The AVNT price surged to a record high of $0.4600, driven by on-chain metrics indicating that whales and smart money investors were aggressively buying the Avantis token.

Avantis token jumped as its 24-hour volume soared by 56% to over $242 million, much higher than its market capitalization of $97 million. Its fully diluted valuation rose to $447 million.

Most of the volume was happening on Coinbase and Aerodrome Finance, which is notable since Avantis is a major player in the Base Blockchain, which Coinbase owns.

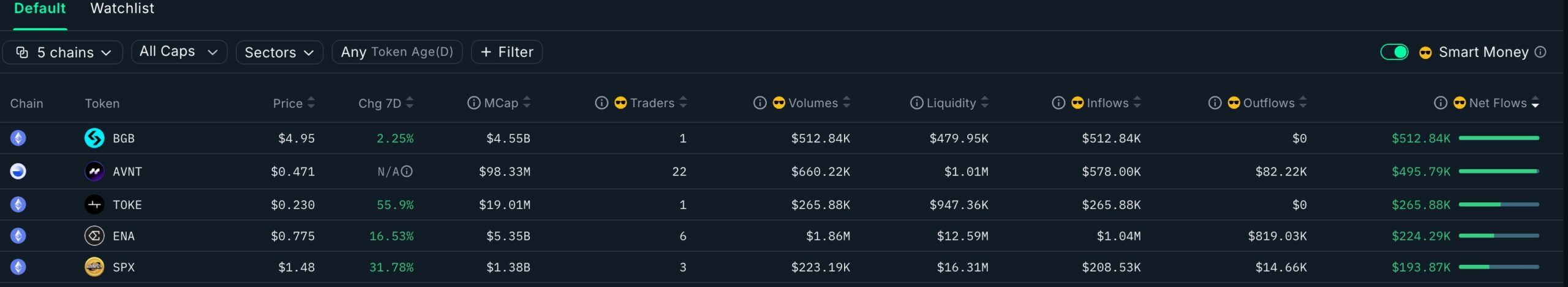

Nansen data shows that smart money investors now hold 1.14 million AVNT tokens, a big increase considering that it launched its airdrop earlier this week.

Similarly, data shows that whales now hold over 1.27 million Avantis tokens, a figure that has been in a strong uptrend in the past few days. Whale and smart money accumulation are bullish catalysts because they are signs that these investors expect the price to continue rising.

One potential catalyst that may fuel further gains is the listing by one or more tier-1 exchanges like Binance and Upbit. Historically, such listings normally lead to a big surge as investors buy.

READ MORE: Ethena Price Set to Crash as a Risky Pattern Forms Amid Whale Buying

Avantis is a Hyperliquid rival in the Base Blockchain that enables users to trade cryptocurrencies and tokenized stocks using leverage and low fees.

Data shows that the network handled perpetual volume of $4.7 billion in August, a few points below the year-to-date high of $4.85 billion. It has also already handled $1.8 billion this month so far, making it the biggest player in the Base Blockchain, which handled $11.8 billion in perpetual futures in July.

Therefore, while it’s too early to tell, it is likely that the AVNT price will do well over time. That’s because of its growing market share in the perpetual futures industry and the demand for Base tokens like Aerodrome Finance and Zora.

READ MORE: Solana Price Prediction: Bullish Catalysts But Key Risk Remains