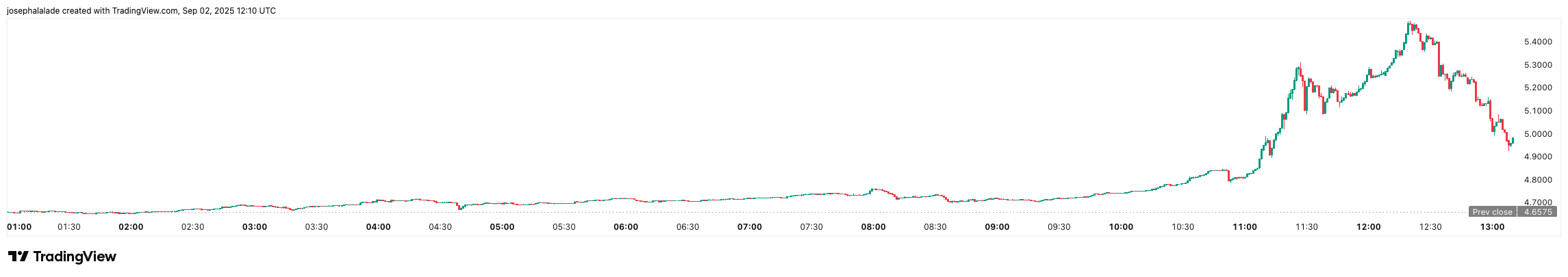

Bitget Token (BGB) is stealing the spotlight today as the exchange-backed token surged nearly 14% in 24 hours, climbing past $5.17 and briefly touching $5.28, its highest level since early August.

Trading volumes exploded to $290 million, up 307% from yesterday, signaling renewed trader appetite for BGB amid a pivotal ecosystem shift.

Further, the bullish performance wasn’t another speculative spike, but it reflects a confluence of institutional-grade announcements that fundamentally change BGB’s role in crypto markets.

Morph Partnership and Tokenomics Shock

The main catalyst arrived this morning when Bitget announced a strategic partnership with Morph Chain, one of the fastest-growing consumer-focused Layer 2 ecosystems backed by Pantera Capital and Dragonfly.

Under the deal, Bitget will transfer all 440 million BGB held by its team to the Morph Foundation, positioning BGB as the official gas and governance token of the Morph network.

The kicker, however, is that Morph will immediately burn 220 million tokens, worth a little over $1 billion, while they will vest the remaining 220 million tokens over 50 months to fuel Morph’s on-chain growth. In effect, Bitget has handed over its treasury, signaling decentralization while engineering token scarcity.

Meanwhile, this follows a broader supply-tightening trend. Bitget already burned 30,001,053 BGB (~$138M) in Q2 2025, reducing circulating supply by 2.56%. Across eight months, the exchange has destroyed 860M tokens, 43% of the total supply.

READ MORE: XRP Price Prediction: At Risk Amid XRP Ledger RLUSD Woes

With a hard cap of 1.14 billion BGB, these burns remove sell-side pressure and create a deflationary tailwind that historically aligns with price rallies.

Institutional confidence in BGB has also grown. Recently, Bitget linked with Chainlink’s Proof of Reserve (PoR) system for Wrapped Bitcoin (BGBTC), allowing real-time checks on its Bitcoin collateral.

As BanklessTimes reported, this upgrade eases concerns about the exchange’s reserves and makes BGBTC a safer option for decentralized finance (DeFi) uses, potentially expanding Bitget Token’s downstream utility.

Bitget Token Price Nears $6, But Resistance Ahead

Charts show a positive trend for BGB. On TradingView, the price has moved above its 50-day average at $4.60 and its 100-day average at $4.59, breaking out of a long period of consolidation.

The indicators also look good. The Relative Strength Index (RSI) is at 68, which is close to being overbought, indicating there is still potential for growth. The MACD shows positive momentum, and the Bollinger Bands are wider, suggesting a rise in volatility.

Overall, technical models give a “Strong Buy” rating, with 17 buy signals and no sell signals.

There is immediate resistance near $5.35 to $5.40, and the next significant level to watch is the $6 mark. For support, traders are keeping an eye on $4.90 in the near term.