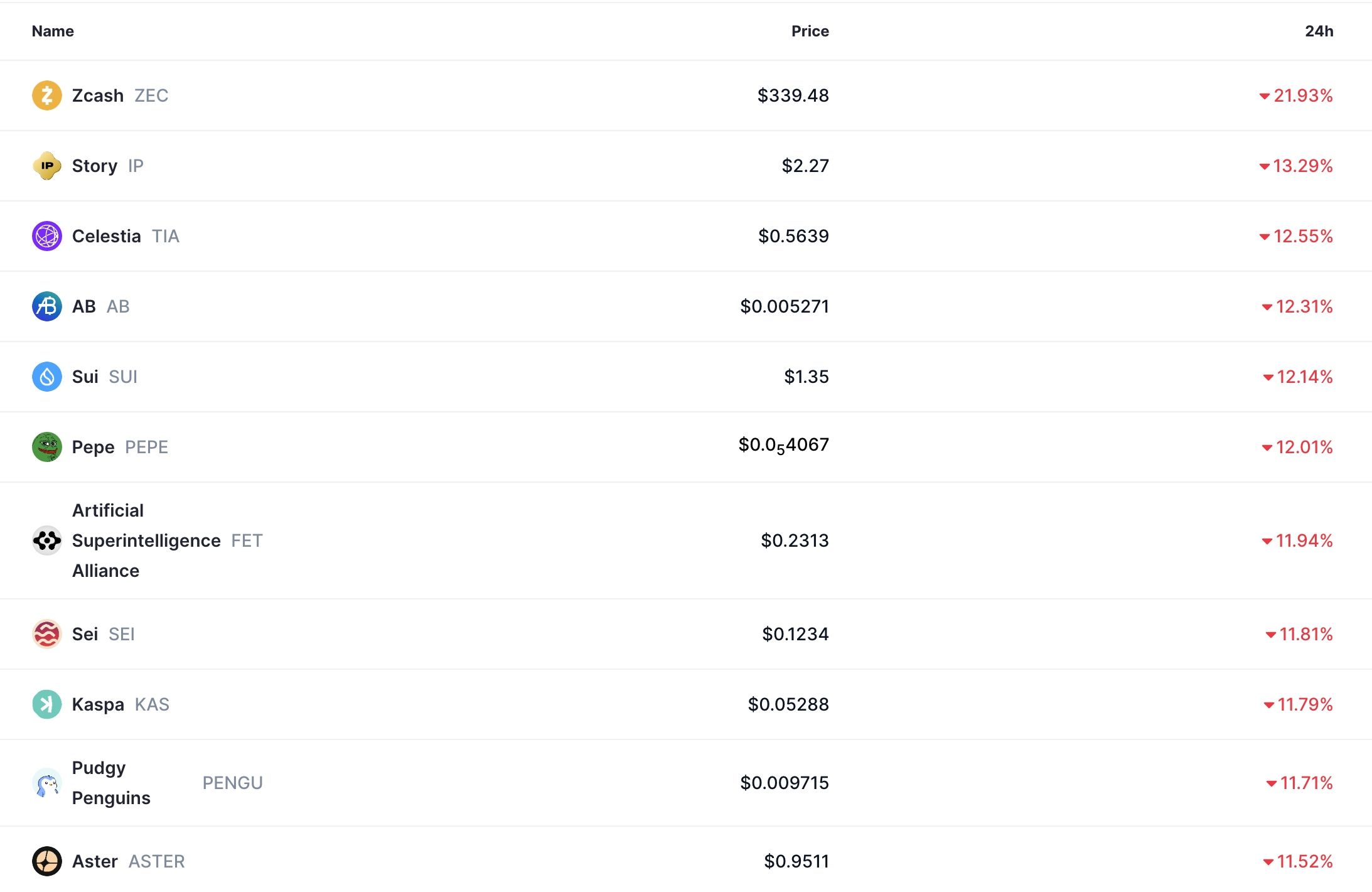

The recent crypto crash resumed this week, with Bitcoin and most altcoins being in the red. Bitcoin price dropped to $84,000, while altcoins like Zcash, Story (IP), Celestia (TIA), Sui (SUI), Pepe, and Sui were the top laggards, falling by over 10%. This article explores some of the reasons why cryptocurrencies are tanking today.

Crypto Crash Happened After Hawkish BoJ Statement

One of the top reasons for the ongoing crypto rally is that the odds of unwinding the Japanese yen carry trade rose this week. This happened after the Bank of Japan (BoJ) Governor hinted that they might raise interest rates this month.

Such a rate hike will occur as the Federal Reserve slashes rates by 0.25%, creating a wider spread between US and Japanese monetary policy.

The statement prompted more crypto investors to recall what happened last year, when the BoJ delivered its first interest rate hike in over a decade. That shocker pushed Bitcoin and most altcoins much lower as traders unwound their carry trade.

READ MORE: Is the IREN Stock Price a Bargain or at Risk of a Deeper Dive?

Soaring Liquidations Have Contributed to the Crypto Market Crash

Another notable reason the crypto crash is happening is that liquidations have jumped in the past few days. Data compiled by CoinGlass shows that liquidations soared by over 700% in the last 24 hours to $990 million.

The report shows that over 271k traders were liquidated in this period, with Bitcoin positions worth over $408 million being wiped out. Positions in Ethereum and Solana worth over $239 million and $47 million were liquidated in the last 24 hours. Some of the other top liquidations included tokens such as Dogecoin, Hyperliquid (HYPE), Litecoin, and Cardano.

The soaring liquidations coincided with a 4.70% drop in open interest in the futures market over the last 24 hours, to $125 million. Also, the Long/Short ratio has moved to 47%/52%, a sign that most traders are now bearish.

Concerns About Tether (USDT)

The ongoing crypto market crash also occurred a few days after S&P Global issued a chilling message about Tether, the world’s largest stablecoin.

In its note, the ratings agency placed Tether at the lowest level of the stability scale, citing its reserves, which are based on assets such as gold, Bitcoin, corporate bonds, and loans.

Indeed, recent data show that Tether has become one of the largest holders of gold over the past few months. Its purchase has likely pushed its price to a record high.

Therefore, S&P Global warned of a potential de-pegging of the USDT if these assets plunge. Such a move would be a big one, as USDT is one of the biggest assets in the crypto industry, with over $184 billion in assets. It is also the anchor of the crypto industry, with transactions worth billions of dollars moving through it.

The crypto market crash is also happening after Strategy’s CEO hinted that the company may sell its Bitcoin holdings if the enterprise value mNAV multiple falls into the negative zone.

READ MORE: Is the IREN Stock Price a Bargain or at Risk of a Deeper Dive?