Arbitrum, the leading layer-2 network in the crypto industry, is expanding its market share in the real-world asset (RWA) tokenization sector, which has helped increase its transactions and holders.

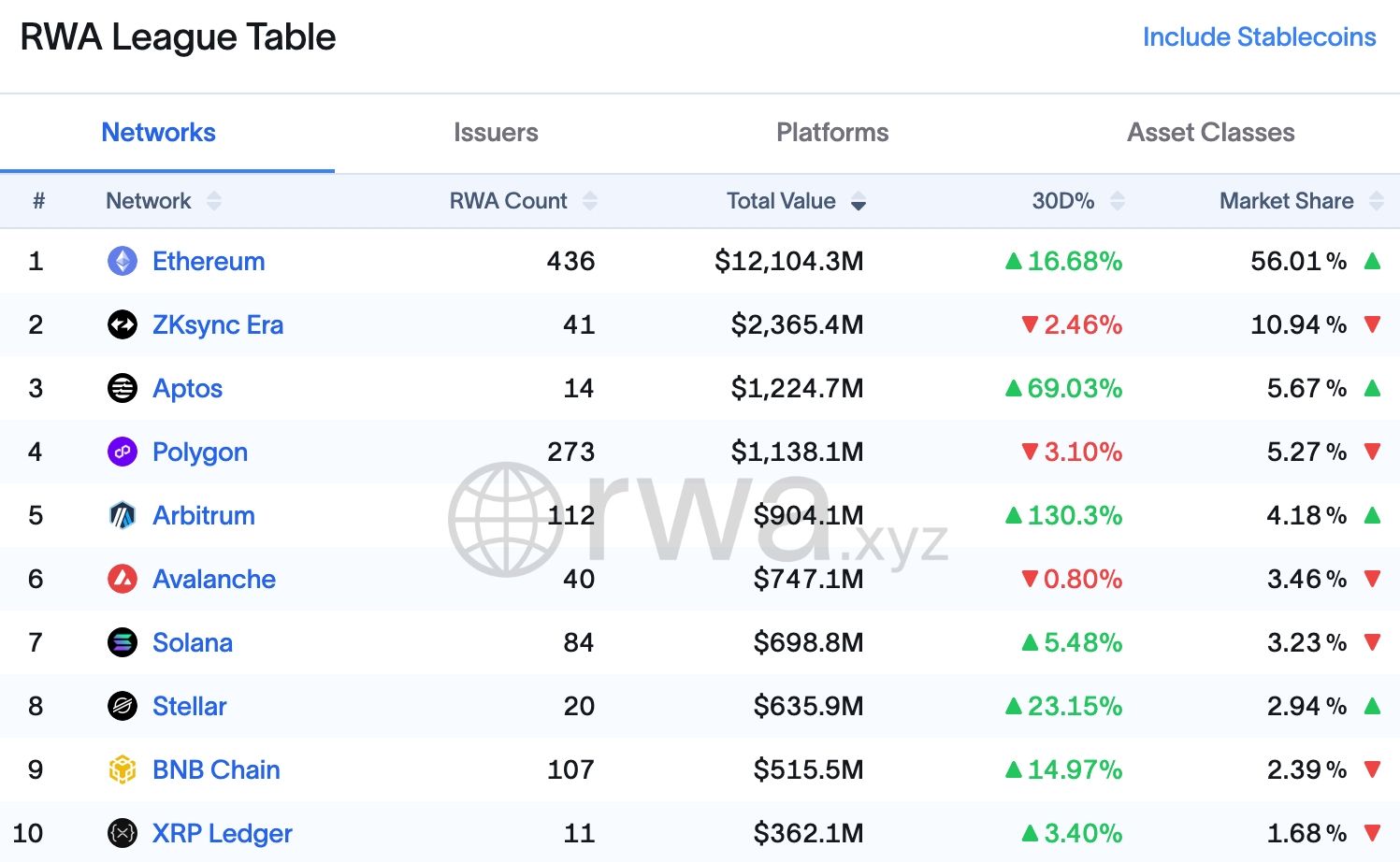

Data compiled by RWA shows that it is the fastest-growing chain in the industry. Its total value locked jumped by 130% in the last 30 days to over $904 million.

Most of this growth came from its partnership with Securitize, whose assets in the network jumped by 1,640% in this period. The other notable players in the network are Circle, USDai Protocol, Spiko, and Franklin Templeton. The 30-day RWA transaction volume rose by 67% to $4.24 billion.

Arbitrum is also a top player in the stablecoin industry, where its assets are approaching $10 billion. Over 7.25 million stablecoin users are in its ecosystem, a figure that continues to grow. Also, the 30-day transfer volume rose by 50% to $155 billion.

More data shows that it has emerged as the third-fastest growing chain in terms of transactions. It handled 86 million transactions in the last 30 days, a 110% monthly increase as the number of users jumped to almost 4 million.

Users love the network because of its relatively small network transaction fees. Its average transaction fee is $0.00092, making it cheaper than most layer-1 and layer-2 network fees.

Arbitrum’s RWA growth will likely continue accelerating in the coming months, especially after its partnership with Robinhood. Robinhood, one of the biggest fintech companies, is using its technology to tokenize 500 American stocks and ETFs for the European market.

The company has also committed to using its stack to build its in-house layer-2 network as it advances the tokenization theme.

READ MORE: Bitcoin Price Prediction: Reasons a BTC Crash is Nearing

Arbitrum also continues to have a major market share in the decentralized exchange (DEX) industry. DeFi Llama data shows that its DEX protocols handled over $593 million in volume in the last 24 hours and $30 billion in the last 30 days.

This growth, which makes it the second-biggest L2 network after Base, is fueled by popular platforms like Uniswap, Sushi, Fluid, Camelot, and PancakeSwap.

Still, the ARB price remains under pressure despite this progress. It was trading at $0.311 on Wednesday, down by 90% from its highest point in November last year.

This crash is likely because of the ongoing competition in the L2 industry and its monthly token unlocks. CoinMarketCap data shows that there are 5.5 billion ARB tokens in circulation against a total supply of 10 billion. Millions of them are unlocked each month, boosting the supply.

READ MORE: Top 5 Reasons Why XRP Price May Spark Higher Soon