The crypto market is in deep fear, but data across Bitcoin, Ethereum, and XRP shows a very different undercurrent: retail is selling heavily, while institutional and whale behavior is starting to stabilize the trend.

Santiment’s latest on-chain data suggests that heavier retail selling makes the setup look stronger for a rebound in Bitcoin, Ethereum, and XRP. The platform tracks small “shrimp-tier’’ wallets, the group most prone to panic, and they’ve been unloading aggressively across all three assets.

Wallets holding <0.01 BTC have dumped 0.36% of the supply in the past 5 days. Small ETH wallets (<0.1 ETH) saw a 0.90% decline over the past month. And XRP’s <100-coin wallets offloaded 1.38% of their holdings since early November, the biggest reduction of the three.

Historically, prices tend to move in the opposite direction of this cohort. Retail sells fear near local bottoms, while whales and institutions absorb that liquidity. Santiment’s view is that shrimp panic often signals stronger hands stepping in.

And that seems to be happening again. Market sentiment is in extreme fear, prices look weak on the surface, but whales, ETFs, and liquidity maps are leaning in a different direction underneath it all.

Bitcoin (BTC): Retail Capitulates, But Whales Absorb the Dip

Bitcoin wallets holding under 0.01 BTC dumped 0.36% of supply in the last five days, one of the fastest bursts of retail selling since September. That behavior lines up with the drop below $90,000 and the extreme fear reading on CMC’s sentiment gauge.

READ MORE: Pepe Coin Price Prediction as Smart Money Pros Sell

But bigger players aren’t following them out the door. A single whale swept up roughly $1 billion worth of BTC, accumulating more than 10,000 BTC, a move that typically signals long-horizon conviction rather than panic.

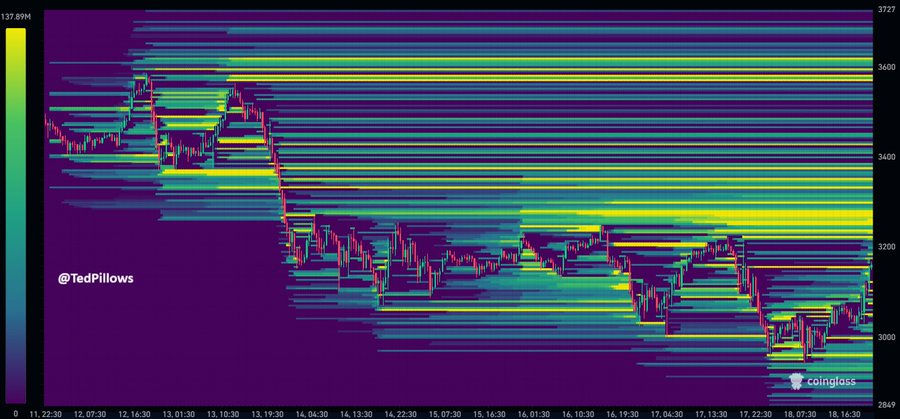

Liquidity maps from Ted Pillows show thick upside bands clustered above spot, especially near $88,000–$90,000, suggesting short-term “max pain” is now to the upside.

With leverage flushed and funding back to neutral, the next leg of Bitcoin price largely rests on spot demand, not on aggressive derivatives.

Ethereum (ETH): Persistent Retail Outflows Meet a Key Liquidity Zone

Santiment data also shows Ethereum wallets holding less than 0.1 ETH shed 0.90% of their supply over the past month, confirming that retail traders have been consistently selling into weakness.

Technically, the market is approaching an interesting setup. ETH’s liquidity heatmap shows a dense block of bids around $3,400–$3,600, an area that has historically triggered relief rallies. After weeks of steady grind downward, the Ethereum price is entering the first high-probability bounce area since early November.

The combination of neutral funding, reduced leverage, and liquidity concentration suggests ETH is due for a reaction, but that reaction likely depends on whether BTC price stabilizes first.

Ripple (XRP): Biggest Retail Sell-Off Contrasts with Rising ETF Demand

XRP’s small wallets, holding under 100 XRP, have offloaded 1.38% of the supply since early November, the largest retail sell-off among the top three assets tracked by Santiment.

Yet, unlike BTC and ETH, XRP is quietly seeing institutional momentum. Canary Capital’s spot XRP ETF recorded $25.4 million in inflows this week and $8.32M on November 18, pushing total assets to $257 million. ETFs don’t create immediate volatility, but they do reflect steady, risk-averse accumulation.

With the XRP price still moving in step with Bitcoin, the divergence between retail selling and ETF buying is notable. If BTC stabilizes, XRP is positioned to be one of the first majors to benefit from renewed spot demand.

READ MORE: Ethereum Price Has Crashed: Top Reasons ETH Will Rebound