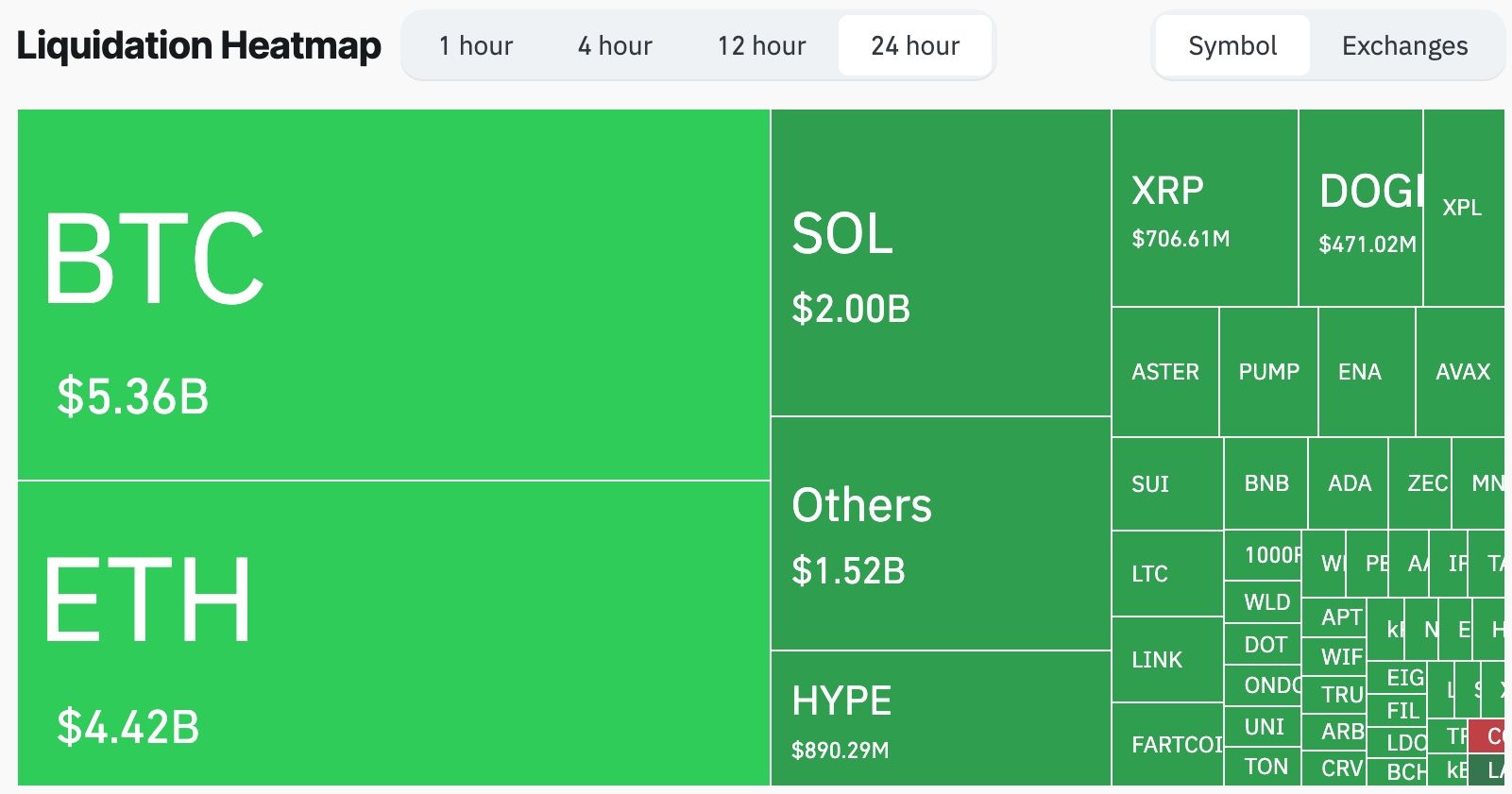

A steep crypto crash is happening today, leading to over $19 billion in liquidations as trade war resumes. Bitcoin price plunged to $112,000, down from a record high of $126,500 earlier this month. The other top laggards in the crypto market were Story, MYX Finance, Celestia, Internet Computer, and Lido DAO.

Why the Crypto Crash is Accelerating

The crypto market crash mirrored the performance in stocks as the Dow Jones, S&P 500, and Nasdaq 100 plunged by over 878, 182, and 820 points, respectively. Also, the CBOE Volatility Index (VIX) jumped by 31% to $21.

The main catalyst or the ongoing stock and crypto crash is the renewed trade war between the United States and China. In a statement, Donald Trump said that he would implement a 100% tariff on Chinese goods from November this year. Trump also announced export limits on critical software.

He said this after China announced some major escalations this week. Beijing started an investigation into Qualcomm, one of the top semiconductor companies in the world. China also started a crackdown of US chips by companies like Nvidia.

READ MORE: Aave Price Prediction: Weak Technicals Meet Strong Fundamentals

China Export Controls

Most importantly, Beijing intensified its leverage by announcing export controls on rare earth metals and magnets, a decision that will hurt US manufacturers like Ford, General Electric, and GM.

China also announced new port fees for ships coming from the United States. Therefore, these announcements led to a sense of fear in the crypto industry, with the closely-watched Fear and Greed Index falling to the fear zone of 35. The Altcoin Season Index stumbled to 37, while the open interest plunged to $154 billion.

The ongoing trade war between the US and China will likely escalate, with Beijing set to announce tariff measures of its own in the near term. It also lowers the chance that Trump and Xi Jinping will meet as previously scheduled.

The crypto market crash is also happening as stagflation fears in the US rise after the new escalation. Recent data showed that the US labor market has deteriorated, with the private sector shedding over 36,000 jobs in September.

The new trade war will likely ensure that inflation remains much higher than the Fed’s target of 2.0%. As such, it is unclear whether the Fed will start cutting interest rates.

READ MORE: HYPE Price Forms Rare Pattern as Hyperliquid Market Share Shrinks