The IREN stock price has suffered a harsh reversal in the past few weeks, erasing some of the gains made in the past few months. IREN has crashed by 42% from its year-to-date high, bringing its market cap from $21 billion to $12 billion today.

IREN Stock Price Forms a Risky Pattern

The daily timeframe chart shows that the IREN share price has slumped in the past few weeks. It has already crashed below the 50-day and 25-day Exponential Moving Averages (EMA). Moving below these levels is a sign that bears are gaining control.

Most importantly, the coin has formed a double-top pattern at ~$75 and a neckline at $48, giving it a height of $27. Subtracting the height from the neckline yields a target price of $21, about 50% below the current level.

Why IREN Shares Are in a Freefall

IREN is an Australian Bitcoin mining company known for its efficiency and higher margins. Like other top mining companies, it is now pivoting to the artificial intelligence industry, where it is providing data center solutions.

READ MORE: XRP Price Reaches Pivotal Support as ETFs Near a $500M Milestone

IREN’s breakthrough in the industry happened recently when it inked a major deal with Microsoft, which will pay it $9.7 billion in the next five years.

The company hopes that other large companies in the AI industry will become clients. Precisely, it hopes to attract companies like Google, OpenAI, Anthropic, and xAI.

IREN is replicating a business model that has become popular recently. A good example of this is CoreWeave, which has become a $35 billion juggernaut in the industry.

The most recent results showed that its business was doing well, with revenue rising to $240 million from $187 million. $237 million of this revenue was from its Bitcoin mining operations, while its AI business made $7.3 million.

IREN reported a net profit of $384 million, mostly due to the unrealized gain of its financial instruments, such as Bitcoin. The company now hopes that its ARR in the AI industry will be $3.4 billion by the end of 2026.

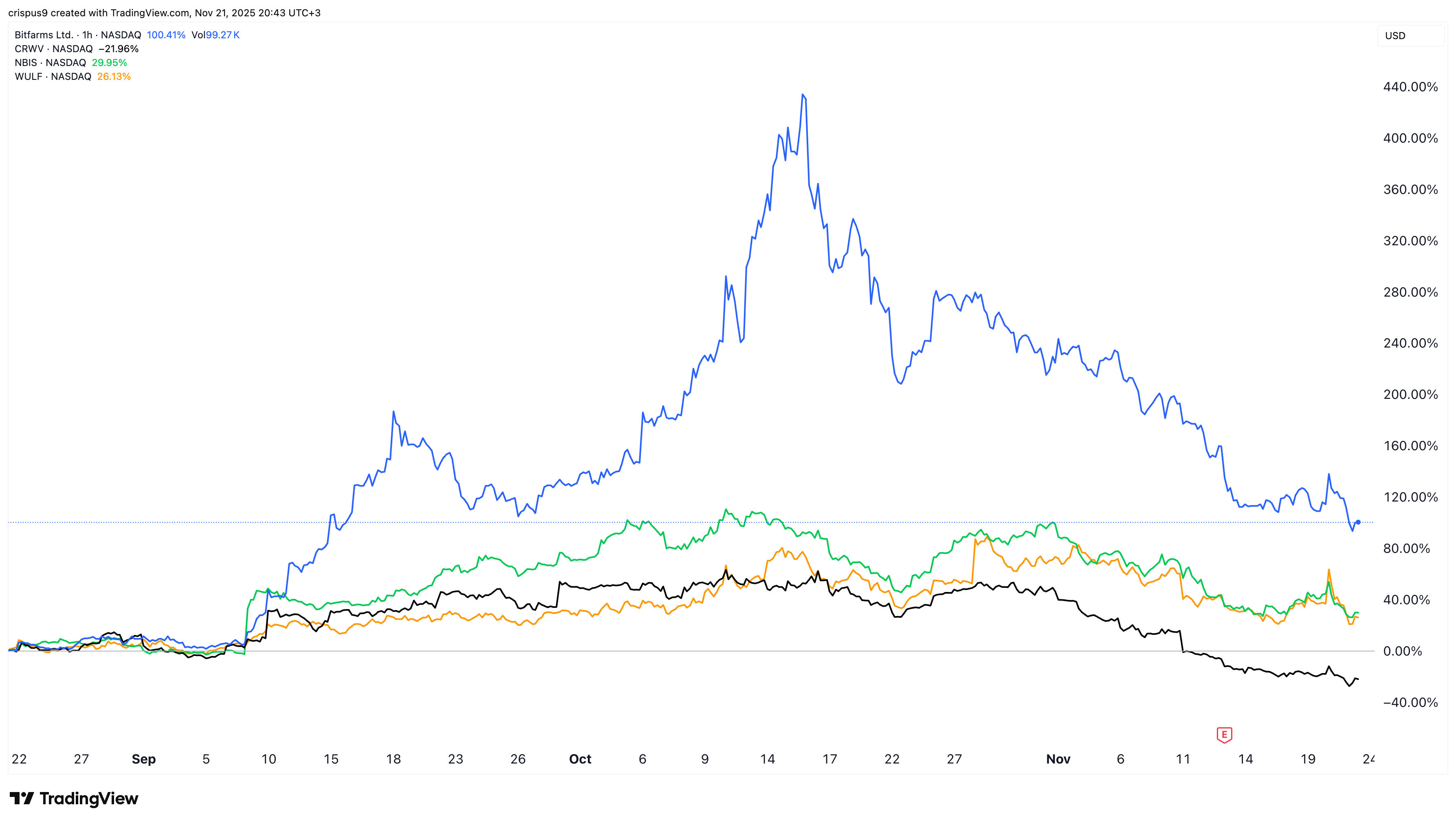

IREN shares have plunged over the past few days amid ongoing jitters about the AI bubble. Indeed, all companies in the industry have plunged. CoreWeave has dived by 62% from its all-time high. Similarly, Bitfarms stock has dived by over 60% from the year-to-date high.

Another reason is concern about ongoing competition in the industry, as more companies are joining. The risk is that, as computing demand rises, clients will have more choices, potentially leading to margin erosion over time.

Additionally, there are concerns about the depreciation of AI GPUs. Top companies, including IREN, estimate that GPUs will remain useful for about 6 years, but analysts warn that ongoing innovation will shorten the timeline.

READ MORE: DJT Stock in a Freefall as Trump Media Faces a Double Whammy