VeChain’s native token, VET, surged 4% in the past 24 hours to trade near $0.0259, with volumes almost tripling, placing it among the top crypto gainers today.

A 199% jump in VeChain price daily trading activity pushed turnover above $152 million, signaling fresh capital inflows.

The move followed a clean breakout from its July downtrend on August 10, which now has at least one crypto positioning for higher levels, potentially to over 840% of price increase, with a target at $0.25315.

VET Staking, Wallet Growth, and Partnerships Growing

On-chain growth continues to support VeChain’s case. Over 5.8 billion VET are now staked on VeChain’s StarGate staking program, with participants earning VTHO rewards every 10 seconds.

The VeChain ecosystem also reported 37,461 new wallets in a single day, pushing active addresses to nearly 11.8 million. A recent VTHO burn of 478,938 further suggests rising network activity. VeChainThor (VTHO) is the token used to power transactions and smart contract execution on the VeChainThor blockchain.

Fundamentally, VeChain has scored wins through its MiCAR license approval in Europe in March, which could expand onboarding of Web2 clients. New partnerships, including one with UFC’s Dana White, have broadened its brand exposure.

Combined with Stargate staking yields of up to 9% APY, analysts suggest this mix of adoption and tokenomics shifts could fuel a stronger cycle than previous runs.

Technical Outlook: Key Levels to Watch for VeChain Price

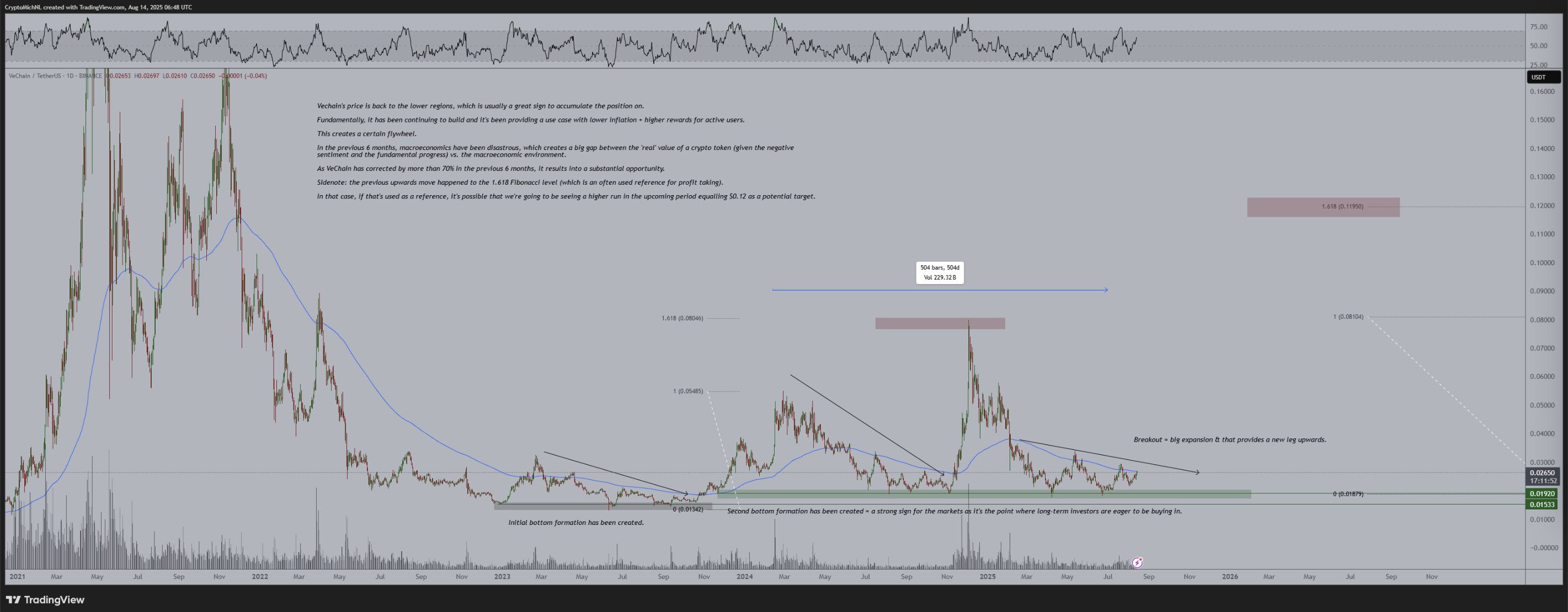

With VeChain token (VET) entering a rising channel after its August 10 breakout, top analysts Javon Marks and Michaël van de Poppe are mapping bold upside scenarios, from $0.12 to as high as $0.25, if momentum continues.

Marks, who has tracked VET since its 2021 highs, maintains that the token has already “broken out of a once key resisting structure.” In his view, this opens the door for a run toward $0.25315, an 840% rally from current levels.

Michaël van de Poppe takes a slightly more conservative but still bullish stance. The Dutch trader emphasizes VET’s current consolidation under the 200-day EMA, with lower highs and reduced volatility preparing the ground for a breakout.

According to van de Poppe, once VET coin flips the 200 EMA back to the upside, the next logical target is the 1.618 Fibonacci level at $0.12.

He also contextualized the move within broader altcoin momentum, noting that VET’s mispricing relative to its fundamental growth makes it one of the stronger candidates to outperform in the next cycle.

Technical Analysis of $VET | @CryptoMichNL on X

“The technical analysis is primed for a breakout,” van de Poppe said, adding that previous periods of consolidation in 2023 and 2024 played out similarly before major runs.

In the short term, traders are eyeing $0.02696, the 50% Fibonacci retracement, as the first resistance to clear, with support at $0.02480. The 7-day RSI at 65.47 suggests upside room before overbought conditions. Sustained closes above $0.02566 are key to validating a continuation higher.