The crypto market rally is happening today, Nov. 10, continuing a trend that started last week. Bitcoin price rose to $103,000, up sharply from this month’s low of $98,000. Other top coins, including Decred, Zcash, Monero, Starknet, and Dash, were among today’s crypto top gainers.

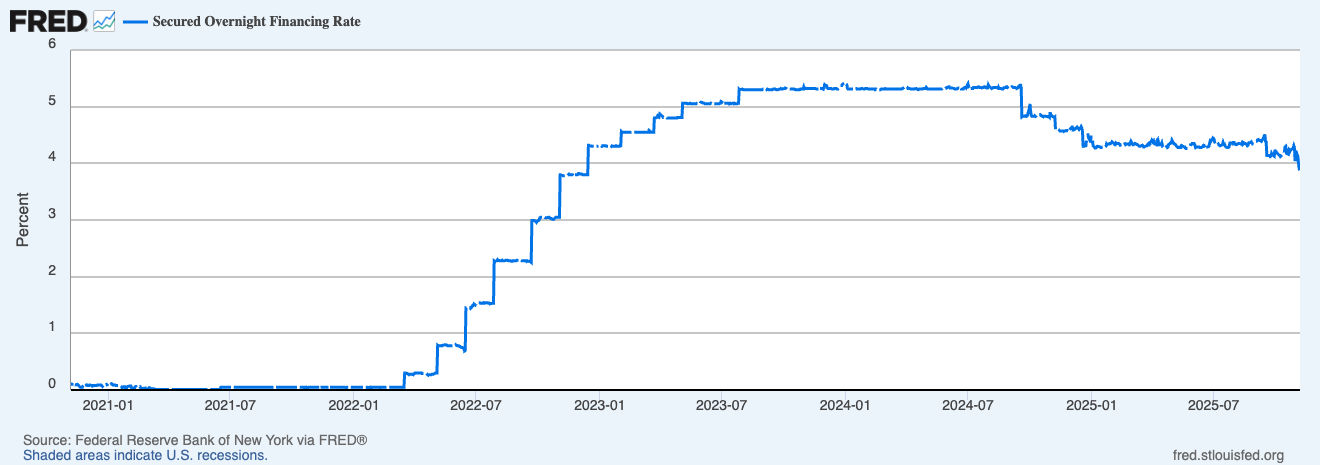

Falling SOFR Could be a Crypto Market Catalyst

One potential catalyst for the crypto market is the Secured Overnight Financing Rate (SOFR), which has continued its strong downtrend over the past few months. This rate plunged to 3.92% on Friday, its lowest level since December 2022. It has slipped from last year’s high of 5.3%.

The SOFR rate is an important number that reflects the cost of borrowing cash overnight using US Treasury securities as collateral. It is a common figure in the financial market to price loans, derivatives, and other instruments.

Most importantly, this figure, which replaced LIBOR, is based on actual transactions in the US Treasury repurchase (repo) market. As such, while the official Federal Reserve interest rate decision is important, the more significant number is the SOFR one.

A falling SOFR rate indicates improving monetary conditions, which in turn leads to more liquidity. Higher liquidity, on the other hand, leads to higher asset prices in the stock and crypto markets.

Bottoming Futures Open Interest

Another potential catalyst for the crypto market is that futures open interest is showing signs of bottoming. Data compiled by Coinglass shows that the interest dropped to over $143 billion today, down from last month’s high of $233 billion.

Open interest has plunged as more investors have reduced their leverage following the recent $20 billion liquidation. This, together with the increased fear, has all contributed to the recent crypto market crash.

Therefore, the bottoming and the eventual rebound of the futures open interest may stimulate a crypto market rebound.

Bitcoin Price Patterns are Risky

Still, technicals pose a big risk for a crypto market rally despite the falling SOFR interest rate. For example, the Bitcoin price has remained below the 50-day and 100-day Exponential Moving Averages (EMA). The two averages have formed a mini-death cross.

Bitcoin has moved below the Supertrend and Ichimoku cloud indicators. That is a sign that bears remain in control. It has also formed a bearish flag pattern. Therefore, the most likely scenario is a strong bearish breakout, which will derail the crypto market rally.

READ MORE: Litecoin Price Rebounds to $100 as Whales Boost Holdings