The Linea airdrop will be the most important crypto news this week as investors get a chance to own the fastest-growing layer-2 network in the crypto industry.

Linea Airdrop Details

Linea is one of the fastest-growing networks in the crypto industry. Started by Consensys, it is a top zero-knowledge Ethereum Virtual Machine (zkEVM).

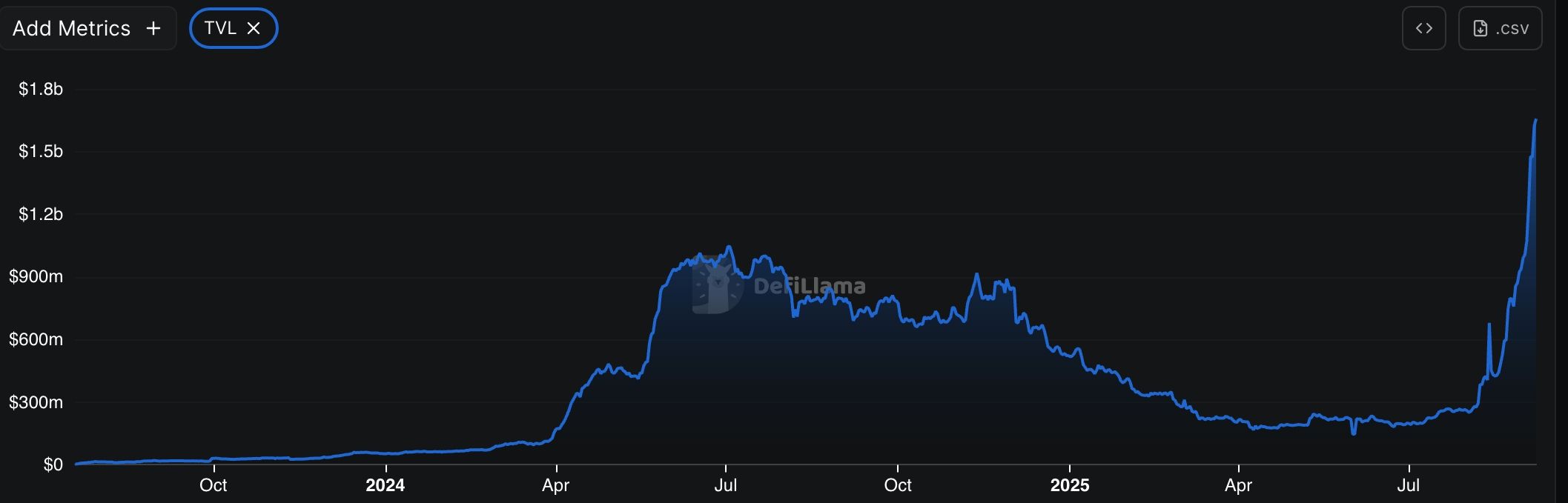

Data shows that it is gaining traction among developers in a highly competitive industry. The total value locked (TVL) in its network has reached a record high of $1.65 billion, attracting some of the top developers in the industry. This is a big milestone as the TVL stood at $186 million in April.

Aave, the biggest player in the DeFi industry, is the biggest part of its ecosystem with over $776 million in assets, a 3,553% increase in the last 30 days. It is followed by other DeFi protocols like Renzo, Etherex, Euler, and ZeroLend.

Linea has also become a major player in the stablecoin industry, where its supply has jumped by 118% in the last 7 days to $292 million. Most of these stablecoins are USD Coin (USDC), followed by USDT and Dai.

85% of the LINEA token will go mostly to the ecosystem, with 10% going to the early users and strategic builders. The remaining 75% will be allocated to the ecosystem fund, which will be the largest in the industry. Consensys, its creator, will receive a 15% allocation that will vest in five years.

READ MORE: Pi Network Price Prediction as Valour Pi Fund Receives Just $2k in AUM

Will Linea Token be a Good Buy?

Linea operates in a highly competitive industry dominated by prominent players like Base, Arbitrum, Optimism, and Polygon. Arbitrum has a market capitalization of $2.58 billion and a fully diluted valuation (FDV) of over $4 billion. It has a TVL of over $4 billion and a stablecoin volume of over $3.79 billion. Therefore, Linea’s valuation will likely be smaller.

It is still too early to predict whether the Linea token will rise or fall after the Linea airdrop. However, the recent performance of most new airdrops provides a potential scenario for what to expect.

As one of the most popular and fastest-growing players in crypto, the LINEA token price is likely to surge after the airdrop, only to pull back as insiders and snipers sell.

This is what happened with Donald Trump’s World Liberty Finance (WLFI) token, which rose initially and then plunged amid heightened selling. It is also what happened with Arbitrum, which initially rose to $5 after its airdrop and then pulled back.

READ MORE: RedStone Crypto Price Prediction: 3 Reasons RED is Soaring