Justin Sun has become one of the wealthiest individuals in the cryptocurrency industry, with a net worth that ranges from $8.5 billion to $13 billion.

Bloomberg places his net worth at $13 billion, while Forbes pegs it at $8.5 billion. His net worth has gone parabolic in the past few years as most cryptocurrencies have rebounded.

Justin Sun owns 90% of HTX

One key part of Justin Sun’s net worth is his stake in HTX, one of the biggest cryptocurrency exchanges.

CoinMarketCap data shows that the exchange handled cryptocurrency volume worth over $3.2 billion in the last 24 hours, much higher than the $2.7 billion that Coinbase handled.

HTX also handled derivatives volume worth over $2.67 billion, making it one of the top players in the industry. According to Bloomberg, Sun owns about 90% of HTX, which accounts for most of his net worth.

As a privately-owned company, it is hard to place a value on the company. However, based on Coinbase’s valuation of $84 billion, it is likely that Sun’s stake is much higher than what Bloomberg estimates.

READ MORE: XRP Price Prediction: Here’s Why Ripple is About to Soar

Justin Sun Net Worth and Crypto Portfolio

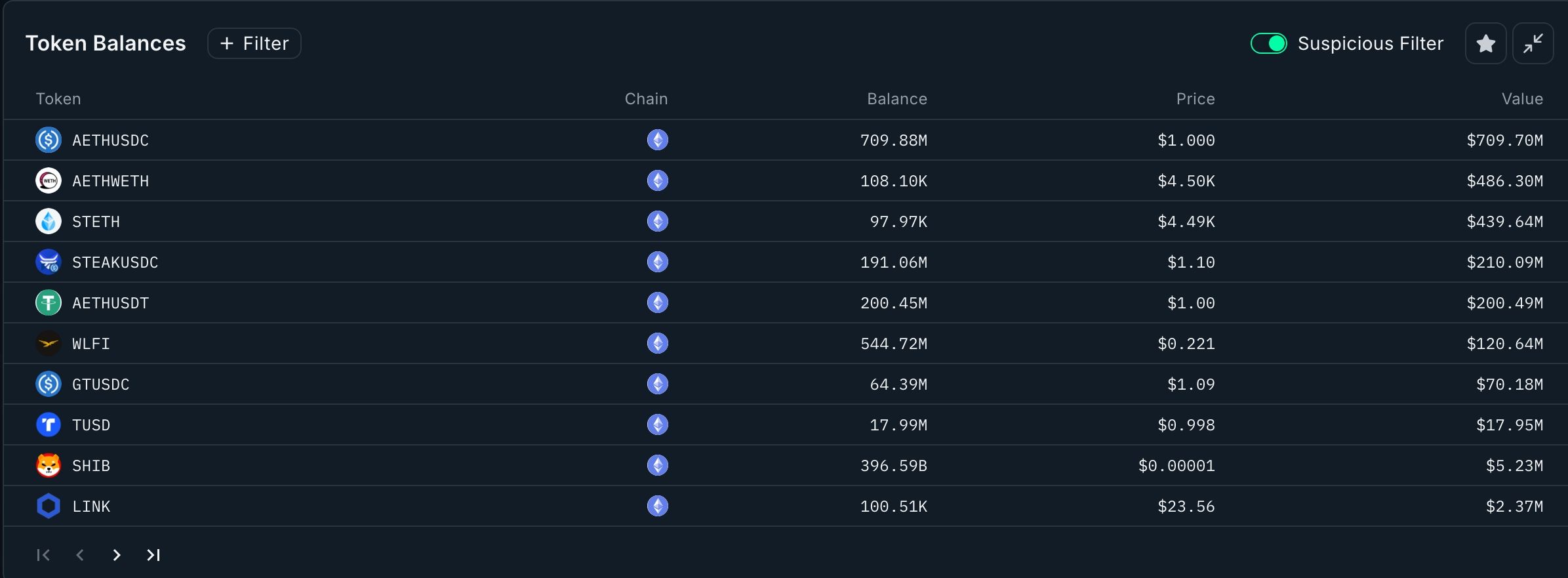

The other key part of Justin Sun’s net worth is his large pile of cryptocurrency holdings. Arkham notes that Sun owns about 4.09k Bitcoins, which are now worth over $490 million. He also owns 224,000 Ether tokens, currently valued at over $1 billion.

As the founder of Tron, Justin Sun’s crypto portfolio is made up of 2.02 billion TRX tokens valued at over $693 million. He is also a large investor in Donald Trump’s WLFI tokens, valued at $121 million.

Data compiled by Arkham and other platforms like Nansen shows that he owns hundreds of other coins. For example, he holds BitTorrent tokens worth $73 million, JST and SUN tokens worth over $10 million each.

Justin Sun’s crypto portfolio is also made up of other cryptocurrencies like Shiba Inu, Pepe, Chainlink, Storj, Floki, HTX, Aave, and Polygon.

There are odds that Justin Sun’s net worth is much higher than what Bloomberg and Forbes estimate. For one, Bloomberg’s calculation includes a large discount of his TRX holdings because he is likely its biggest holder.

Also, the calculation of his tokens only looks at those that are on-chain, ignoring those that are in exchanges like HTX and Binance.

Additionally, the calculations do not include his other entities, like Poloniex, a crypto exchange he bought in 2019. Poloniex handled over $888 million in volume in the last 24 hours, much higher than Gemini’s $149 million.

READ MORE: Pi Network Price Prediction: 1 Key Reason Pi Coin Value May Jump Soon