The Altcoin Season Index continued its recent downtrend, with most tokens under pressure. Top tokens like DoubleZero, Story, MYX Finance, Pungy Penguins, and Celestia have all plunged by over 70% in the last three months. This article explores some reasons why an altcoin season may happen in 2026.

Altcoin Season May Happen as Fed Cuts Interest Rates

One potential reason why an altcoin season may happen is that the Federal Reserve may continue cutting interest rates in 2026. While officials pointed to one interest rate cut next year, most analysts expect more than that.

Polymarket traders expect that the bank will deliver three cuts during the year. Besides, Donald Trump will nominate a Fed Chair willing to deliver more cuts. These cuts will come as the bank continues implementing its quantitative easing (QE) policy.

Odds of more cuts have risen after a report released on Tuesday showed that the unemployment rate rose to 4.6% in November. At the same time, crude oil prices have slumped, a move that will lead to lower consumer inflation.

Bitcoin typically performs well when the Fed cuts rates and implements QE policies. The altcoin season normally happens when Bitcoin is in an uptrend.

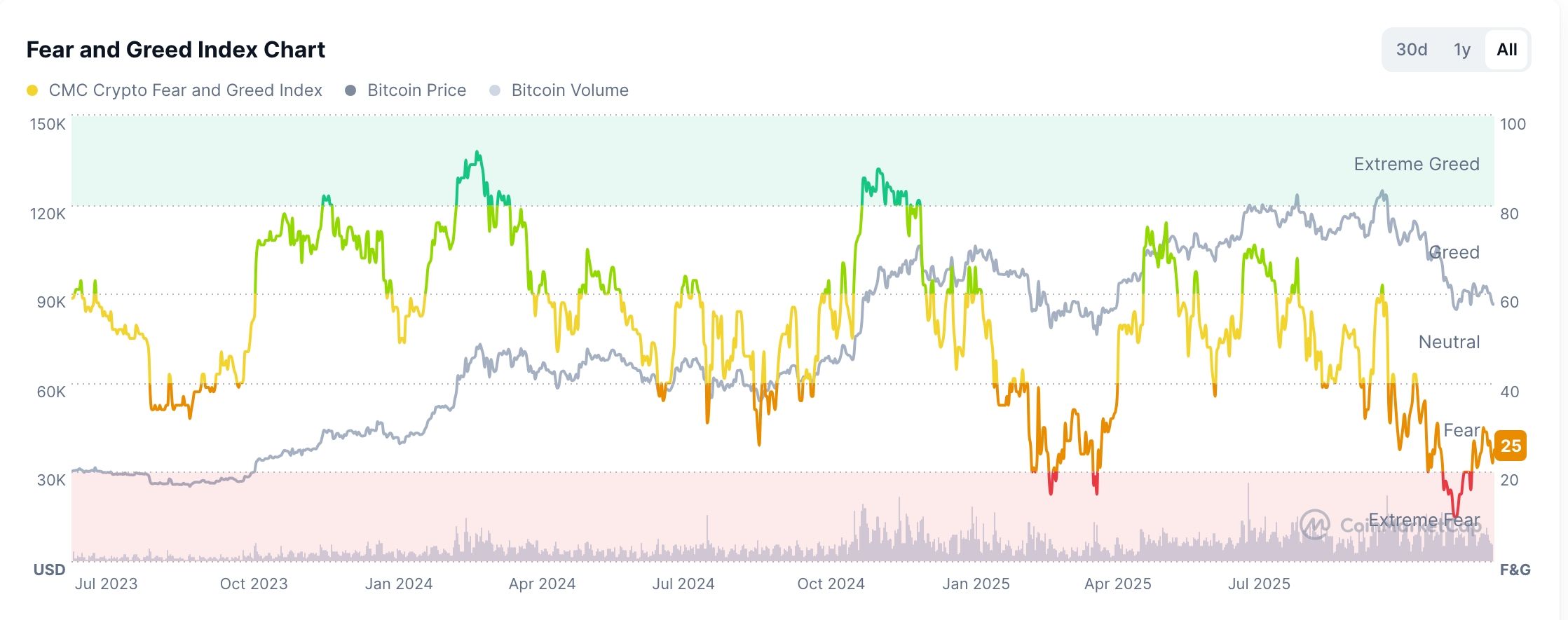

Crypto Fear and Greed Index Points to a Rebound

Meanwhile, the closely-watched Crypto Fear and Greed Index remains in the fear zone of 25. It has dropped from the year-to-date high of 88.

