Chainlink price action is testing nerves again. While the total crypto market cap shed another 6.5% in 24 hours to $2.93 trillion, LINK is hovering around $12.6 after a multi-week slide, even as fresh on-chain inflows, bullish institutional reports, and tightening technical patterns put the token at a decisive moment.

Chainlink Price Holds Support, but Momentum Is Weak For Now

LINK continues to trade heavily across USD and BTC pairs. Over the past month, the token is down roughly 27%, sliding from the mid-$17 region into the low-$12s. Volatility has accelerated as Bitcoin’s own retracement dragged the broader market lower.

Still, traders are paying close attention to the fact that Chainlink’s price is sitting right on a major horizontal support level.

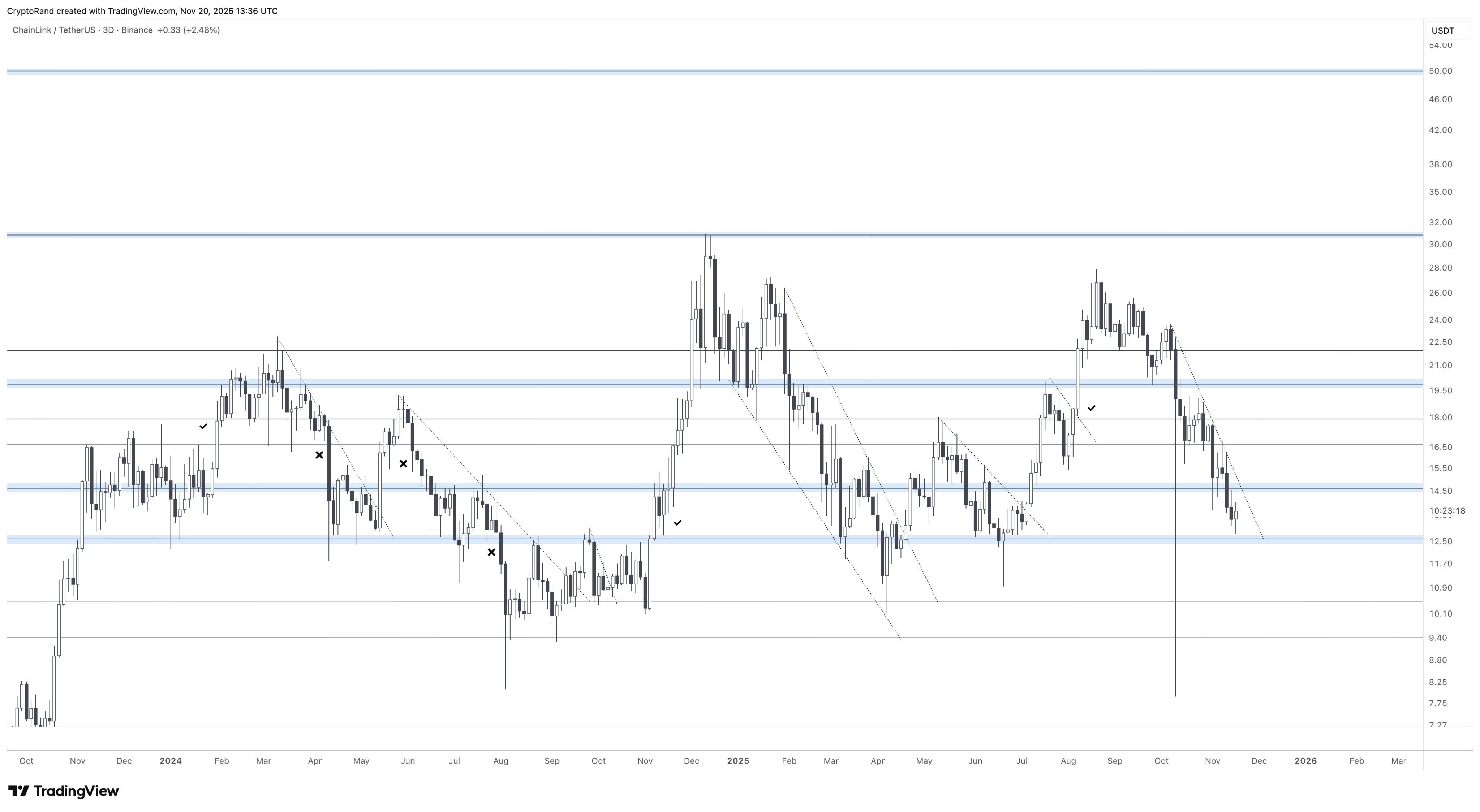

Rand (@cryptorand) points to a clear squeeze between that support zone and the main downtrend resistance. “Key decision time,” he warned, sharing a chart showing LINK compressing into a narrowing structure, the kind of setup that usually doesn’t last long.

World of Charts, meanwhile, is more optimistic. He highlights a falling wedge breakout forming on LINK/BTC, arguing that a decisive move could send LINK toward $30 in the coming weeks. His view hinges on the BTC pair finally turning after months of bleeding, a prerequisite for sustainable USD relief.

So far, the chart hasn’t confirmed either direction. Buyers are defending the floor, but momentum is missing.

Fundamentals Paint a Stronger Long-Term Picture

Away from the charts, the fundamentals keep improving. The Chainlink Reserve, a smart contract that converts enterprise payments and service fees into LINK, added another 81,285 LINK, bringing total holdings to 884,673 LINK (~$11.5M) across 16 inflows since August.

Roughly 90% of the latest inflow came from USDC swaps on Uniswap, with the rest from user fees already paid in LINK tokens.

Importantly, these tokens do not re-enter circulation. No withdrawals are expected “for years,” according to comments.

This steady buyback-style mechanism arrives just as institutional attention spikes. A new Grayscale Research report calls Chainlink “the critical connective tissue between crypto and traditional finance,” emphasizing its role in tokenization, a market now at $35B, up from $5B in early 2023.

Grayscale argues Chainlink offers unique broad-market exposure because it powers data, interoperability, and compliance across multiple blockchains.

READ MORE: Bitcoin Price Prediction: Peter Brandt Makes the Case for $200,000