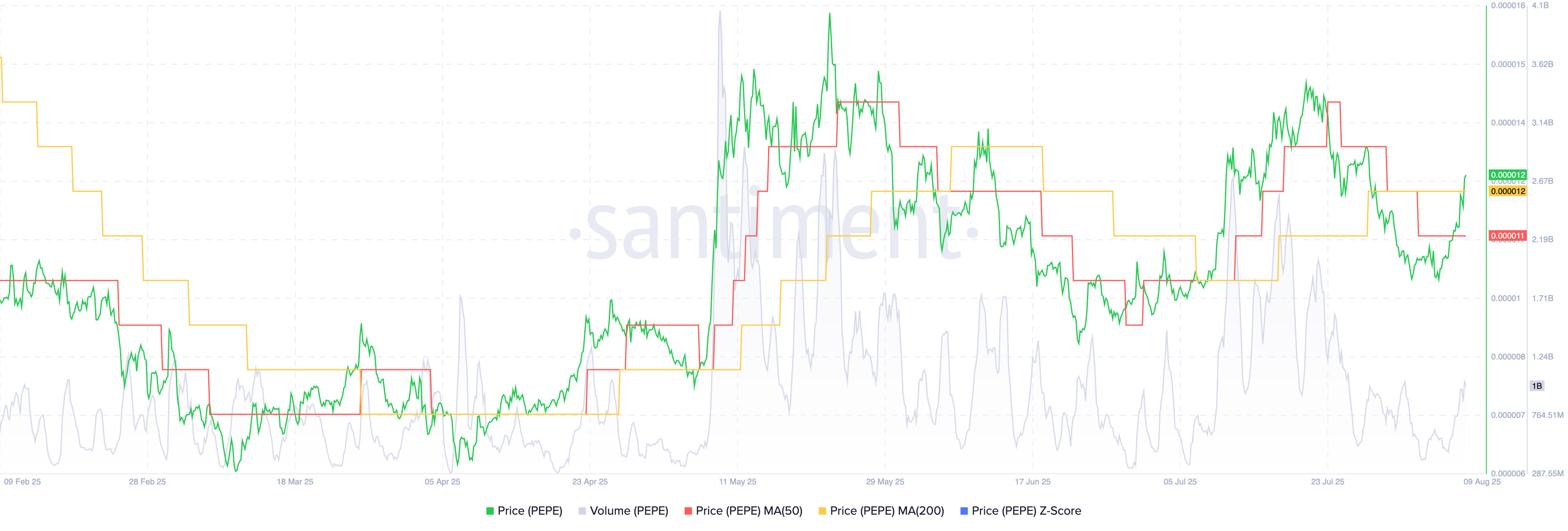

Pepe Coin has broken past key resistance, riding the Ethereum price surge toward new all-time highs. On August 8, PEPE price reclaimed its critical 50% Fibonacci retracement level at $0.0000123, snapping a 5-day consolidation.

The move was marked by eight consecutive green candles on the 15-minute chart and backed by a 17.68% jump in 24-hour trading volume to $1.01 billion.

Ethereum’s Rally Sparks Meme Coin Rotation

The breakout in the price of PEPE Coin coincided with a wave of bullish sentiment across Crypto Twitter. Friedrich told his 72k followers, “$ETH is going for a new ATH and the biggest meme on $ETH will blast. $PEPE I’m talking about,” framing it as one of those “rare opportunities” traders shouldn’t miss.

Ethereum price breakout above $4,100 has been the major macro driver. Javon Marks reminded crypto traders that ETH had already climbed +120% from its April lows on a confirmed bullish divergence, now targeting $4,811 next.

Meanwhile, Plazma noted the shift in market psychology: He maintained that this is an organic rotation to risk-on assets after breaking years-old resistance.

“The memes that pumped when the market was doubtful are manipulated with controlled supply,” he noted.

In simpler terms, with the ETH price rising towards the November 2021 all-time high of $4,891.70, meme coins like PEPE are being bid up as traders hunt for higher-beta plays.

PEPE Price Prediction as Bulls Take Control

PEPE price’s August 8 breakout pushed the meme coin above the $0.0000117–$0.0000120 pivot zone, a level that had repeatedly capped upside since late July. This move triggered automated buy programs and liquidated short positions, adding fuel to the rally.

READ MORE: Cardano (ADA) on the Edge: This Level Could Decide the Trend

Technical indicators show a positive trend as trading volume increased to 19.45% of the market cap. The MACD is now positive, with stronger momentum in the histogram, and the RSI (14) is at 57.15. This means a reset from overbought conditions, allowing for further growth.

Moreover, the PEPE price now trades above the 10, 20, 50, 100, and 200-day EMAs, with the daily TA summary flashing Strong Buy (16 buy signals, zero sell).

Further data from IntoTheBlock shows whale transactions (> $100K) rose 6.63% on August 8, but exchange balances also climbed by 1.2T PEPE. This split behavior, characterized by accumulation alongside distribution, suggests that some large holders are taking profits while others position for more upside.

Futures open interest also fell 10% to $666B, hinting at reduced leverage exposure. That could limit blow-off tops but also keep rallies healthier.

Immediate resistance for the PEPE Coin sits at $0.0000128, which is the July 23 swing high. A daily close above could open a run toward $0.0000147, followed by $0.0000156, the level highlighted on analyst Friedrich’s chart.

However, support lies at $0.0000110, which is the breakout retest zone, with deeper backing at $0.0000100, as we might see a broader market pullback if ETH fails to hold $4,100.

READ MORE: IBIT ETF Hits $86 Billion as Harvard, Brown Universities Buy