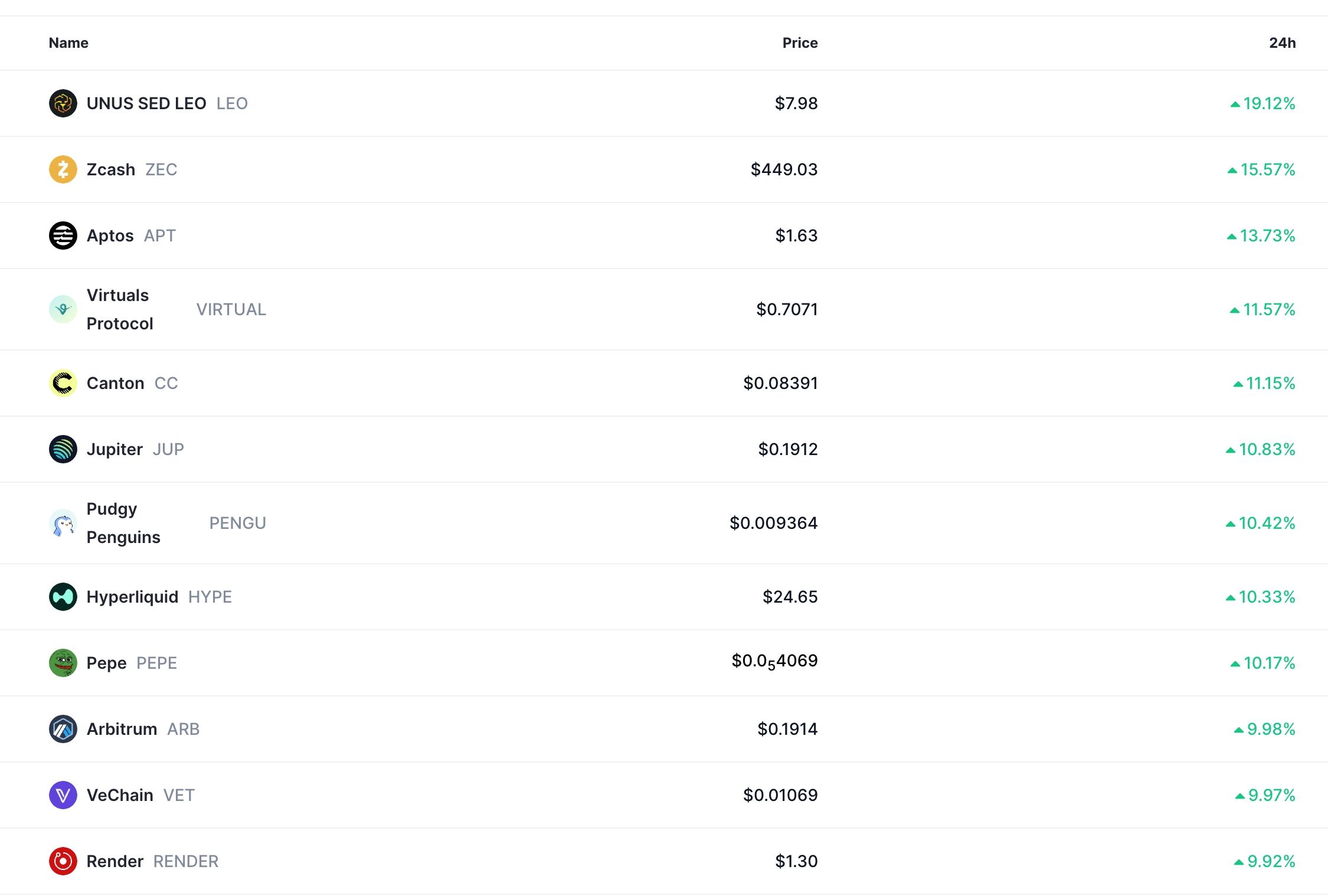

The crypto market is going up today, Dec. 20, with Bitcoin and other altcoins being in the green. Bitcoin price rose to $88,000, while Ethereum jumped to $2,935. Some of the top gainers were tokens like Zcash, Aptos, and Virtuals Protocol. This article explores some of the reasons behind the crypto rally.

