Ethereum price (ETH) has reclaimed over $4,300 for the first time since late 2021, thanks to a historic wave of institutional investments. On August 11, U.S ETH ETFs saw record net inflows exceeding $1.02 billion, with BlackRock accounting for $639.8 million.

This influx into ETH ETFs follows reports of a major buying spree, with one unknown institution purchasing nearly $947 million worth of ETH in just the past week.

Although some traders are starting to take profits and signs of overbuying appear, many are closely watching the Ethereum price as it approaches its previous all-time high of $4,891 and the critical $5,000 mark.

ETH Soars as Institutional Demand Hits Record Levels

The inflow surge follows weeks of growing institutional interest in ETH-based ETFs, with cumulative flows now exceeding $10.85 billion. The August 11 spike dwarfed previous highs, and the distribution data shows that BlackRock and Fidelity’s products are absorbing the lion’s share of new capital.

This institutional activity has been mirrored on-chain: exchange reserves have fallen to 18.7 million ETH, the lowest in over three years, as large wallets move coins into cold storage.

Retail sentiment is also climbing fast. Token Terminal data places daily active addresses at 544.6K, up nearly 30% from June lows.

Social chatter reflects bullish conviction, with trader and analyst ZYN, who has over 100k X followers, suggesting ETH price could reach $4,800–$5,000 before hitting a local top, based on historical RSI patterns.

Ethereum Price Outlook: $5K in Sight, but CPI Could Shake It Up

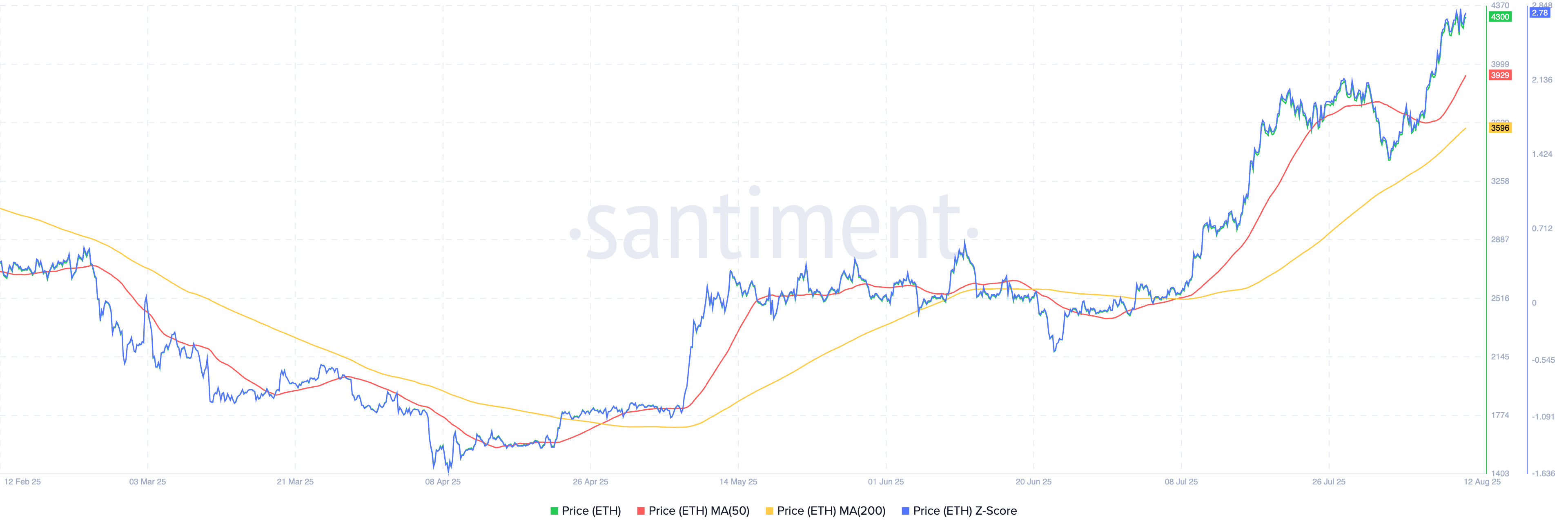

Ether price remains in a bullish breakout. The 4H chart shows price comfortably above the 50-day ($3,929) and 200-day ($3,596) moving averages, with the golden cross formed in late July still intact.

The Relative Strength Index (RSI14) is at 71.44, firmly in overbought territory, and Glassnode data reveals short-term holders have realized roughly $553 million in daily profits (7-day SMA), the highest profit-taking intensity since December 2024. Around 385,000 ETH flowed into Binance this week, raising the risk of near-term sell pressure.

Key resistance for Ethereum prices is $4,300, then $4,700, a level where around $2.23 billion in leveraged trades could get liquidated, potentially causing a sharp move higher. On the downside, $4,025 is the first major safety net, with a deeper drop toward $3,750 possible if profit-taking ramps up.

If buying pressure from ETFs and whales keeps up, the Ethereum price could smash through $4,300 and make a run toward $4,800–$5,000, as suggested by RSI patterns. Clearing $4,700 would likely spark heavy FOMO buying, especially if more big-money headlines hit the market.

However, we can’t ignore the bearish case either. Global crypto markets dipped 2.32% ahead of the U.S. CPI release today, with the Ethereum price underperforming BTC as traders trimmed altcoin exposure. The Crypto Fear & Greed Index has already slipped from 62 yesterday to 60 today, suggesting a cooling appetite for risk.

READ MORE: Zora Crypto Price Prediction as Smart Money Holdings Surge 710%