Arbitrum price ripped into the mid-$0.50s on a clean, high-volume breakout, putting bulls back in control after months of consolidation. Data shows the ARB coin is trading at $0.55, up over 15% today, with $1.46 billion in turnover, up 164% day-on-day.

Trader chatter mirrors the tape as one popular analyst flagged one of the year’s largest volume inflows and mapped the next magnet zones at $0.70 and $1. At the same time, another expert highlighted a momentum reset, which is MACD turning up and RSI “still fresh.”

Arb Price Technical Analysis: Key Levels to Watch

The Arbitrum coin now trades decisively above its 50-day ($0.44) moving averages, an objective regime shift after a long base. A Central Charts snapshot showed price pressing through an oblique resistance around $0.548, confirming a volatility expansion.

Immediate resistance sits at $0.57–$0.60. That’s where today’s impulse meets prior micro-supply and where many short-timeframe traders will try to fade strength.

READ MORE: Best Altcoin to Buy as the Raging Crypto Bull Run Gains Steam

A strong acceptance above that band on rising volume unlocks $0.68–$0.70, the top of the spring range, and a clear horizontal from multiple failed rallies earlier in the year. If ARB coin clears $0.70, the roadmap opens toward $0.80, with the round-number gravity of $1 in play if momentum and flows persist.

Notably, the first buy-the-dip zone is $0.50, reinforced by a cluster of short MAs and today’s breakout ledge. Below that, $0.47–$0.49 is a structural shelf flagged by traders and visible across multiple charts; it’s where the market last absorbed supply before squeezing higher.

Why Arbitrum Price Is Going Up Today

There are many reasons why the Arbitrum price is going up today. For one, participation looks constructive on the network. Arbitrum’s active addresses are up 16% on the week and 32% this month. Also, token trading volume on a rolling 30-day basis climbed to about $12.9 billion, a 55% surge.

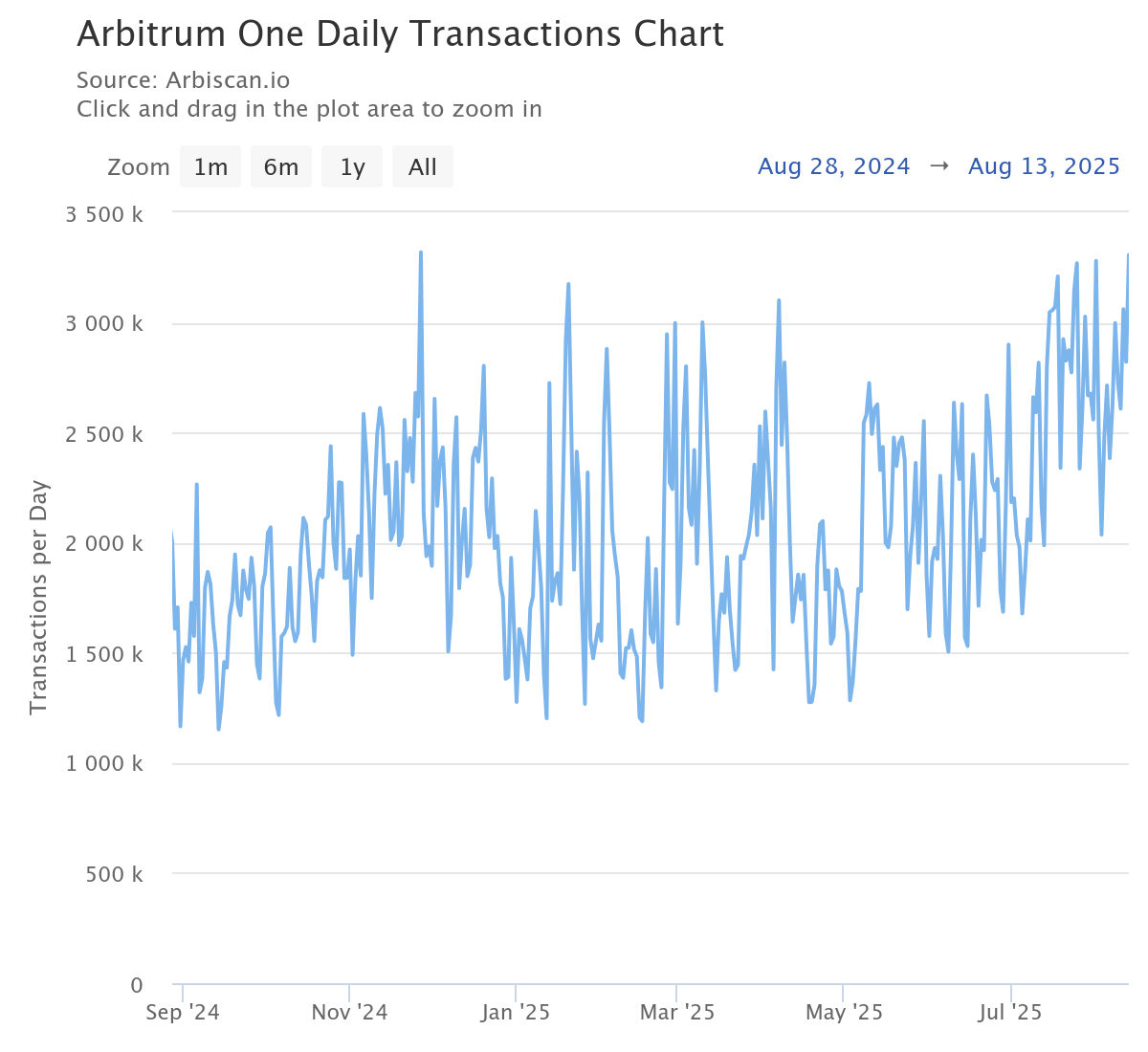

Further data shows that Arbitrum throughput is re-accelerating, with Arbiscan showing over 3.31 million transactions on August 13 and over 112k new addresses that day.

Arbitrum One Daily Transaction Chart | Arbiscan

On the DeFi side, dashboards show about $4.75 billion TVL and $896 million in 24h DEX volume, keeping the network in the flow of on-chain liquidity.

Two headlines also cleared the air: GMX finalized a $44M compensation plan for July’s exploit on August 13, removing a major DeFi overhang, and Offchain Labs acquired ZeroDev to strengthen smart-account infrastructure, useful developer fuel as L2 competition gets sharper.

Ethereum price performance also helps. ETH price surged to $4,788 today, a multi-year high and just shy of its 2021 all-time high. This comes as there are speculations that the crypto bull run is here. When Ethereum rallies, Layer 2 coins like Arbitrum usually follow.

READ MORE: XLM and XRP Prices Alert: Ripple and Stellar Left Behind in Crypto Rally