Bitcoin and the crypto market remained under pressure on Monday, with BTC briefly falling below $90,000 and other altcoins being in a bear market after falling by over 20% from their year-to-date high. So, will the Federal Reserve interest rate cut help to stimulate a crypto rally this week?

Federal Reserve to Cut Interest Rates This Week

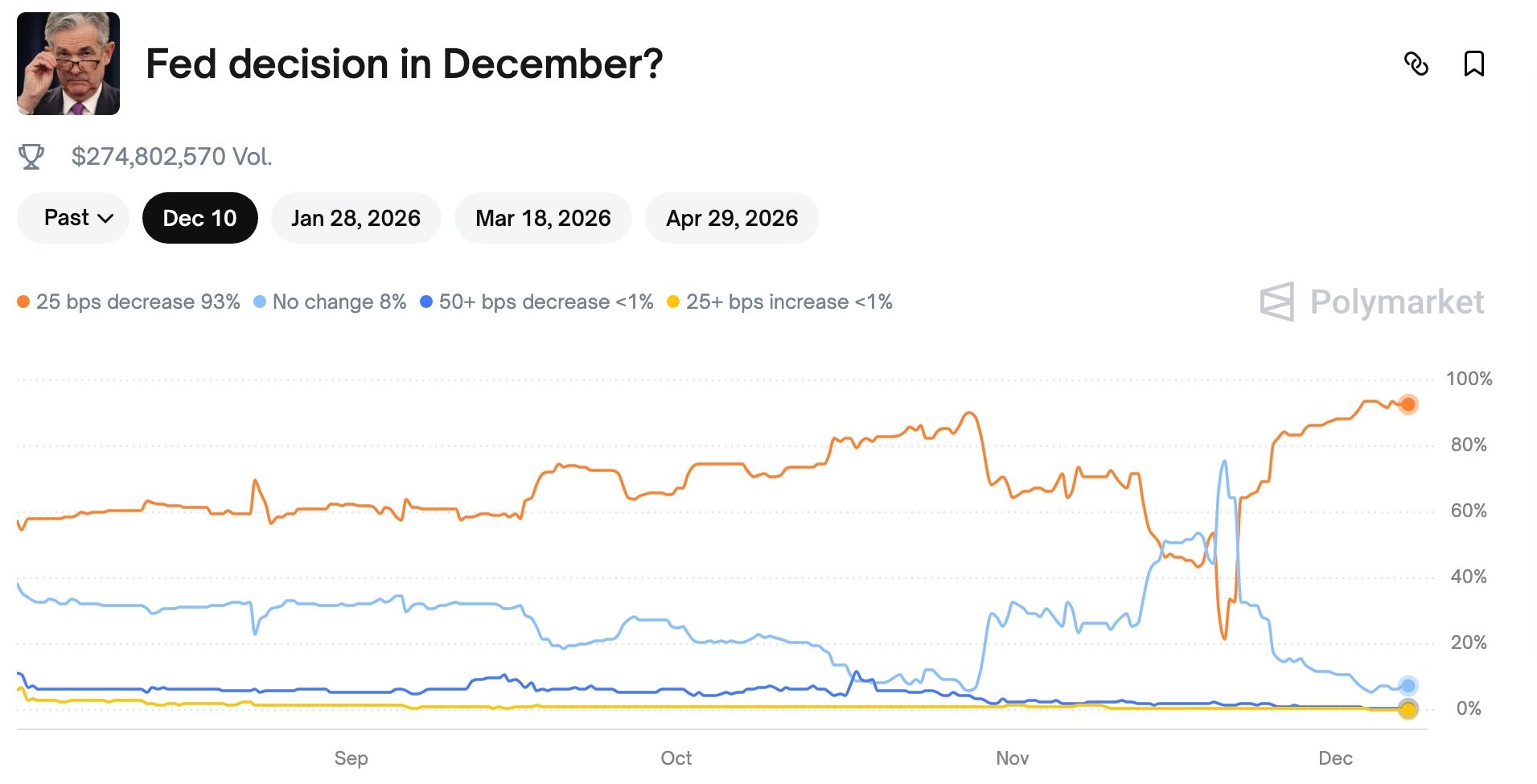

The main crypto news this week will be the Federal Reserve’s interest rate decision on Wednesday. Economists and Polymarket traders believe that the bank will cut interest rates by 0.25% in its third consecutive meeting. These odds have jumped to 93% on both Polymarket and Kalshi.

In theory, a Fed cut following the bank’s end of quantitative tightening (QT) policy should be a highly bullish catalyst for cryptocurrencies and stocks.

This view is supported by Donald Trump’s hint that he will nominate Kevin Hassett as the next Federal Reserve Chair. Hassett works at the White House, and unlike Powell, he is viewed as a Trump “puppet” who will lean towards interest rate cuts.

The Fed will cut interest rates to support the labor market, which has shown some weakness in the past few months. A report released by ADP showed that the economy lost over 30,000 jobs last month.

Officials supportive of cuts also argue that Donald Trump’s tariffs have not significantly fuelled inflation, with the headline Consumer Price Index (CPI) remaining around 3% in the past few months.

READ MORE: SoFi Stock is Crashing Today: Time to Panic Sell or Buy the Dip?

Will the Fed Cut Lead to a Crypto Rally?

In theory, a Federal Reserve interest rate cut and the end of quantitative tightening should be highly bullish for the crypto market. Besides, history shows that crypto prices rise when the Fed is cutting rates and fall when it is tightening.

However, there are reasons why this week’s rate cut may not lead to higher prices. First, the crypto market crash happened recently despite the Fed’s two rate cuts. Also, the rate cut, if it happens, has already been priced in by market participants since odds have jumped to 93%. As such, there is a likelihood that crypto prices will retreat once the Fed cuts happen. This is known as buying the rumors and selling the news.

Third, a Fed cut could drive up inflation, putting pressure on the bank to back off on further cuts. This explains why US bond yields have drifted higher over the past few weeks, with the 10-year rising from 3.962% earlier this month to 4.14% today.

The 30-year yield, which is determined by the market, has soared to 4.80%. Soaring bond yields often lead to more weakness among risk assets.

READ MORE: Chainlink Price Prediction as ETF Inflows Rise, Exchange Reserves Plunge