Crypto Market Going Up as Polymarket Traders Remain Optimistic

One of the main reasons the crypto market is rising is that Polymarket traders are optimistic about the industry and the Santa Claus rally.

A Polymarket poll with over $133 million in volume shows that most traders anticipate the Bitcoin price will jump to $95,000 before the end of the year. The odds of the coin rising to that price target rose to 30%.

On the other hand, the odds that the coin will drop to $80,000 stand at 22%. As such, more traders are optimistic about a bullish breakout than those who expect it to fall.

This prediction is important because a Bitcoin rebound to $95,000 would fuel further gains to $100,000. Such a move would also increase demand for other cryptocurrencies over time.

The prediction is also based on the Santa Claus rally, in which top assets tend to rally ahead of Christmas Day.

READ MORE: Ethereum Price Prediction as Rare Bearish Pattern Forms

Buying the Dip After the BoJ Interest Rate Decision

The crypto market came under intense pressure this week as investors waited for the Bank of Japan’s interest rate decision. Most analysts and Polymarket traders expected the bank to hike interest rates by 0.25%, moving them to the highest level in three decades.

The bank did exactly that on Friday and hinted that it would start selling its ETF holdings, which are currently worth over $500 billion.

Therefore, investors are now buying the news after selling the rumors. It is common for traders to sell assets ahead of risky news and then buy the dip when the event finally happens.

In this case, the reason could be that Kazuo Ueda, the central bank governor, did not hint at additional interest rate hikes in 2026 during his press conference. His conference was relatively neutral, pushing ING analysts to predict that it will deliver one more hike in the second half of the year.

US Inflation Data and Federal Reserve Outlook

The other main reason for the crypto market rally is that investors are optimistic that the Federal Reserve will deliver additional interest rate cuts in 2026.

A report released by the Bureau of Labor Statistics (BLS) showed that the headline Consumer Price Index (CPI) dropped to 2.6% in November, while the core CPI moved to 2.7%. Inflation will likely continue to fall now that crude oil prices have dropped below $60.

Another report showed that the unemployment rate rose to 4.6% as thousands of government employees left. Therefore, a combination of an elevated unemployment rate and falling inflation means that the Fed will maintain a dovish tone next year.

Besides, Donald Trump is expected to nominate a Fed governor willing to cut interest rates during the year. Potential contenders are Kevin Hassett, Kevin Warsh, and Christopher Waller. Crypto prices do well when the Fed is cutting rates.

Stock Market Rebound

The crypto market is rising as investors watch the performance of American stocks, where the Dow Jones, Nasdaq, and S&P 500 indices jumped by over 0.50%.

This rally was driven by technology companies like Oracle, Nvidia, and Broadcom, which have been published in the past few weeks amid fears of an AI bubble that may burst soon.

The stock market rally occurred as Nvidia stock jumped over 4% after Trump signaled he would allow chip shipments to China. There is usually a correlation between crypto prices and the stock market, as both are considered risky assets.

Potential Dead Cat Bounce

The main risk is that the ongoing crypto market rally could be a dead-cat bounce. A DCB is a situation in which an asset in freefall rebounds briefly and then resumes the downtrend.

These dead-cat bounces, or bull traps, have been common in the past few months, with any attempts to rebound facing substantial resistance around $94,000

The odds that this is a dead-cat bounce have risen as Bitcoin has remained below the key $90,000 resistance level, and the rally shows signs of exhaustion. As we have warned recently, the Bitcoin price has formed a bearish flag pattern, pointing to more downside, potentially to $75,000 in the coming weeks.

READ MORE: The Bizarre XRP Price Crash: Why is Ripple in a Freefall Amid the Good News?