Bitcoin price slid below $89,000 on Friday after failing to hold the $92K support zone. The move caused a market crash, with a brief BTC spike down to $88K before stabilising.

This drop quickly changed the mood and drew attention to the idea that if Bitcoin had bounced back through $92K, the trend would probably have kept running, but it didn’t.

Bitcoin (BTC) currently trades near $89,125, roughly 3.37% lower on the day, with a market cap of about $1.78 trillion.

The swing matters because it broke up a steady climb and opened the door for a deeper test of support. Right now, the chart shows buyers stepping in close to the lows, which has stopped the market from sliding any further for the moment.

Whales Reverse Course and Start Accumulating

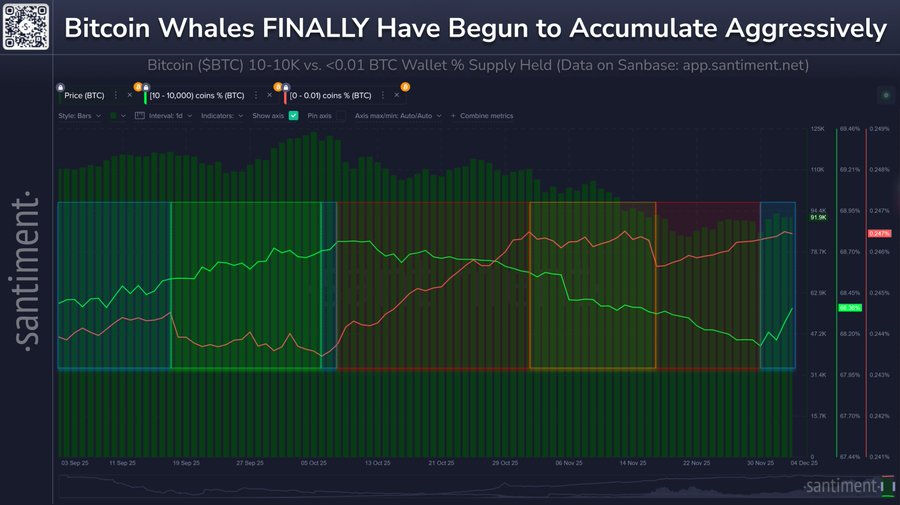

On-chain data from Santiment shows large Bitcoin holders have begun buying again. Whales and sharks have accumulated 47,584 BTC so far in December, reversing a months-long period of distribution that saw 113,070 BTC leave their wallets between mid-October and the end of November.

Historically, when large wallets accumulate strongly, the Bitcoin price tends to stabilise and eventually push higher. The current environment is complicated by retail traders also buying dips, which slows upward momentum.

A turning point emerges when smaller wallets begin selling into strength while whales continue to absorb supply. Santiment suggests that such a shift would likely trigger an advance similar to the one seen in September and early October.

Bitcoin Price Short-Term Outlook Hinges on $87K vs. $92K

Michaël van de Poppe says the drop through $92K knocked Bitcoin price down to around $88K before the market caught itself and stopped falling.

The BTC price has been moving sideways since then, and the next meaningful shift hinges on whether buyers can regain the $92K level. If they do, the broader trend looks intact, and confidence should return fast.

Holding $87K is also part of the equation. As long as that support stays in place, the structure still looks healthy, and $92K remains the first area traders would expect the market to test again on the way up.

A slip under $87K paints a very different picture. Losing that level opens the door to a deeper pullback, possibly toward the earlier lows, which could set up a double bottom. That kind of pattern often gives a sturdier base for the next rally, though it usually takes a little time to form and play out.

READ MORE: Chainlink Price Prediction as ETF Inflows Rise, Exchange Reserves Plunge