Shiba Inu price remains in a technical bear market after plunging by over 70% from the year-to-date high. It has underperformed most blue-chip tokens like Bitcoin and Solana. This article explores whether the Shiba Inu Coin price will rebound as its fundamentals improve.

Will Shiba Inu Price Rebound as Whales Buy and Exchange Reserves Plunge?

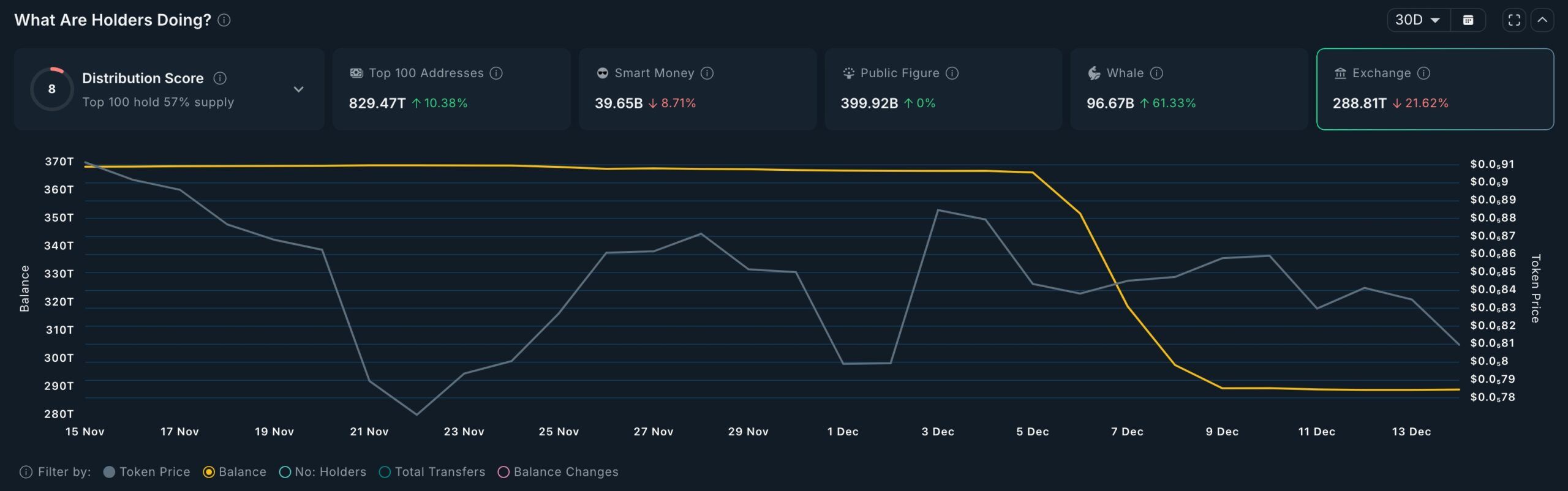

Shiba Inu’s fundamentals are improving this month. Data compiled by Nansen show that exchange supplies have plunged by 21% over the last 30 days, indicating that investors are not selling their tokens. Also, the supply flows mean that holders continue to move their tokens to self-custody, which is a highly bullish sign for the meme coin.

There are now 288 trillion Shiba Inu coins in exchanges, down from this month’s high of 366 trillion. This makes it one of the top coins that investors are moving from exchanges.

The other top catalyst for Shiba Inu Coin is that whales have started coming back in to buy it. They have now accumulated over 96 billion coins, well above the December low of 1.36 billion, meaning they have boosted their holdings by nearly 7,000% in the past few days.

READ MORE: Best Crypto to Buy Now Ahead of a Santa Claus Rally

Additionally, the top 100 addresses have boosted their holdings by 10.3% in the last 30 days. These numbers indicate investors are buying the dip, hoping the token will rebound in the near term.

However, there are risks of buying Shiba Inu today. First, the token remains in a bear market, and, as the chart below shows, it is not showing signs of a comeback.

Second, there are signs that the meme coin sector has lost favor with investors, with most coins, including Dogecoin, continuing to fall this year.

Third, macro factors, including the upcoming Bank of Japan (BoJ) interest rate hike, suggest that the crypto market may remain under pressure in the near term.

SHIB Price Technical Analysis

Technicals suggest that the SHIB price has been in a strong downward trend this year. It has dropped below the descending trendline connecting the highest swings in May, July, and September this year.

It is also slightly above the lower trendline that links the lowest swings since April this year. Shiba Inu price remains below the 50-day and 100-day Exponential Moving Averages (EMA) and the Supertrend indicators.

The descending channel suggests that the coin remains in a bear market. Therefore, the token will remain in this bear market as long as it is inside this channel and below the moving averages and the Supertrend indicators. A move above these levels will point to more gains, potentially to $0.000012.

On the other hand, a drop below the lower side of the falling channel will signal more downside, as it will indicate that bears have prevailed.

READ MORE: Pyth Network Plans Chainlink-Like Treasury Reserve Amid Token Slide