Chainlink native token LINK is once again in the spotlight after rallying over 5% in the past 24 hours, trading around $25 as of August 20.

The bounce has been sharp, with Chainlink price gaining nearly 7% off its recent lows, according to a market analyst, who noted that the token is “leading the bounce” and could see the “sky as the limit” if it clears the key $29–34 resistance region.

The latest spike is a cocktail of whale accumulation, exchange outflows, and growing institutional adoption of Chainlink services, which is driving a supply squeeze that has traders eyeing higher levels in the coming weeks.

Whales Buy Big as Exchange Balances Drop

Data shows whales acquired 1.1 million LINK (≈$27 million) in the past seven days, with the top 100 wallets increasing their holdings by 12%.

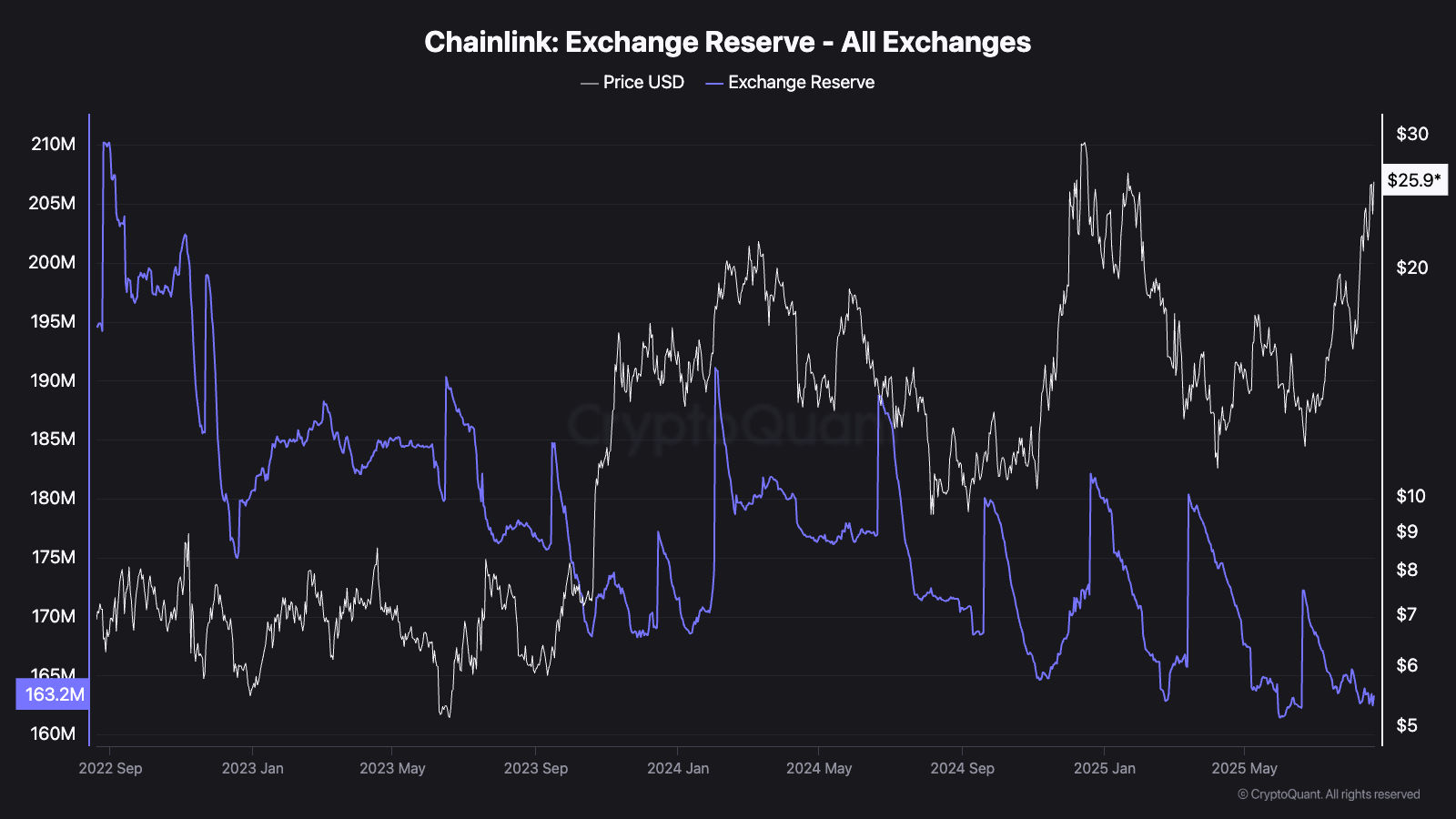

At the same time, CryptoQuant data shows that the number of LINK tokens on exchanges has decreased to approximately 163 million, nearing a yearly low. This is up from June’s 161 million but significantly down from over 200 million in late 2022.

Chainlink exchange reserve | CryptoQuant

This tightening supply is critical for traders. With fewer tokens sitting on exchanges, liquidity thins, and even moderate buy-side demand can push prices higher.

Institutional Utility from Partnerships

The bullish fundamentals extend beyond on-chain moves. Chainlink continues to roll out high-profile partnerships, placing itself at the center of the fast-emerging tokenized asset economy projected to top $30 trillion by 2030.

READ MORE: Bitcoin Price Prediction: Patterns Point to a BTC Crash

On August 20, Bitget, a top-20 exchange with over 120 million users, integrated Chainlink’s Proof of Reserve for its wrapped Bitcoin product (BGBTC).

Pendle Finance, with $9B+ in TVL, also adopted Chainlink’s data standard on Arbitrum and Base to power its new futures platform, Boros. This integration enables highly secure access to on-chain funding rates.

Further, Chainlink also spotlighted its Network Value Flow, a system where protocol fees are aggregated and converted into LINK, flowing into the Chainlink Reserve and distributed to service providers. Already, over 2.6 million LINK has been locked into the reserve, signaling long-term sustainability.

These integrations come on the back of earlier partnerships with Mastercard, SWIFT, and the Intercontinental Exchange, where Chainlink oracles now feed institutional-grade FX and commodities data into DeFi.

Chainlink Price Outlook: Traders Eye $29–34 Breakout Zone

On the charts, Chainlink price is consolidating near $25 after clearing the $24.50 resistance. Volume is healthy, and momentum indicators suggest more room to run.

Crypto analyst and trader Jelle, with over 111k followers on X, points to $29–34 as the next major resistance band, a zone where LINK has repeatedly failed in past cycles. A clean breakout could open the path toward $40, levels not seen since the 2021 bull market.

The bullish case is reinforced by whales front-running this move with steady accumulation. On the bearish side, failure to break above $29 could trigger profit-taking, sending LINK back to its near-term supports at $23.50 and $22.80.

READ MORE: Why Did the Stock and Crypto Market Crash Today (19/08)