Bitcoin price came under intense selling pressure on Friday as the Bank of Japan (BoJ) delivered its final interest rate decision of the year. BTC dropped to $85,800, down from this month’s high of $94,650, which is ~30% below the year’s high.

Bitcoin Price Drops After BoJ Interest Rate Hike

BTC and other altcoins retreated after the BoJ delivered its interest rate decision. As was widely expected, the bank hiked interest rates by 0.25%, bringing the benchmark figure to 0.75%. While low in global standards, the interest rate is the highest it has been in decades.

The bank decided to hike rates to contain inflation, which has remained elevated for some time. A report released on Friday showed that Japan’s headline inflation figure dropped to 2.9%, while the core CPI remained at 3%. These numbers are much higher than the bank’s target. Its statement said:

“If the outlook presented in the October 2025 Outlook Report will be realized, the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate and adjust the degree of monetary accommodation.”

READ MORE: Crypto Analysts Explain the Ongoing Bitcoin Price Crash

Bitcoin price reacts to the BoJ because of its place in the world economy. Japan is the fourth-largest economy globally by GDP after the United States, China, and Germany. Its central bank is one of the largest in terms of assets and the largest holder of US debt.

Most importantly, the BoJ has fueled asset prices over the years by leaving interest rates artificially low. That move created a major carry trade opportunity as investors borrowed the cheap yen and invested in other assets.

The rising interest rates are now leading to a recalibration and the unwinding of the biggest carry trade. Data show that the Bitcoin price has dropped by double digits after each of the last BoJ rate hikes. The most severe decline happened after the initial hike the previous year.

This BoJ rate hike is also essential as it came a few days after it was revealed that the bank will start selling ETFs worth over $500 billion. Increased asset dumping by the BoJ may have a major impact on the market.

BTC Price May Have a Relief Rally After the BoJ Hike

There are two main reasons the Bitcoin price may rally after the BoJ rate hike. First, investors may move to buy the news. In this case, the coin dropped before the rate hike, so they may buy the dip now that it has happened. This is the opposite of the concept of buying the rumor, selling the news.

Second, the BTC price may benefit from the recent US inflation report. Data released on Thursday showed that the headline and core inflation figures dropped to 2.6% and 2.7% in November. These numbers suggest the Fed may adopt a more aggressive rate-cutting policy.

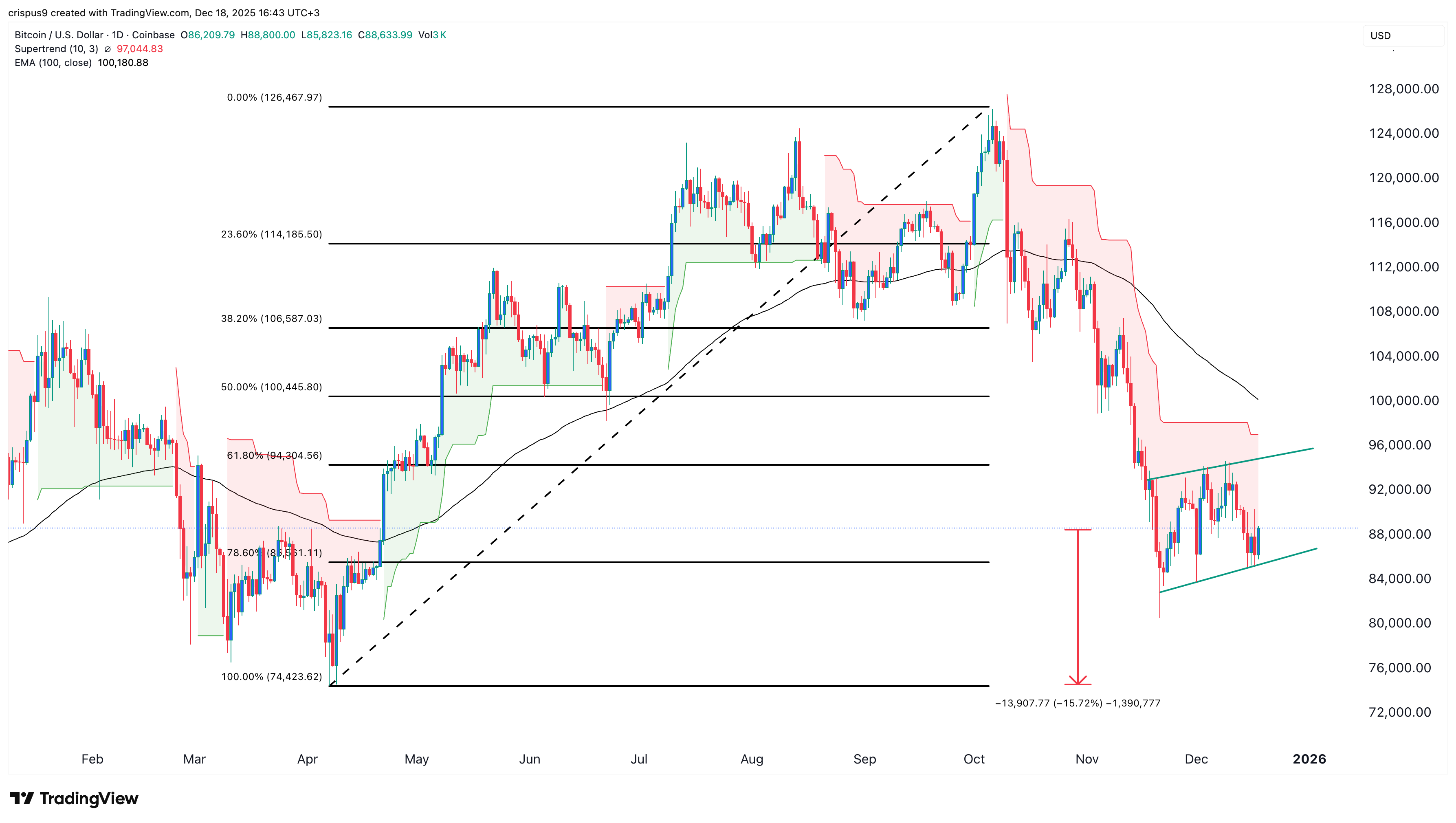

However, any Bitcoin price rally will be brief, as the chart above shows that the coin has formed a giant bearish flag pattern on the daily chart. It has already completed the formation of the flagpole and is now in the flag section, meaning that a retreat is possible.