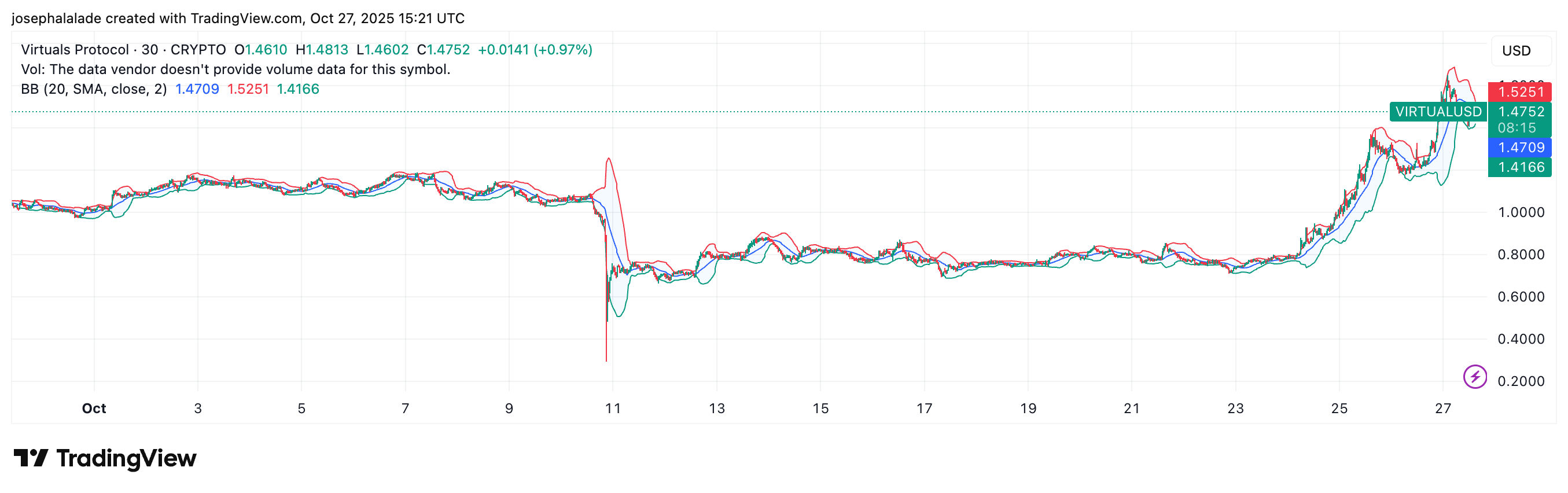

Virtuals Protocol (VIRTUAL) just delivered one of the strongest daily rallies among mid-cap tokens, breaking out from months of sideways grind. The token climbed by more than 60% from $1.00 to $1.65 before easing to around $1.45, its highest level since mid-July.

The sudden spike comes as agent-to-agent activity on the Virtuals network explodes, hinting at an inflection point for the emerging “agentic economy.”

On-Chain Data Shows AI Agent Boom Driving VIRTUAL Rally

The surge in VIRTUAL price was sparked by the integration of Coinbase’s x402 protocol, an open standard enabling instant, accountless stablecoin payments over HTTP, tailor-made for AI and Web3 interoperability.

Since adopting x402, Virtuals has seen weekly agent-to-agent transactions jump from below 5K to over 25K, according to ecosystem data shared by EtherMage. The increase highlights accelerating real-world usage as human and AI agents transact autonomously across the network.

At the ecosystem level, activity is snowballing. Projects like VPay, AurraCloud, and Mute Swap are deploying new AI-powered DeFi and payment solutions on top of Virtuals.

VPay, for instance, launched a neobank app where users can spend $VIRTUAL, $VPAY, and USDC through Visa, automate finances, and soon interact directly over x402.

With over 1M holders and nearly $1B market cap, Virtuals Protocol is quickly emerging as the base layer for autonomous financial infrastructure.

VIRTUAL Price Clears Major Resistance, Eyes $1.70–$2.10

From a technical standpoint, VIRTUAL has broken decisively out of a descending channel that capped prices since May. The breakout occurred around $1.00, reclaiming key resistance at $1.18–$1.20, coinciding with the 100-day moving average and 0.382 Fibonacci retracement.

Momentum remains strong, with the RSI hovering around 70, reflecting bullish sentiment but nearing overbought territory. Also, the 50- and 100-day moving averages have flipped to Buy signals, and oscillators indicate a “Strong Buy” on the daily timeframe.

If the current pullback stabilizes around the $1.15–$1.25 support zone, the next resistance targets are $1.70 and $2.10. A breakdown below $1.10 would invalidate the bullish setup and signal a potential retest of prior lows near $0.95.

The short-term tone remains bullish, supported by strong on-chain fundamentals and expanding ecosystem adoption. However, with prices up over 60% in a week, some cooling is expected as traders lock in profits.

READ MORE: XRP Price Prediction: Top Catalysts for a Ripple Surge