To a large extent, Hamster Kombat was one of the biggest success stories in the crypto market in 2024. It was a viral platform in the so-called tap-to-earn industry that dominated the crypto industry.

The Rise and Fall of Hamster Kombat

At its peak, Hamster Kombat had over 300 million users from around the world. These users used its Telegram mini-apps to accumulate millions of HMSTR tokens, which they hoped to cash out or even HODL after the token generation event (TGE).

Hamster Kombat succeeded in other ways. For example, it broke a YouTube record by becoming the fastest channel to reach over 34 million subscribers. Even today, it is the only crypto channel that has over 1.2 billion cumulative views.

Hamster achieved this goal due to the large number of users on its platform and the fact that watching its videos was a way to accumulate HMSTR tokens.

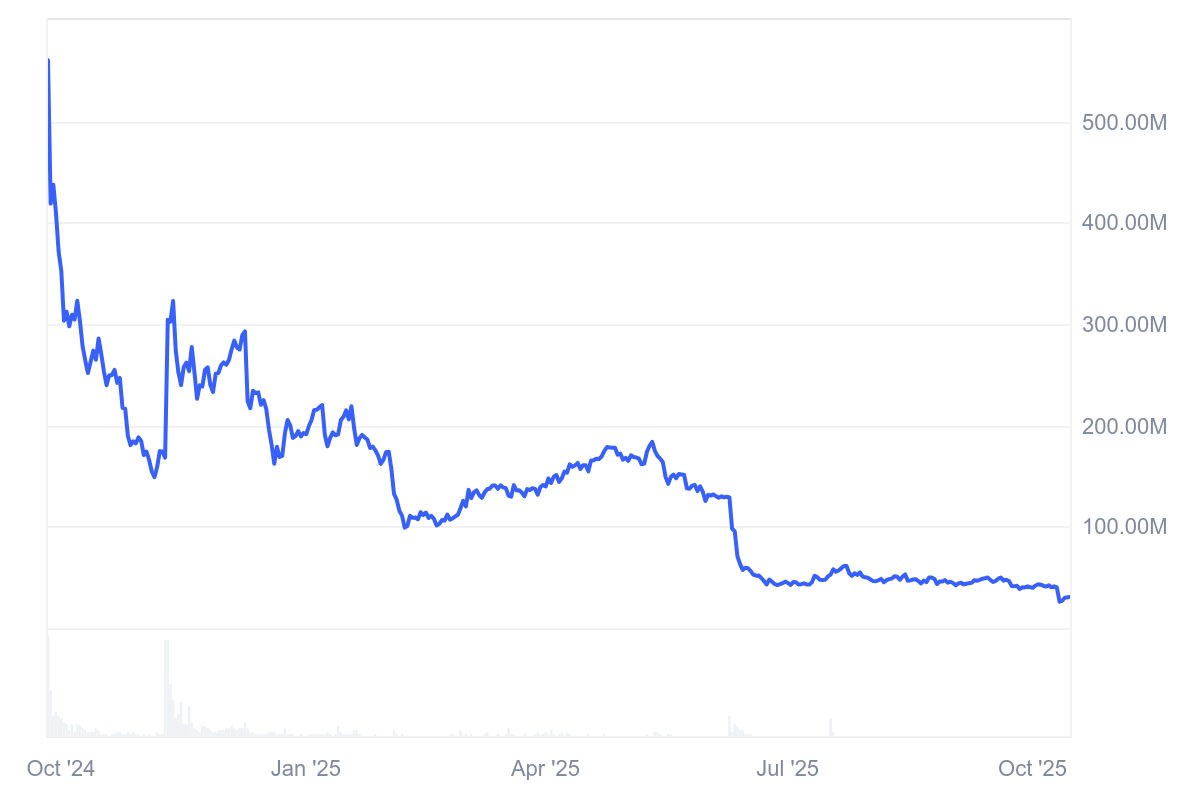

Hamster Kombat held its TGE in October last year, with its market capitalization jumping to over $560 million. This figure made it the second-biggest tap-to-earn platform after Notcoin.

It then started a freefall, with any attempts to rebound finding substantial resistance. Today, HMSTR token has a market capitalization of $30 million and a fully diluted valuation (FDV) of $47 million. If the trend continues, the valuation might ultimately reach zero soon.

READ MORE: Shiba Inu Price Soars as Whales Scoop Up Billions in SHIB

Hamster’s daily volume has also dried up this year. It had a volume of $5.1 million in the last 24 hours.

Why Hamster Kombat Collapsed

One reason for the collapse is that the tap-to-earn industry was a fad. A closer look at the other top similar projects, including Tapswap, Catizen, Blum, and Rocky Rabbit, reveals that all have collapsed, with their tokens being much lower than their listing prices. Tapswap, which had over 60 million users, is now valued at just $220k.

Second, most HMSTR airdrop recipient sold their tokens, leading to more selling pressure. Many of them sold in protest as the team slashed their allocations shortly before the airdrop.

Third, Hamster Kombat is a highly inflationary token, with a maximum supply limit of over 100 billion tokens and a current circulating supply of 64.37 billion, with millions of tokens being released a month.

The collapse is also because of the failures of the ‘to earn’ industry. A closer look at most tokens that depend on this model, like ‘play-to-earn’ and ‘move-to-earn’, shows that all of them have plunged as recipients always convert them into stablecoins and cash out.

Additionally, Hamster Kombat’s strategy to expand its network failed to gain traction since most of the users were only interested in monetizing their tokens. For example, the plan to launch a layer-2 did not get off the ground.

READ MORE: Here’s Why the Falcon Finance (FF) Price is Soaring Today