In most cases, cryptocurrency prices begin to recover when the Fear and Greed Index falls into the fear zone. They also retreat when the index enters the extreme-greed area.

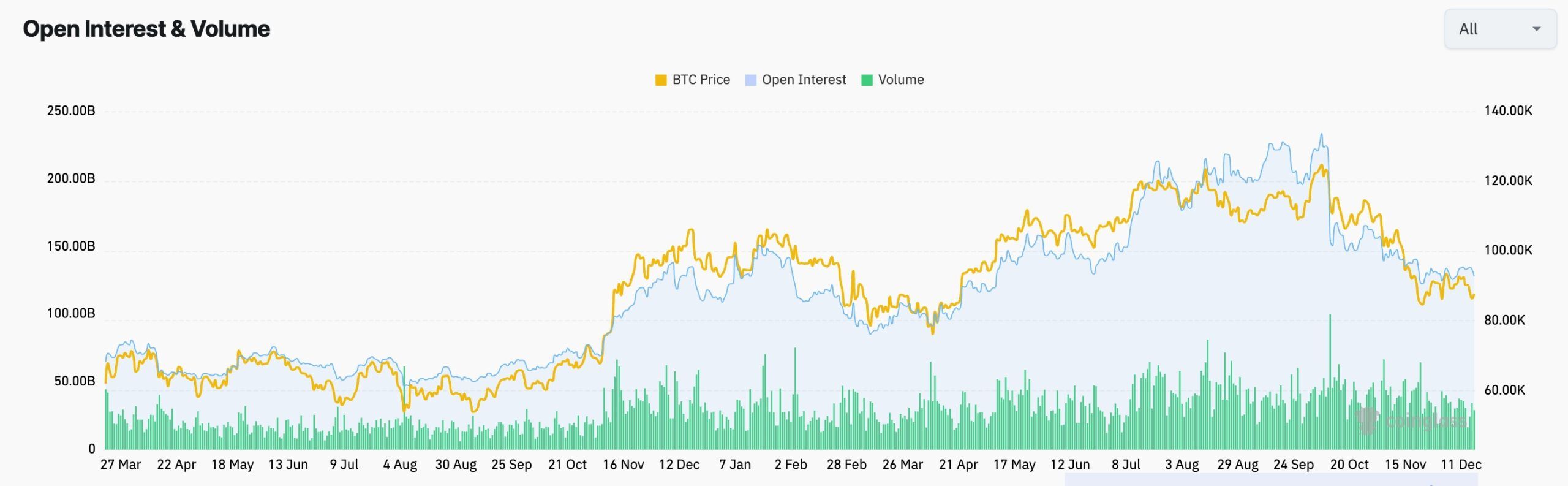

Futures Open Interest Crashes to Bottom

One reason for the ongoing crypto market crash is that investors have reduced their leverage over the past few months. This deleveraging began when the crypto market experienced a major liquidation event in October.

The futures open interest dropped to $127 billion on Wednesday, down sharply from the year-to-date high of over $225 billion. As the chart below shows, the figure has continued making a series of lower lows recently.

Fortunately, these dips don’t last forever, and the figure will start to go back up, which will push altcoins higher.

Altcoin Market Cap Has Landed at a Key Support

Technicals suggest that the altcoin market capitalization has dropped to a crucial support level, which may lead to a rebound in the coming weeks or months.

The Altcoin Market Cap figure has bottomed at a crucial level where it failed to move below several times since August last year. It has always rebounded whenever it moved to that support level.

Therefore, there is a slim chance that the figure will rebound and possibly retest the $1.7 trillion market cap.

The risk, however, is that the figure has formed a head-and-shoulders pattern, which may lead to more downside in the near term.