The recent crypto market rally is always faltering, with Bitcoin and most altcoins struggling to retest their yearly highs despite some positive news in the industry. For example, the recent Bitcoin rally faced substantial resistance at $107,390.

Other top tokens that have rallied recently have also found resistance and pulled back. Solana price remains on edge despite the ongoing inflows into spot SOL ETFs. XRP price has crashed ahead of the launch of the spot Ripple ETFs.

Crypto Market Rally Faltering Amid Fear Among Traders

The main reason all crypto market rallies falter is that investors are extremely fearful and therefore remain on the sidelines.

Data shows that the Crypto Fear and Greed Index has remained in the fear zone of 30. In most cases, cryptocurrencies do well when investors are greedy and vice versa.

There are many signs demonstrating the ongoing fear among investors. For one, the futures open interest has remained below $140 billion, down from the October high of over $250 billion.

READ MORE: Here’s Why Donald Trump’s WLFI Price is Soaring Today

More data show that the funding rate in the crypto market has flattened over the past few weeks, a sign of limited liquidity. Cryptocurrencies do well when the funding rate is positive.

Meanwhile, demand for Bitcoin and Ethereum ETFs in the United States has faded over the past few weeks, a sign that investor demand has waned this year.

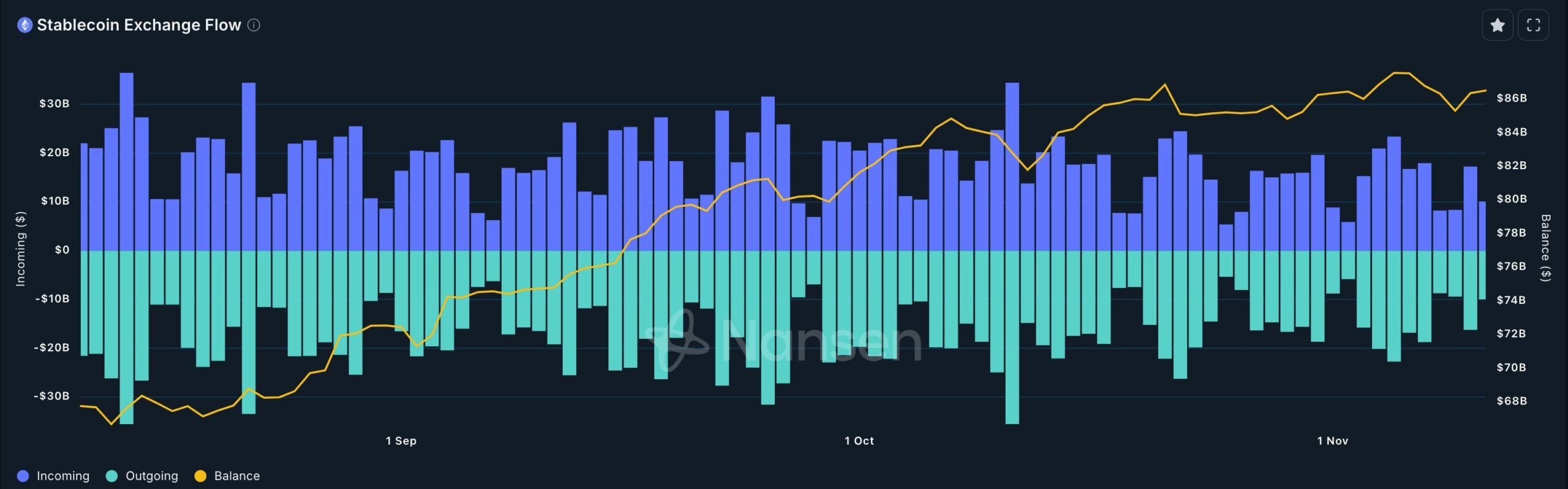

Meanwhile, data compiled by Nansen shows that the entry of stablecoins into exchanges has flatlined over the past few weeks. It remains around $85 billion, a sign that new money is not entering the market.

Additionally, there are concerns that Digital Asset Treasury (DAT) continues to struggle, with most of its stocks down by over 50% from their year-highs. This trend has reduced these companies’ demand for cryptocurrencies.

The ongoing fear stems mostly from the $20 billion wipeout on October 11, when Donald Trump threatened tariffs on Chinese goods.

Technicals Explain the Ongoing Crypto Crash

Another important reason the crypto market is crashing is that Bitcoin and most altcoins are showing weak technicals.

Data shows that Bitcoin has already formed a death cross, as the 50-day and 200-day Weighted Moving Averages (WMA) have crossed.

Similarly, the Bitcoin price has formed a double top pattern on the daily chart and a giant rising wedge on the weekly chart. All these patterns explain why the Bitcoin price remains under pressure, which, in turn, is affecting the entire crypto market.

READ MORE: XRP Price Prediction and Target Ahead of Ripple ETFs Launch