past week.

At present, traders appear to be cashing out after a 42% monthly pump, classic “buy the rumor, sell the news” behavior despite the project’s DeFi roadmap and key infrastructure launches on Solana.

Traders Sell the News as Jupiter Lend Private Beta Launches

The Jupiter Lend private beta, built in partnership with Fluid Defi Protocol, introduces some of the most advanced money market mechanics to Solana DeFi, offering up to 95% Loan-to-Value (LTV), 1% liquidation penalties, and isolated risk vaults.

Yet, the launch came with caveats: it’s waitlist-only, capped at $1 million borrow limit per vault, includes only six assets, and is still undergoing three more audits.

While the tech looks impressive, the restricted access and gradual rollout likely cooled market enthusiasm. According to a tweet from Jupiter Exchange, the full public launch, featuring more vaults, broader asset support, and incentives from 10+ DeFi partners, is slated for later this month.

Furthermore, recently launched Jupiter’s Verify v4 system streamlines token verification on Solana, providing faster approvals and clearer guidelines.

Solana investor Marino highlighted how the Verify V4 upgrade enhances security for traders and builders, providing more utility for $JUP holders through priority access and scam protection. Still, the 24-hour trading volume for JUP dropped 17.75% to $43.94 million, and none of this was enough to hold back today’s sell pressure.

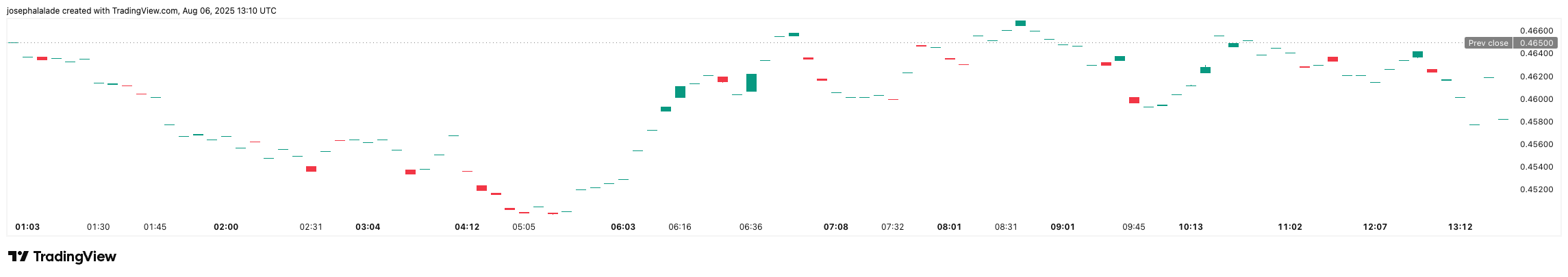

Jupiter Price Analysis: $0.478 is the Key Level to Reclaim

Current technical indicators confirm a bearish trend across multiple timeframes. The MACD histogram shows -0.0135, indicating increasing downside momentum.

Meanwhile, the RSI (14) registers at 43.47, nearing the threshold for oversold conditions but not quite reaching it. Furthermore, the price has fallen below both the 7-day EMA at $0.481 and the 30-day SMA at $0.5155, which serve as definitive signals of weakness in the overall trend.

On the weekly chart, the Jupiter price closed at $0.4589, with resistance stacking near the 50-day MA ($0.7227) and Bollinger average ($0.4687). Traders are now eyeing $0.452 as the next support level to hold.

A breakdown from there could send the JUP price toward the $0.42–$0.43 Fibonacci support zone, while upside targets remain capped unless the token reclaims the $0.478 retracement level.

READ MORE: Pump Fun Price Prediction as It Tops LetsBonk in Token Launches