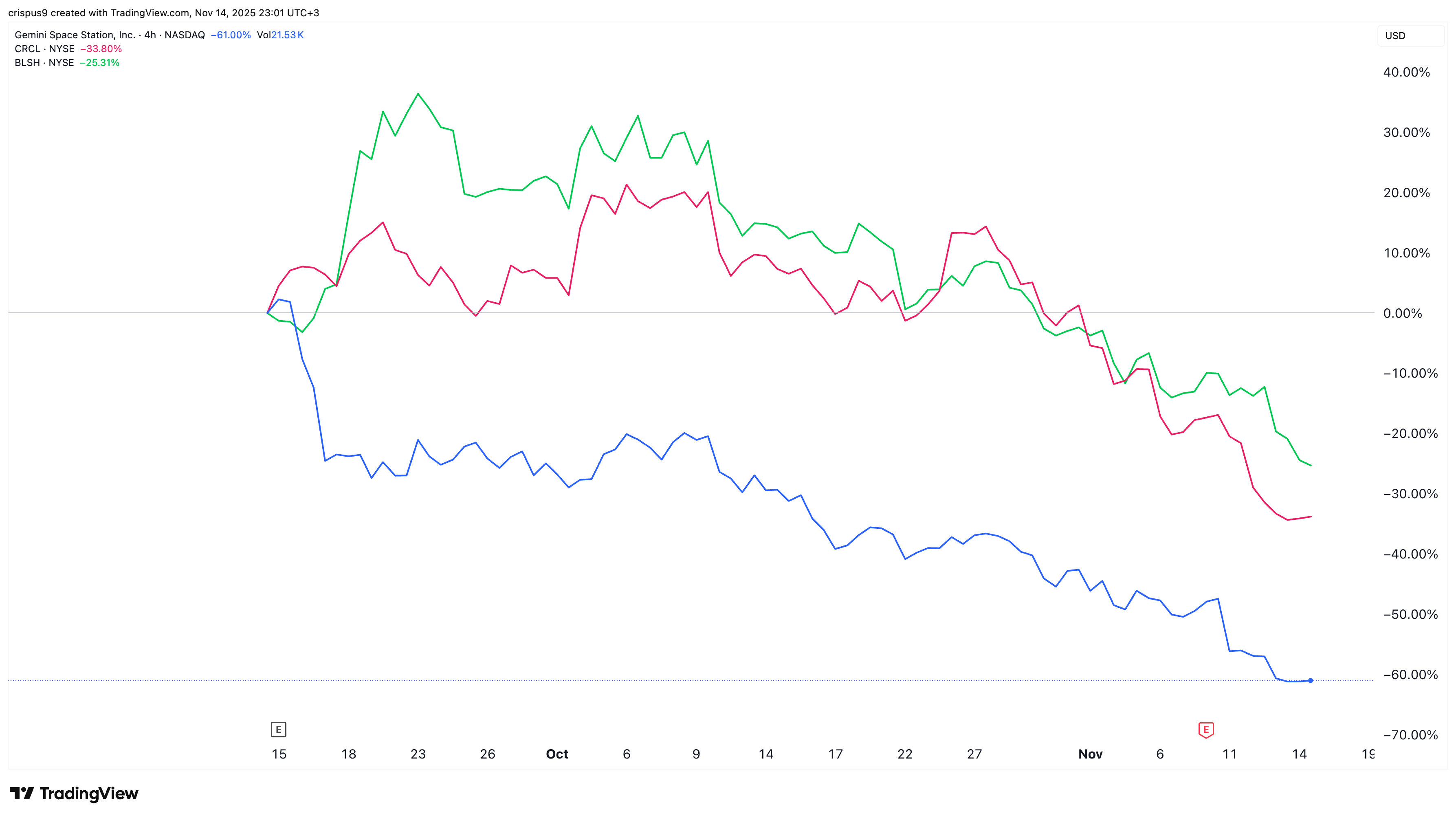

Top crypto companies that launched their IPOs this year have seen their stocks plummet, costing investors billions of dollars. The Circle stock price has crashed from its all-time high of $299 to $82 today.

Similarly, the Bullish stock price has moved from $117.20 in August to $38 today. Gemini stock has moved from $46 in September to $12.30, costing the Winklevoss Twins and other investors billions.

Circle Stock Crashed Amid Valuation Concerns

The CRCL stock surged shortly after the IPO as the stablecoin theme escalated. This surge, however, pushed its market capitalization to over $60 billion, close to its stablecoin supply.

In addition to its pricey valuation, the stock also plunged as the Federal Reserve began cutting interest rates. It cut rates by 0.25% and analysts expect further cuts in the coming months.

Lower interest rates affect Circle shares because of how it makes money. It generates its revenue by investing customer funds in short-term government bonds.

READ MORE: IREN Stock Price Risky Pattern Points to 60% Dive to $20

In an ideal situation, Circle’s revenue should rise when interest rates are high and when the USDC supply is rising. In this case, the supply of USDC has largely stalled at $75 billion, while rates are falling.

At the same time, the company reiterated its guidance in its financial results this week. In most cases, for highly valued companies like Circle, investors love it when they raise their estimates rather than just reiterate.

There are also concerns that Circle stock will drop ahead of the upcoming lockup expiration in December.

Why Gemini and Bullish Stocks Have Plunged

Gemini and Bullish stocks have plunged amid ongoing price action in Bitcoin treasury companies. Bullish is the sixth-largest Bitcoin holder, with 24,300 coins, while Gemini holds 4,002. As a result, their stocks have dropped as Bitcoin’s price has plunged over the past few days. MSTR and other treasury stocks have fallen by double digits.

The two companies have also slipped amid the ongoing downturn in cryptocurrencies, with Bitcoin and most tokens crashing. This crash has led to low volume in centralized and decentralized exchanges. That also explains why other crypto stocks companies like Coinbase have plunged.

The two companies also issued weak forward guidance. Bullish expects its trading volume to be between $133 million and $142 billion in the current quarter, down from $179 million last quarter. Its transaction revenue will be between $25 million and $28 million this quarter, up from $24.1 million in Q2.

Bullish and Gemini stocks have also dropped as competition in the crypto exchange industry rise. This includes companies like Coinbase, Binance, and OKX.

READ MORE: Top Reasons Why CORZ Stock Price is in a Freefall