Chainlink price has crashed into a bear market as it plunged by about 20% from its highest point this year. It was trading at $22.62, up by 106% from its lowest level this year. This article explores why the LINK price may have a strong bullish breakout.

Chainlink Price Technicals Point to a Surge Soon

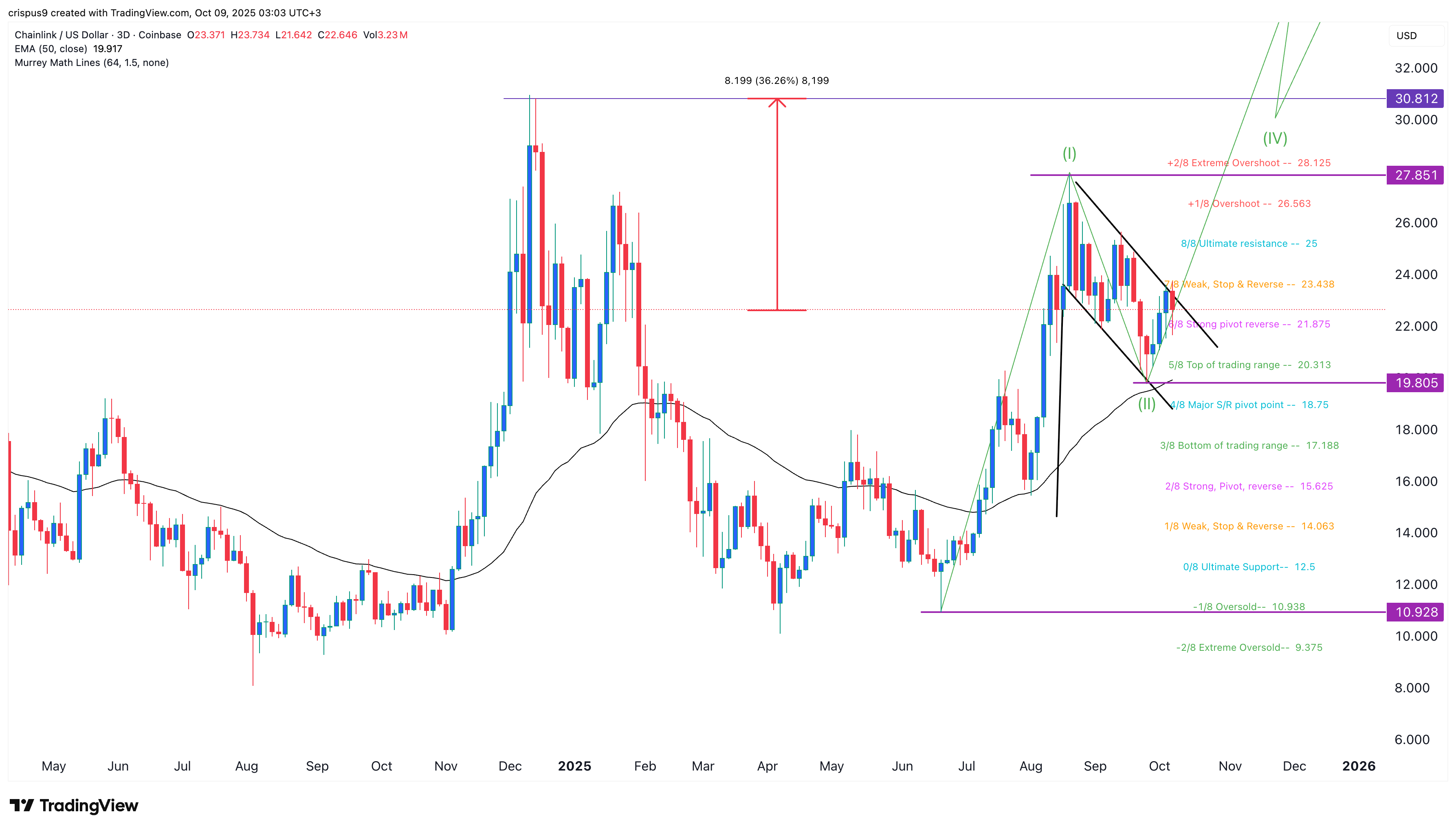

The three-day timeframe chart shows that the LINK price bottomed at $10.92 in June this year. It then bounced back and hit the key point at $27.85 on August 20.

Chainlink price has moved above the 50-day Exponential Moving Average (EMA), which has provided it with substantial support since July 9.

The token has also formed a bullish flag pattern, which is a popular continuation pattern. This pattern consists of a vertical line and a descending channel.

LINK price has moved above the strong pivot reverse point of the Murrey Math Lines tool at $21.8.

READ MORE: Here’s Why Trump Coin and WLFI Token Prices are Crashing

Most importantly, Chainlink has moved into the second phase of the Elliot Wave pattern. This phase is a reversal sign that normally falls between 50% and 61.8% Fibonacci Retracement level.

Chainlink is also located in the handle section of the cup-and-handle pattern, a common bullish continuation pattern in technical analysis.

Therefore, the most likely scenario is where the LINK price bounces back and moves to the important resistance level at $27.85, its highest level this year. This target also coincides with the extreme overshoot level of the Murrey Math Lines tool.

A break above that level will signal more upside, potentially reaching last year’s high of $30.8, which is 36% above the current level.

On the flip side, a drop below the key support level at $20 will invalidate the bullish forecast. This price is both the lower side of the flag and slightly below the top of the trading range of the Murrey Math Lines tool.

The Bullish Case for LINK Token

There are a few reasons why the Chainlink crypto price may rebound in the coming weeks. First, the developers will launch the SmartCon Conference in November, where major announcements are expected to be made. This is an annual event that brings top players in the financial services industry, including Swift and JPMorgan.

Second, the company has continued to accumulate LINK tokens as part of the Strategic LINK Reserves. These reserves now hold about $9.4 million in assets, a significant amount since their launch in the first week of August.

Third, the supply of LINK tokens has continued falling in the past few months and now stands at 263 million, down from 278 million in the same period last month.

Additionally, Chainlink price will also jump if the Securities and Exchange Commission starts approving altcoin ETFs. Such a move will lead to rising expectations that the agency will approve the recently filed spot LINK ETFs by Grayscale and Bitwise.

READ MORE: Here’s Why Peter Brandt’s XRP Price Prediction is Wrong