Mantle price (MNT) has surged to become one of today’s top-performing altcoins, climbing over 12% in 24 hours to trade at $1.37 and briefly hitting $1.39.

The rally pushed Mantle into CoinMarketCap’s daily leaderboard alongside OKB and Cardano, supported by a surge in 24-hour volume to $692 million, an 82% jump that signals strong spot demand.

Also, the move extends MNT’s month-long recovery, where the token has gained nearly 50% since early August.

Coinbase Futures, Bybit Collateral, and Staking Programs Fuel Demand

The sharp upside comes on the back of a flurry of exchange-driven catalysts. Coinbase International Exchange confirmed it will list MNT perpetual futures on August 21, alongside RSR and SUPER. This marks Mantle’s debut on Coinbase’s derivatives market, which unlocks exposure to institutional traders seeking leverage and hedging strategies.

Furthermore, Bybit has doubled down on Mantle integration. On August 19, the exchange adjusted MNT’s collateral ratio across its loan products, making it more favorable for borrowing and leverage strategies.

Just days earlier, Bybit EU launched a MiCA-compliant staking program for MNT, offering yield opportunities in a regulated framework. Mantle has also been plugged into Bybit’s “Double Win” structured products and Creator Campus initiatives, expanding utility beyond governance into yield farming, event access, and creator-driven adoption.

READ MORE: Bitcoin Price Prediction: Patterns Point to a BTC Crash

Together, these moves have amplified Mantle’s profile from a governance token to a multifunctional asset woven into Bybit’s product suite, an evolution traders are comparing to Binance’s early adoption of Binance Coin (BNB).

Mantle Network Upgrades and Ecosystem Expansion

Fundamentals are also strengthening. Mantle Devs announced that Mainnet upgrade v1.3.1 will go live on August 27, with full support for Ethereum’s upcoming Prague hard fork. The upgrade, codenamed Skadi, promises smoother integration for builders and unlocks new tooling for DeFi protocols.

The Mantle ecosystem has already seen TVL rise nearly 25% between August 7 and 13, reaching $1.6 billion, showing its growing reputation as a liquidity-first L2.

On-chain adoption is trending steadily upward. According to Token Terminal, Mantle now counts 24.9K token holders, ranking 10th among L2 ecosystems.

While its market share of 0.3% is modest compared to Arbitrum or Optimism, the growth trajectory highlights Mantle’s expanding community base.

Mantle’s MNT Breaks Key Averages, Nears Resistance

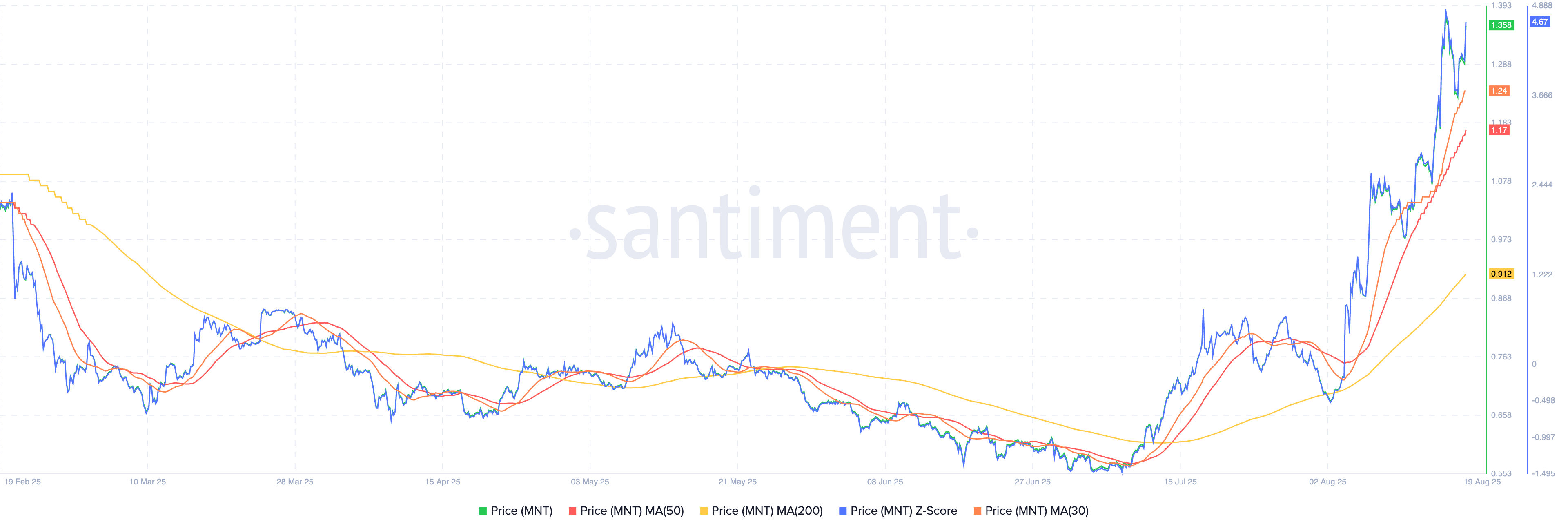

Mantle price has broken convincingly above the 50-day ($1.17) and 200-day ($0.91) moving averages, with the 30-day average climbing to $1.24. Momentum indicators from Santiment show MNT entering overextended territory, with a Z-Score above 4.6, suggesting the rally is stretched but not yet exhausted.

Mantle (MNT) price chart | Santiment

Crypto analyst Daan Crypto Trades noted Mantle is “currently at resistance but getting close to that all-time high,” citing Bybit’s deepening involvement as a structural driver.

He speculated that if MNT were used for trading fee discounts, annual buying pressure could reach $500M–$2B, placing Mantle’s fair value significantly higher than its current $4.6B market cap.

Whale activity also supports the bullish case. Exchange data shows a 106% spike in whale spot buys versus sells in the last 24 hours, with net outflows of nearly $10 million, the highest since July.

This reduces immediate sell pressure, although it raises the risk of profit-taking if over-leveraged longs unwind, currently 43% of open interest ($112M).

READ MORE: Will Pi Network Coin Price Crash Continue or Rebound?