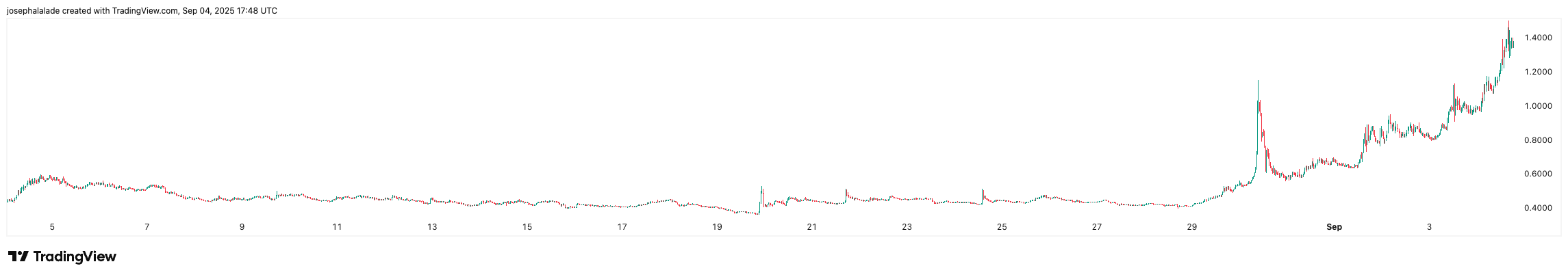

MemeCore price ($M) has stolen the limelight with one of the most dramatic rallies in the crypto market this quarter. In just 90 days, the first Layer-1 blockchain built for Meme 2.0 has surged more than 3,700%.

On Thursday, $M notched a new all-time high at $1.49, before pulling back to $1.34 with a 24-hour volume north of $53 million. That’s a massive leap from its July lows of $0.035, translating into a 3,757% gain or over 38x in just two months.

Beneath the euphoria, however, signs are mounting that Meme Core price ($M) may be headed for a sharp correction.

Why is MemeCore Price Going Up?

MemeCore bills itself as the first Layer-1 blockchain purpose-built for memes, introducing a framework where culture itself becomes capital. Its mission is to create a decentralized meme economy where creators, amplifiers, and contributors are rewarded for participation.

The main catalyst behind the rally lies in a mix of cultural hype and aggressive community marketing. An X post revealed that MemeCore had reportedly rented Seoul’s Lotte World theme park for the final night of Korea Blockchain Week (KBW).

This spectacle indicates that the MemeCore project is willing to flex its financial muscle to build cultural relevance.

However, the strategy worked as momentum traders piled in, volume spiked, and $M cemented its place among the top-performing assets in the top 100.

Yet, much of the price movement seems tied less to long-term fundamentals and more to short-term spectacle.

As one trader quipped on X: “MemeCore isn’t just buying marketing; it’s buying gravity.” That gravity can turn downward just as quickly.

Parabolic Gains Put $M in Overbought Territory

MemeCore price has entered overextended territory. The M token has broken through every major resistance level since mid-August, with parabolic price action taking it above $1.30. The RSI is flashing extreme overbought signals, and momentum indicators suggest diminishing upside unless new catalysts appear.

Bulls point to MemeCore’s Proof of Meme (PoM) consensus model and community-centric tokenomics as justification for further upside. If the market digests this rally, consolidation above $1 could set the stage for a push toward $2, a psychological round number.

However, bears are circling. If the MemeCore token slips below $1.00 support, liquidation cascades could drag it back toward $0.40–0.50, levels that can be called a “reality check zone.”

Given the thin liquidity outside centralized exchanges and the project’s heavy reliance on event-driven hype, the risk of sharp MemeCore price retracements is high.