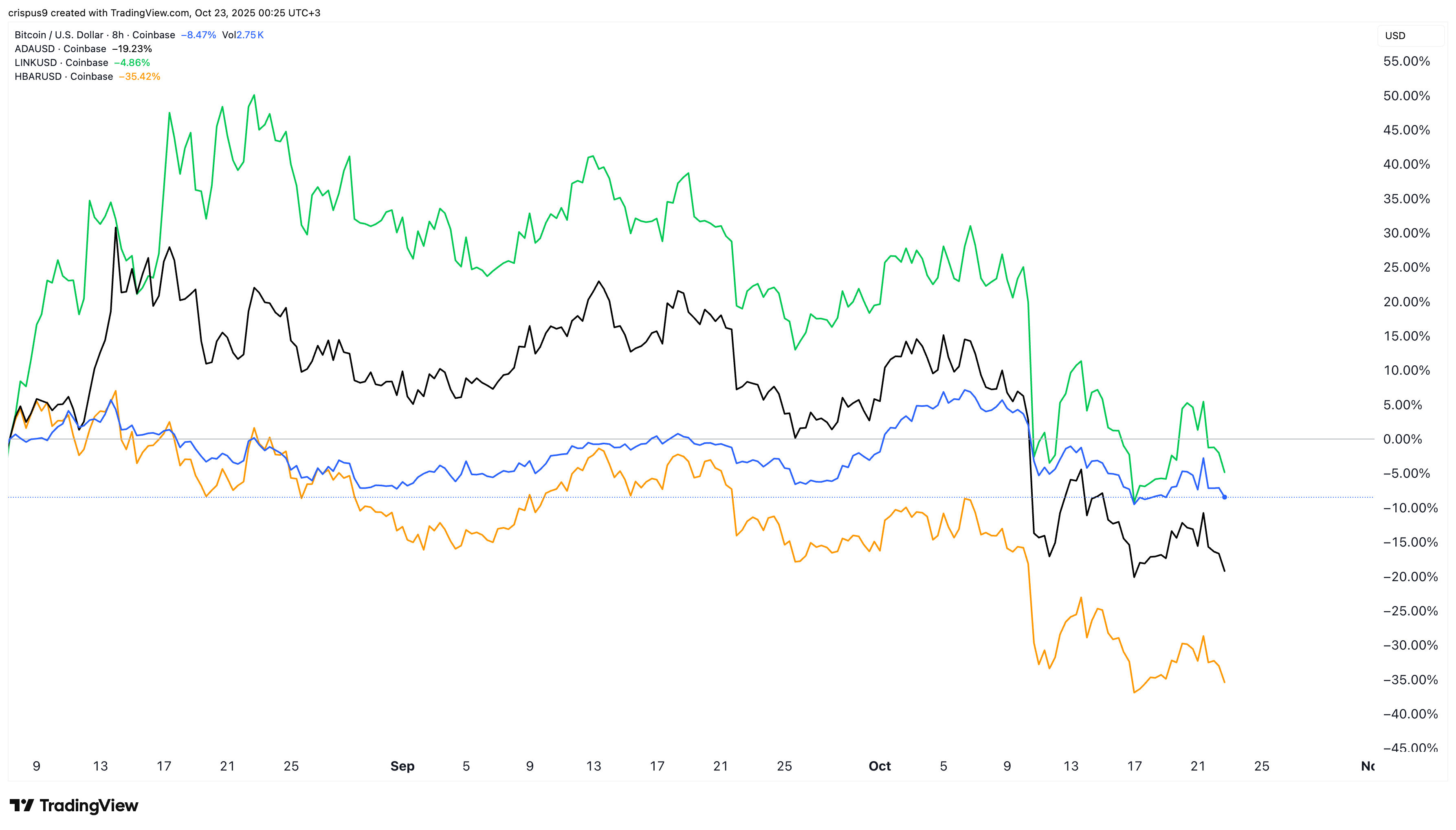

A crypto crash is happening today, with Bitcoin and most altcoins being in the red. Bitcoin dropped to $108,000, much lower than the year-to-date high of $126,200, while tokens like Grass, Aster, Synthetix, Spark, and SPX6900 fell by over 10% in the last 24 hours.

Explaining the Crypto Crash Today

The ongoing crypto market crash coincided with the stock market’s performance, with the S&P 500 Index falling by 40 points and the Nasdaq 100 Index and Dow Jones falling by 215 and 325 points, respectively.

One of the main reasons the crypto market crash happened is concerns about the economy, as tensions between the US and China remain. China has continued to announce some major actions against the US, including launching an investigation into some American companies.

Donald Trump threatened to prohibit the sale of key software to China in addition to the tariffs. On the positive side, these major announcements could create leverage ahead of the upcoming talks between the two countries.

READ MORE: Will the Crashing Shiba Inu Price Bounce Back?

The crypto market crash is also happening as concerns about the Federal Reserve continue. While the weak labor market supports the case for interest rate cuts, the reality is that inflation remains at an elevated level.

Analysts expect the upcoming inflation report to show that the headline Consumer Price Index rose from 2.9% in August to 3.1% in September. Core inflation is expected to move from 3.1% to 3.3%.

Most importantly, the crypto crash is happening as investors continue reacting to the recent liquidation event that cost over 1.6 million investors over $19 billion within a day. This was the biggest liquidation event ever, surpassing major black swan events like the FTX collapse and the Terra implosion.

Will Crypto Go Back Up?

The ongoing crypto market crash has led to queries on whether these coins will go back up in the near term.

There are reasons to believe that top coins like Bitcoin, Ethereum, and Ripple (XRP) will do well in the long term as they are supported by strong fundamentals.

Bitcoin is widely seen as a safe-haven asset, while Ethereum has utility in key industries like decentralized finance and stablecoins. XRP has a major role in the stablecoin and payments industry.

The potential catalyst that may push the crypto market higher is the upcoming approval of altcoin ETFs by the Securities and Exchange Commission once the government shutdown ends.

Another catalyst for the crypto market is the upcoming decision by the Trump administration to allow 401 (k) accounts to invest in cryptocurrencies and other alternative assets.

READ MORE: Arbitrum Sets Pace in RWA Sector as On-Chain Activity Skyrockets