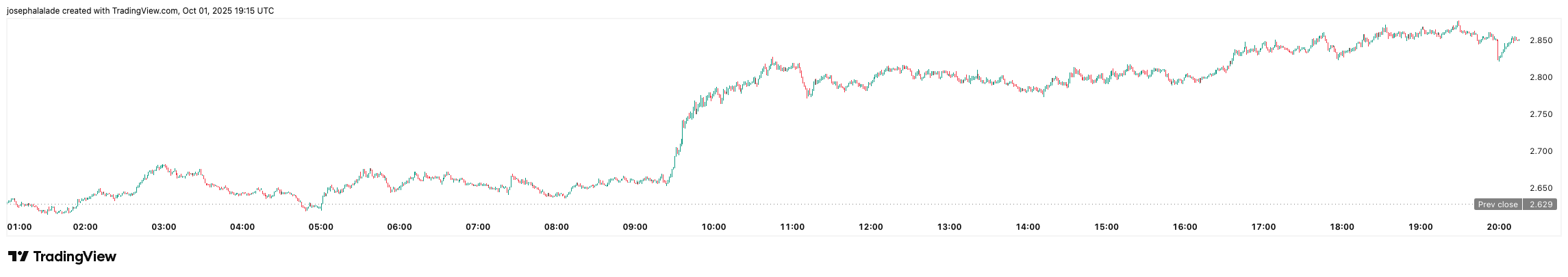

NEAR Protocol price rose sharply on October 1, gaining more than 10 percent in 24 hours to trade at $2.86. The NEAR token rose from an intraday low of $2.57 as trading volume surged above $309 million, a 42% increase from the previous day.

Momentum followed confirmation of a partnership with Cardano, which founder Charles Hoskinson hailed as “the future of crypto.” The integration enables ADA swaps across more than 20 blockchains without using bridges, which have long been regarded as one of the weakest security points in the cryptocurrency ecosystem.

By leaning on NEAR’s “intents” framework, the collaboration strengthens interoperability while giving Cardano’s 3.6 million holders direct access to cross-chain liquidity.

Q3 Growth Across Sharding, AI, and Ecosystem Adoption

The bullish trend extends beyond Cardano. NEAR’s Q3 report highlighted progress in scalability, artificial intelligence (AI), and adoption. The protocol scaled to nine shards, increasing throughput by 12.5 percent, while expanding validator seats from 300 to 500 to enhance decentralization.

On the AI front, NEAR released the Shade Agent Sandbox, integrated with IQ AI for cross-chain agent development, and onboarded FractionAI for decentralized prediction markets. At the same time, the number of monthly active addresses surged past 52 million, placing NEAR among the busiest Layer 1 networks.

Interoperability also gained momentum as NEAR Intents processed more than $1.3 billion in swaps across 117 supported assets and expanded to blockchains including Tron, Sui, Aptos, Cardano, and Stellar.

Institutional adoption advanced with Bitwise’s NEAR Staking ETP launch and BitGo adding support for NEAR-native stablecoins. In total, over 600 million NEAR are now staked.

Data from Token Terminal shows NEAR generated $290,800 in fees over the past 30 days, ranking seventh among Layer 1s. Daily active addresses held near 2.9 million, placing NEAR second only to BNB Chain and ahead of Solana and Ethereum.

NEAR Protocol Price Prediction: Short-Term Outlook

NEAR protocol price broke through $2.80, turning it into support. The next test lies at the $3.00 psychological level, with further resistance expected around $3.20.

Support rests at $2.70 and $2.55. If buying pressure sustains above current levels, bulls may attempt to break out past $3.00. Failure to defend $2.70, however, could trigger a retracement back to the mid-$2.50 range.

READ MORE: Pudgy Penguins Price Breaks Out, Analysts Eye 88% Increase