The much-anticipated Klarna IPO is around the corner as demand for new listings jumps following the recent debuts by companies like Webull, eToro, CoreWeave, Bullish, and Circle. This article explores some of the key details of Klarna’s listing.

Klarna IPO Details

Klarna, one of the top players in the Buy Now, Pay Later industry, will be in the spotlight this month as it goes public. Its recently-launched S1 documents showed that its business is in a growth trajectory, which may help its stock do well.

Klarna made $2.8 billion in revenue in 2024, higher than the $2.27 billion it made in 2023 and $1.9 billion in 2022. This revenue jumped as more clients joined its network, and the gross merchandise volume soared by 14% to over $105 billion.

Klarna’s number of users has also been growing, and it stood at 93 million in 2024, up from 84 million in the previous year.

Most importantly, Klarna has now become a profitable company, with its net profit being $21 million. That is much higher than the $244 million loss it made in 2023 and $1.0 billion in 2022.

READ MORE: Ethereum Price Prediction: Will ETH Rise or Crash in September?

Will Klarna Stock be a Good Buy

Odds are that Klarna (KLAR) stock will be a good buy in the long term due to the ongoing demand for BNPL and its status as a highly profitable company.

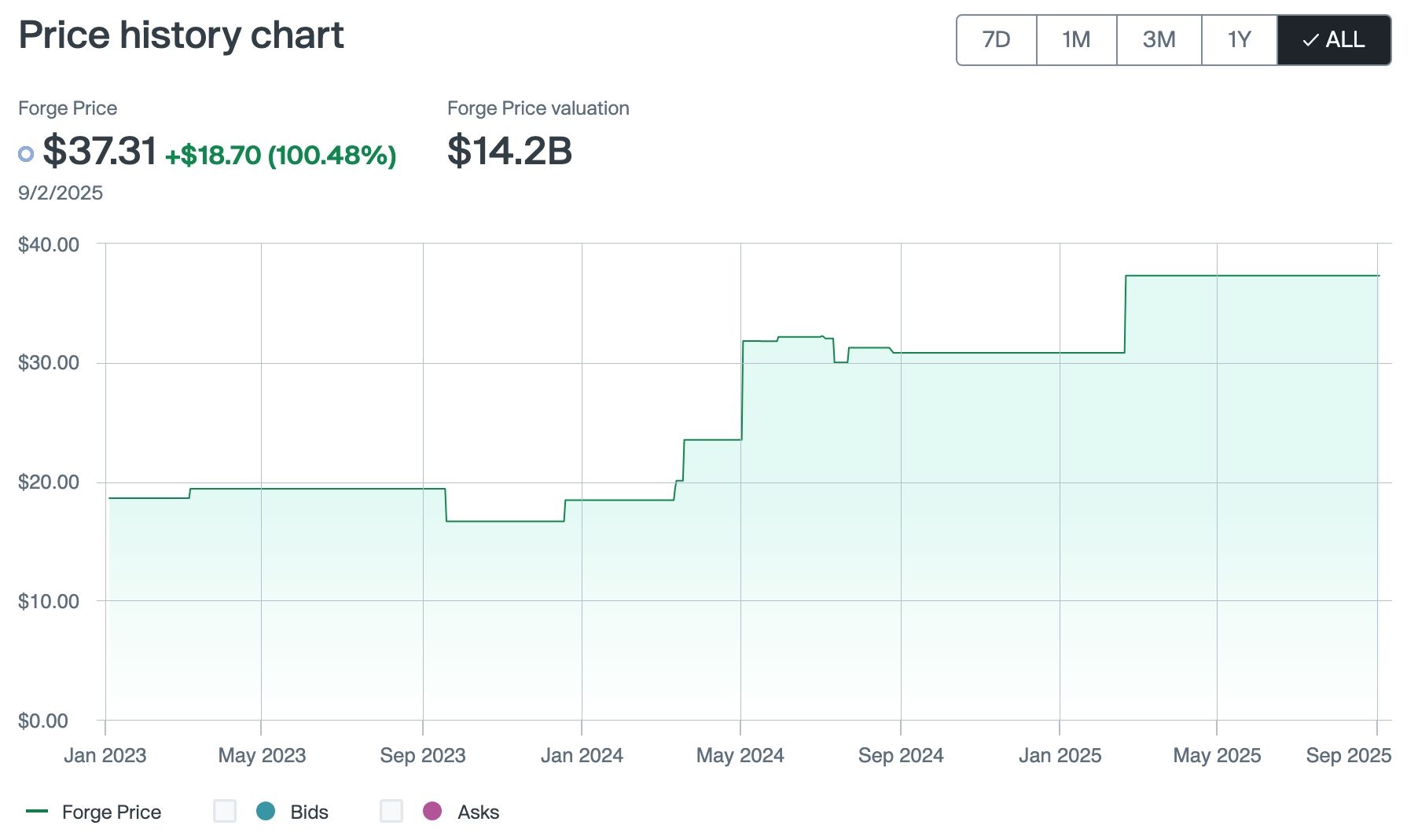

Indeed, data compiled by Forge Global, a company that allows trading of private companies, shows that Klarna’s stock has jumped significantly in the past few years.

Klarna stock chart | Source: Forge

Consequently, its valuation has jumped from about $6 billion in 2022 to nearly $15 billion. This figure is much lower than its peak valuation of over $46 billion during the pandemic.

Another sign that the Klarna IPO will do well is that Affirm, one of its top competitors, is thriving, with its stock rising by 86% in the last 12 months. It has moved from $2.7 in 2022 to $82 today.

The current macro environment is also supportive of a company like Klarna. Recent data shows that consumer inflation has remained at an elevated level in the past few months, pushing more people to use BNPL products.

Klarna, like other BNPL services, offers a checkout platform that lets users shop and pay in four installments without interest. In these transactions, it generates revenue by charging its clients interest.

It also offers interest loans for bigger purchases. Some of its top clients are companies like Asos, Uber, Lululemon, and Airbnb.

The most likely scenario is where the Klarna stock price jumps after its IPO, drops towards the lockup expiry, and then rebounds over time.

READ MORE: XRP Price Prediction: At Risk Amid XRP Ledger RLUSD Woes