The recent crypto crash escalated today, November 14, with Bitcoin and most altcoins being in the red. Bitcoin price tumbled to $95,000, while the market capitalization of all coins tracked by CMC plunged by 3.43% to $3.30 trillion.

Crypto Crash Intensifies as Liquidations Jump

One of the main reasons the crypto market is crashing today is that liquidations are in a strong uptrend. Data shows that liquidations jumped by 255% on Friday to over $1.3 billion.

Bitcoin positions worth over $670 million were liquidated in the last 24 hours. Similarly, positions in Ethereum and Solana worth over $293 million and $87 million were liquidated in this period. Over 272k traders were wiped out today.

Crypto liquidations put downward pressure on the market by forcing exchanges to close positions. Traders about to be liquidated often close their positions earlier.

Federal Reserve Interest Rate Cut Odds Fall

The other reason for the ongoing crypto crash is that the odds of a Federal Reserve interest rate cut have fallen. These odds have moved from 90% in October to 50% today. At the same time, US bond yields have continued to rise, with the 10-year moving to 4.2%.

The crypto market normally does well when the Federal Reserve is cutting interest rates. A good example of this is what happened during the pandemic, when Bitcoin and most altcoins soared to record highs.

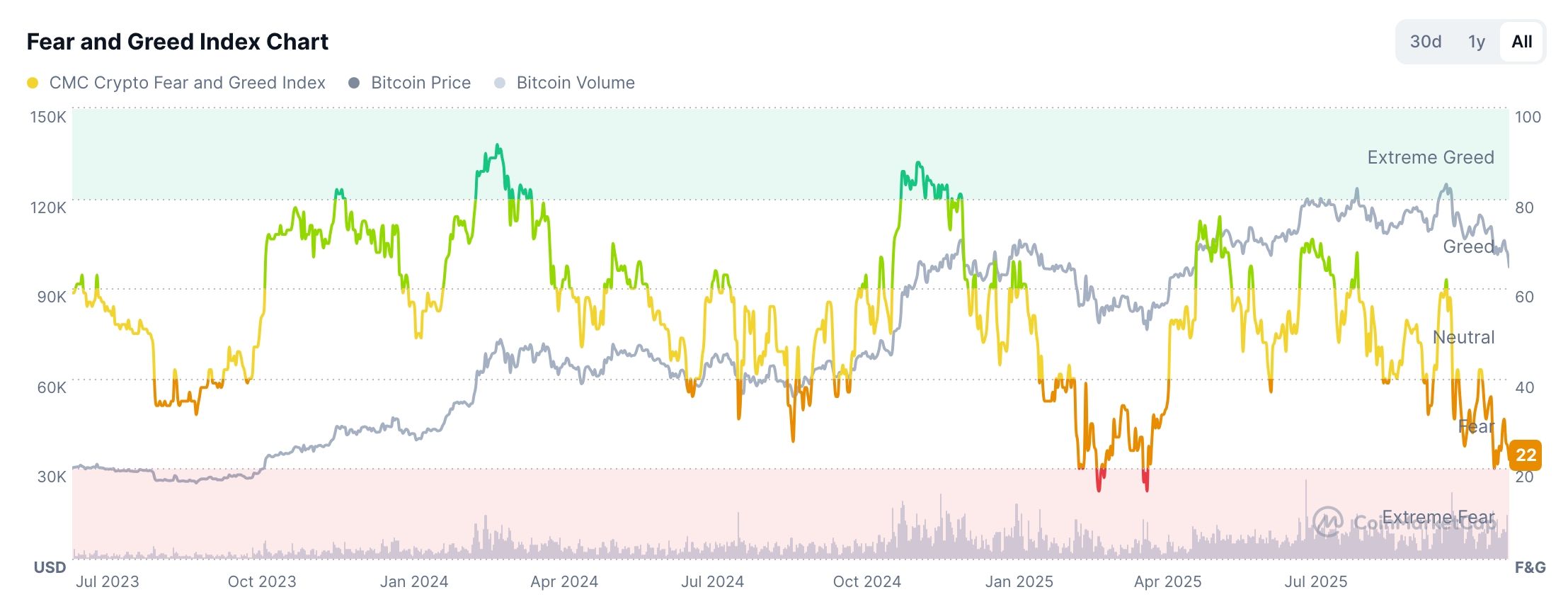

Extreme Fear in the Crypto Industry

Meanwhile, there is extreme fear in the cryptocurrency industry. Data shows that the Fear and Greed Index moved to the fear zone of 22, down from the year-to-date high of 85.

The root cause of this fear is the $20 billion liquidation event that happened in October. Since then, investors have stayed on the sidelines, with futures open interest plunging by over 40%.

At the same time, whale investors have continued selling their coins. It i estimated that large Bitcoin investors have dumped over $40 billion in assets in the last few months.

The fear is also evident in the ETF market, where Bitcoin and Ethereum funds have shed billions in assets over the past few months.

Other Reasons Behind the Crypto Market Crash

There are other reasons that explain the ongoing crypto crash. For example, the drop is due to developments in the Bitcoin treasury industry, where the NAV multiples of companies like Strategy, MicroCloud Hologram, and Metaplanet have plunged below 1.

Other Digital Asset Treasury (DAT) stocks have also continued their freefall in the past few months. Additionally, the crypto crash is happening as investors sell off amid news of ETF approval.

READ MORE: Top Reasons Why CORZ Stock Price is in a Freefall