The Pepe price could be on the cusp of a steep decline in the coming days as it forms a descending triangle pattern and whales continue to dump the coin. It was trading at $0.0000096, a few points above the lower side of this triangle pattern. It has plummeted by about 40% below the current level.

Pepe Price Technical Analysis Points to a Steep Crash

The daily chart shows that the Pepe price peaked at $0.00001645 in May, when Bitcoin and most altcoins experienced a surge. Since then, the coin has crashed, with each attempt to rebound finding substantial resistance.

The Pepe Coin price also formed a strong support level at $0.0000091, where it has failed to move below on several occasions since March. Therefore, there are signs that it has formed a descending triangle pattern, which normally leads to a strong bearish breakout.

The bearish outlook is also evident from the fact that the coin has remained below both the 50-day and 100-day Exponential Moving Averages (EMAs). Staying below these two prices indicates that bears are in control.

READ MORE: Avalanche Price Prediction: Why AVAX May Hit $50 in October

Also, the coin is slowly forming a small bearish flag chart pattern. Therefore, the most likely scenario is that it will have a strong bearish breakout in the coming days. If this happens, the next key level to watch will be at $0.0000076, its lowest level on May 6.

Whales Have Sold 1.5 Trillion Pepe Coins

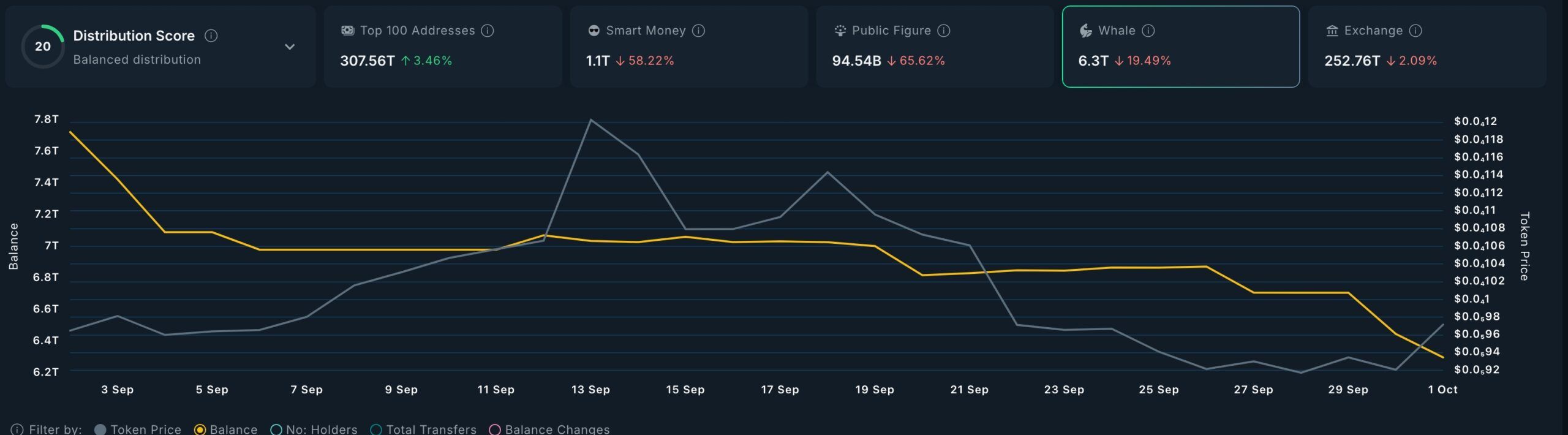

The ongoing price action is occurring as big investors, commonly known as whales, sell their tokens. As the chart below shows, these investors now hold 6.29 trillion Pepe tokens, down from 7.71 trillion on the same day last month.

Whales are not the only major investors who have dumped their tokens. Smart money investors have lowered their holdings by nearly 60% in the last 30 days. Precisely, they now hold 1.1 trillion tokens, down from 2.53 trillion on the same day last month. Public figure investors have reduced their holdings by 65% to 95 billion coins.

One potential reason why whale, smart money, and public figure investors have dumped their tokens is that no fund manager has filed for a Pepe ETF. Polymarket odds of a Pepe ETF approval have dropped to just 2%.

Another reason for the Pepe price action is that its daily volume and open interest have declined significantly over the past few months. That is a sign that it is having weak demand from investors.

READ MORE: Kava AI Joins BNB Chain to Support Smarter DeFi Applications