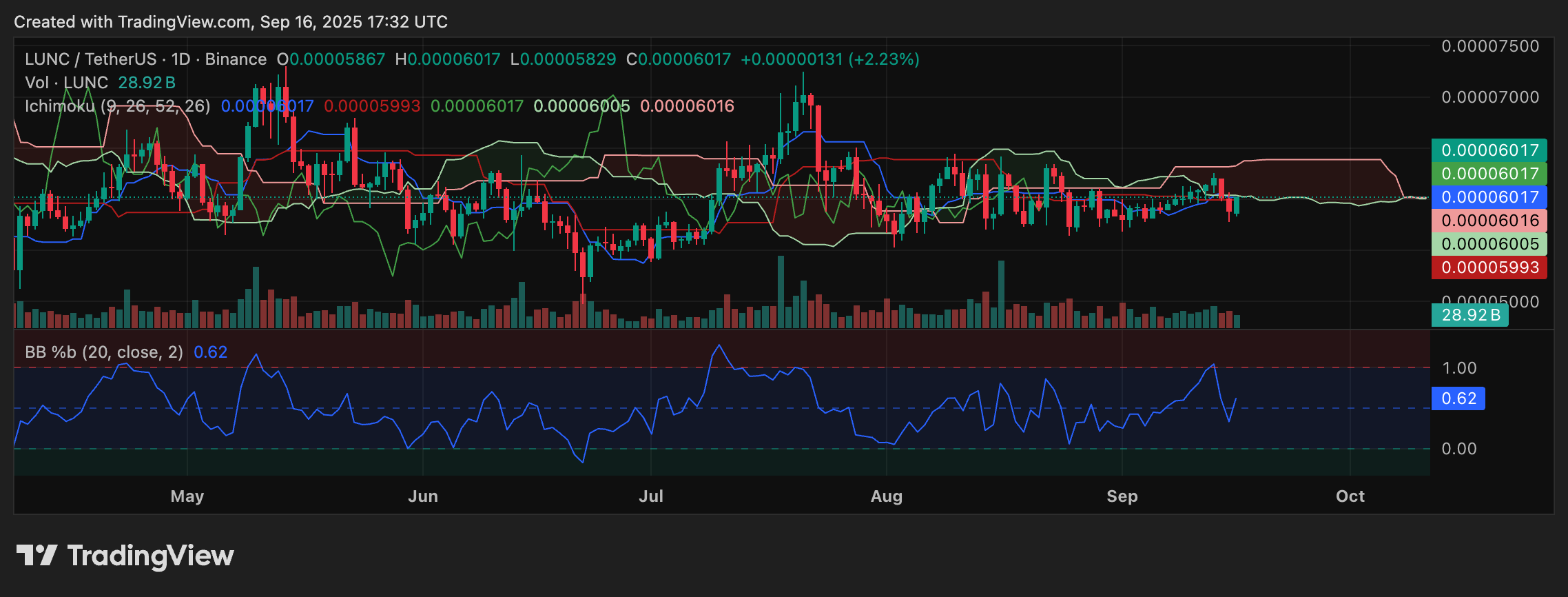

Terra Classic (LUNC) price rose slightly on Tuesday, reaching about $0.0000596 after a 2.6% daily increase. However, the token is still down over 44% year-to-date and over 27% this year, which is quite different from the overall rise seen in many other major altcoins.

Despite these poor numbers, a well-known analyst believes that LUNC’s price might be ready for a significant breakout, as technical indicators show promising signs.

Analyst Eye $0.000217 for Terra Classic (LUNC)

Crypto analyst Javon Marks flagged what he calls a “larger regular bullish divergence” on the LUNC price chart, projecting a potential 260% rally to $0.000217.

His chart highlights higher lows on momentum indicators despite flatlining price action, which is often an early reversal signal.

Market-wide tools confirm the mixed picture. Bollinger Bands show tightening volatility around $0.000060, suggesting a pending move. Meanwhile, Ichimoku Cloud resistance at $0.00006016 looms as a key ceiling.

Meanwhile, the charts tell a conflicted story. Oscillators such as the MACD and momentum indicators are leaning bullish, supporting Marks’ divergence thesis.

Yet moving averages paint a different picture, with most signals flashing sell across short- and long-term ranges. Resistance at $0.000062 remains a key test, while support has formed at $0.000058, trapping LUNC in a narrow consolidation band.

Whale Control Raises Stakes

Adding fuel to speculation is new on-chain data showing just how concentrated LUNC’s supply has become. According to BiNodes, Binance wallets control 35% of the token’s circulating supply, including a hot wallet holding more than 1.8 trillion LUNC.

This level of concentration means Binance activity can dictate short-term price moves, whether through sudden inflows that boost liquidity or potential outflows that trigger sell pressure.

READ MORE: XRP Price Prediction: Here’s Why Ripple is About to Soar