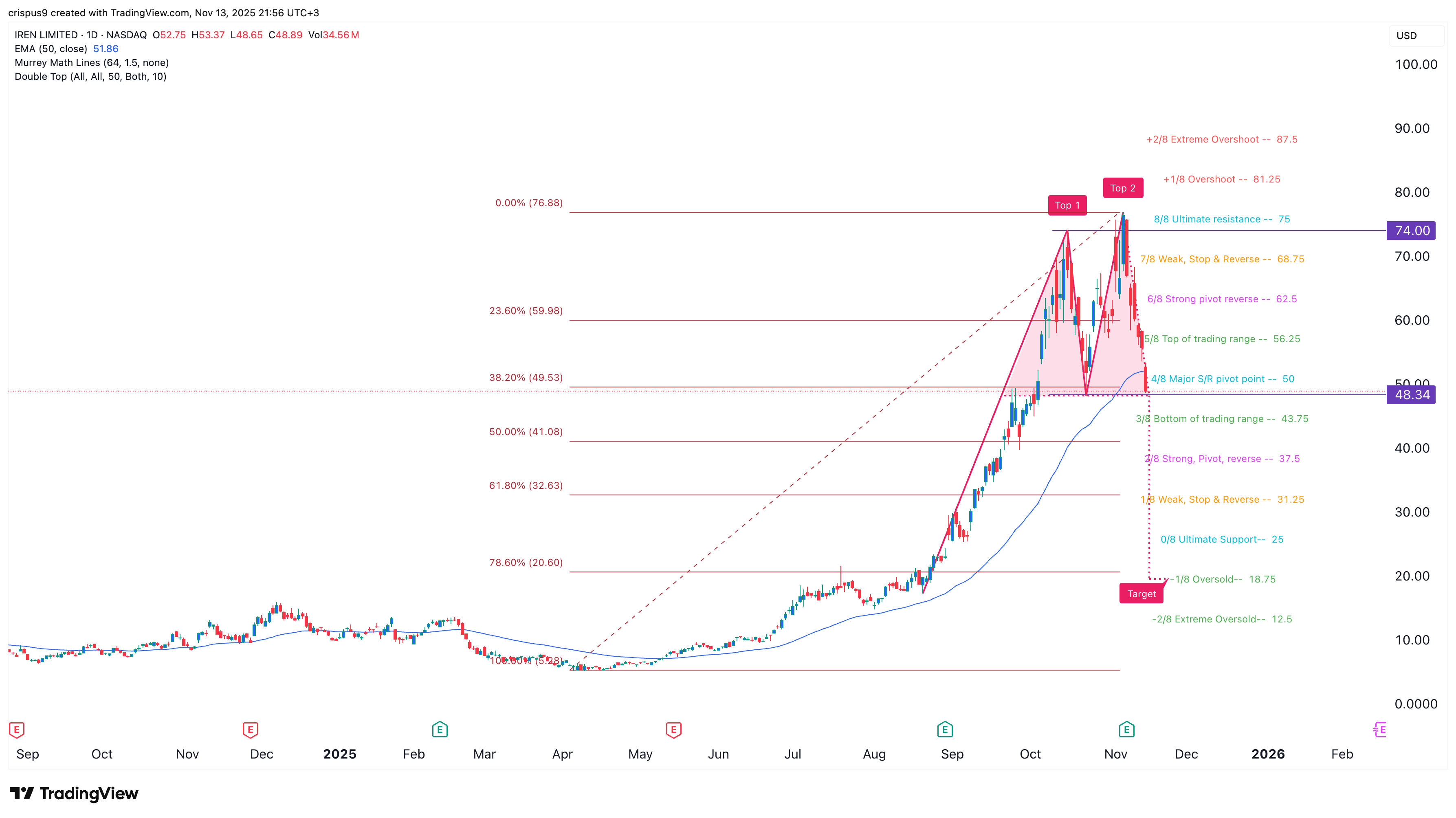

IREN stock price has pulled back and entered a bear market in the past few weeks despite publishing strong financial results. It dropped to a low of $49, down by 35% from the year-to-date high of $76. It has also formed a risky pattern pointing to more downside in the near term.

IREN Stock Price Technicals Point to a Crash

The daily timeframe chart shows that the IREN share price has been in a steep freefall, mirroring the performance of other companies in the industry, such as Core Scientific, CoreWeave, and Nebius.

A closer look shows that the IREN share price has formed a double-top pattern at $74 and a neckline at $48.34. This pattern often leads to a strong bearish breakout as it signals that there were no bids above $74.

Furthermore, IREN’s stock price has now moved below the 38.2% Fibonacci Retracement level, a sign that the sell-off is gaining momentum. It has also moved below the 50-day Exponential Moving Average (EMA).

The stock has also moved below the Major Support and Resistance pivot point of the Murrey Math Lines tool.

READ MORE: XRP Price Did Not Rally After XRPC ETF Launch: Here’s Why

Therefore, by measuring the depth of the double-top pattern and then the same one from the neckline, it shows that there is a risk of a crash to $20. This is a notable price, as it coincides with the Murrey Math Lines tool’s oversold level.

IREN’s Business is Thriving

The ongoing IREN stock price crash is notable given the company’s strong performance. It recently inked a $9.7 billion deal with Microsoft. Microsoft will prepay 20% and pay the remaining amount over the duration of the deal.

IREN has also inked deals with other companies in the AI space, like FluidStack, together.ai, and Fireworks AI. As a result, the management expects its annual run rate to be $3.4 billion by the end of 2022, when it will have 140k GPUs.

The most recent results showed that the company’s revenue rose to $240 million, up sharply from the $52.6 million in the same period last year. Its net income jumped to $384 million from a loss of $51.7 million in the same period last year

Most of its revenue came from Bitcoin mining operations, which jumped to $232 million from $180 million in the same period. That happened as the hashrate jumped, helping offset the soaring mining difficulty.

The IREN stock is therefore falling because of ongoing challenges in the AI industry, which have seen many companies like CoreWeave and Nebius plunge by double digits. It is also falling because of the ongoing Bitcoin price crash, which will affect its revenue.

READ MORE: XPL Price Risks Crash to Record Low as Key Plasma Metrics Implode