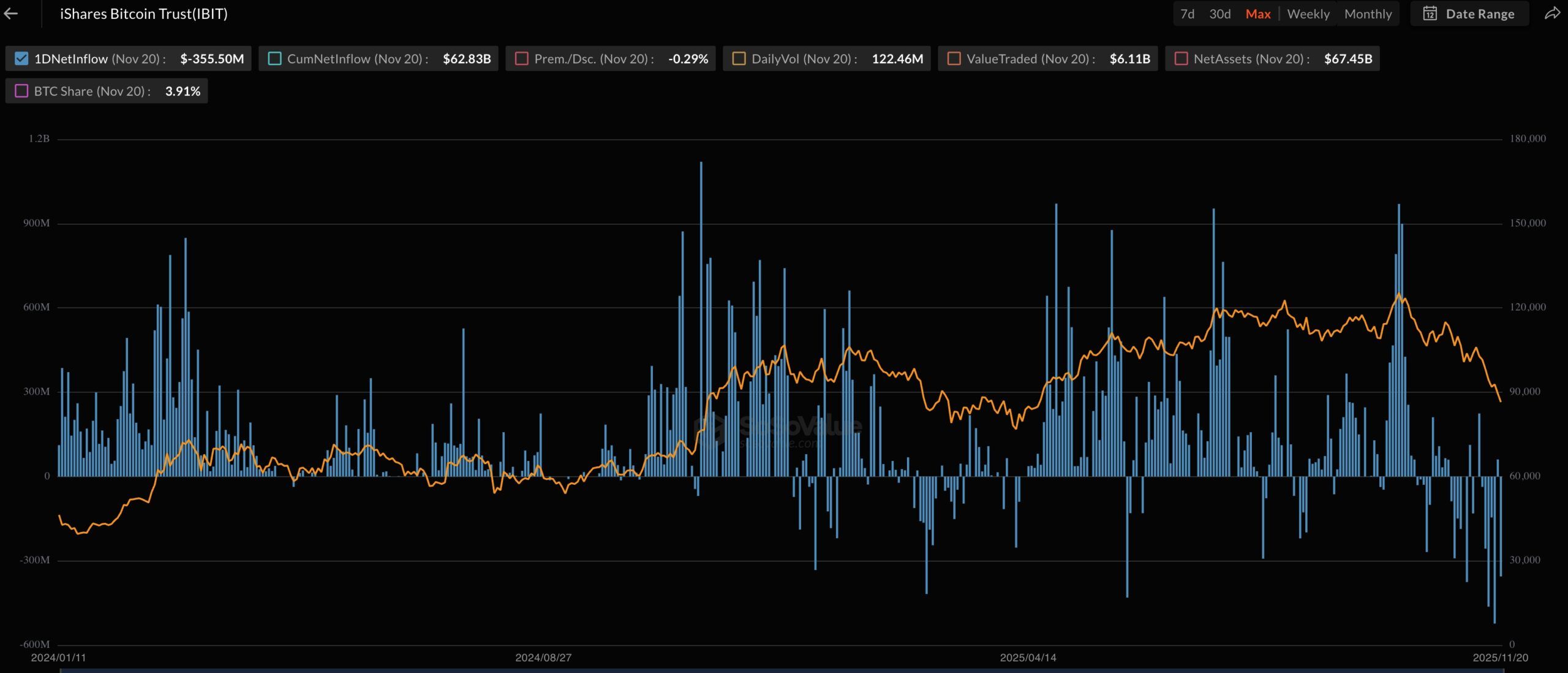

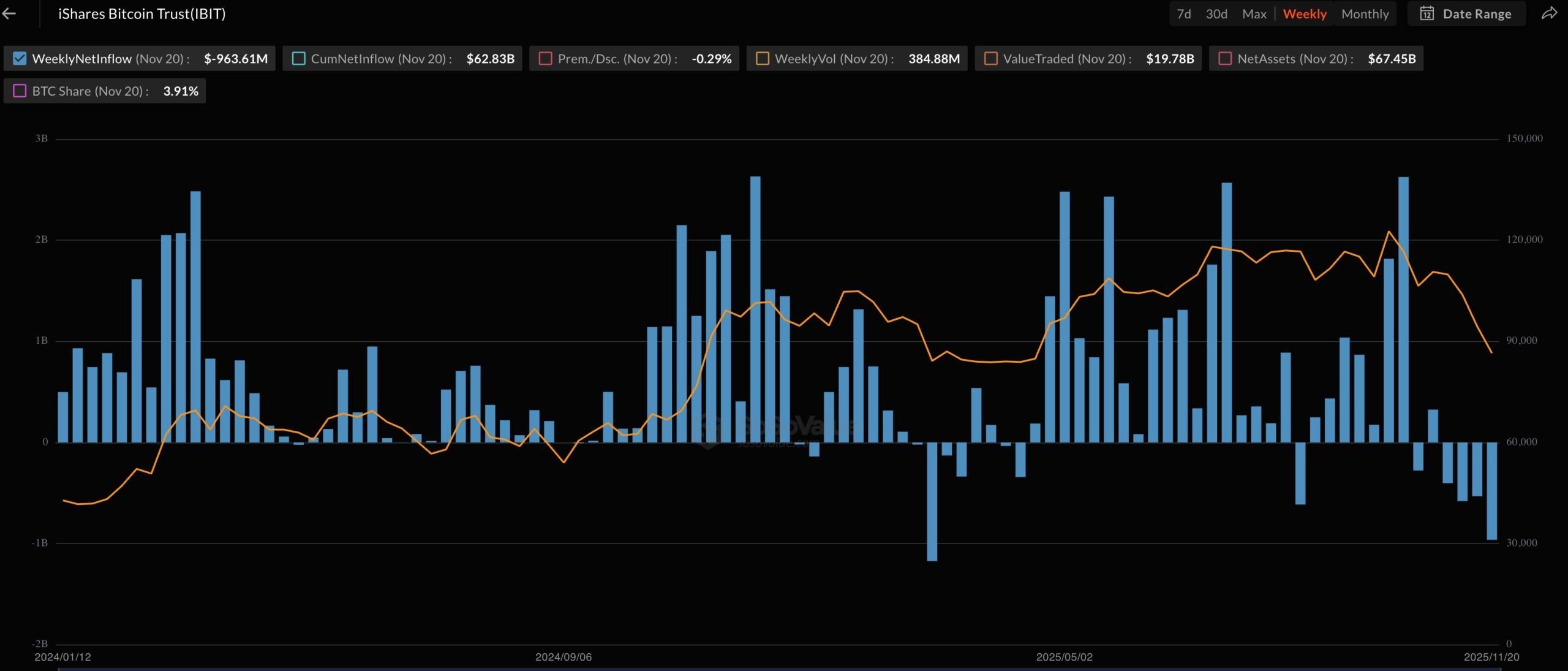

The IBIT ETF went through a rough patch this week as the crypto market crash intensified, with Bitcoin falling to the important support at $80,000. BlackRock’s ETF bottomed at $46.67, down by over 32% from its highest point this year.

IBIT ETF Had the Longest Streak of Weekly Losses

The IBIT ETF has broken at least four personal records during the ongoing crypto market crash. First, the ETF capped its longest weekly declines since its inception in January last year.

It dropped by over 10% this week, the seventh consecutive week in the red. Before this, the longest streak in the red happened in February, when it dropped for four straight weeks. It moved from $56 to $46 during the week.

READ MORE: Pi Network Price Prediction: A Coiled Spring Ready to Pounce?

Second, the fund set a record for its largest daily outflows on Tuesday, shedding over $523 million in assets. Its previous record happened on May 30th when the fund shed $430 million.

Third, the ETF recorded the longest weekly outflow streak this week. It shed over $1 billion in assets this week, the fourth consecutive period in the red. Before that, its longest streak happened earlier this year when it shed assets for four straight weeks. In total, the fund has now shed over $2.5 billion in assets in the last four weeks.

In a comment about the ongoing ETF outflows, Bitfinex analysts wrote that:

“The spot ETF channel remains intact, and the outflow likely reflects tactical rebalancing rather than a wholesale exit from the asset class. When the dominant vehicle sees large redemptions, it can drain liquidity, widen basis spreads, and increase margin-related volatility. The structural thesis remains firm.”

BlackRock’s Bitcoin ETF Broke a Daily Volume Record

Nevertheless, data shows that BlackRock’s Bitcoin ETF broke a record in its daily traded volume. Positions worth over $8 billion were traded on Friday as market volatility jumped.

Five, the fund’s put volume jumped to a record high as investors hedged their long positions. A put is a financial contract that gives a buyer the right, but not the obligation, to sell an underlying asset at a specified price within a specified period. In this case, the put is acting as an insurance policy that protects users when the market falls.

The ongoing IBIT stock price crash has also negatively impacted BlackRock, whose shares have fallen by over 17% from their highest point this year. IBIT is its most profitable fund because of its significant assets and higher fees.

READ MORE: Bitcoin Price Prediction: Peter Brandt Makes the Case for $200,000